While gender diversity in the boardroom is an important focus for business, far less analysis has been done on the effect of board composition by field of expertise.

Accountants, lawyers and management consultants have traditionally dominated the ranks of board directors, but in today’s disruptive age, the inclusion of technologists at the table is strategically smart.

After all, tech complacency will seal the short-term fate of any business in a world where the largest taxi company, Uber, owns no cars, the largest media company, Facebook, produces no content and the biggest accommodation business, Airbnb, owns no property.

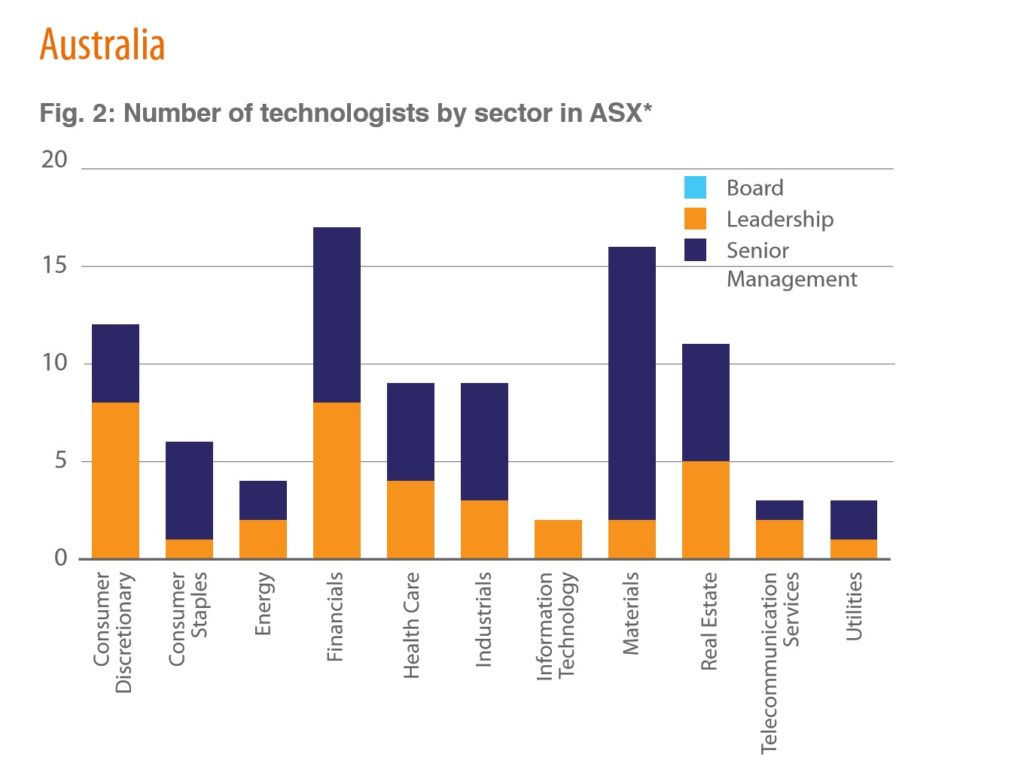

To gauge how prepared businesses in Australia and New Zealand are for change, Calastone investigated the composition of executive leadership at S&P/ASX100 and S&P/NZX20 listed firms. The results are interesting and shocking.

Overall, only 40 per cent of S&P/ASX100 companies have a technologist in their leadership team. New Zealand scored higher with technologists in 45 per cent of S&P/NZX20 businesses.

Astoundingly, there is no evidence of a technologist occupying a seat in an Australian boardroom.

Technology has redefined how we interact with and consume services across virtually all sectors.

A few industries have remained relatively isolated from market-wide technological disruption, among them is the managed funds industry.

This generally forward-thinking sector, which is so important to all of us as we save for our future, is being tested in its ability to adapt to emerging and evolving consumer preferences, tightening regulation, increasing pressure on fees and industry globalisation. All of which is being accelerated by the growing effects of technology.

Securing the industry’s long-term competitiveness is less about predicting the future and more about having sufficient understanding of the technology that could be deployed and utilised to solve problems, meet market demands and reinvent processes.

Acquiring such understanding requires the right people to steer the business strategy and ensure technology is embodied within the organisational culture.

Our research found those sectors which have already experienced technology driven change (i.e. retail banking, e-commerce, online gaming) are more likely to have a technologist at the executive leadership level. This isn’t a coincidence.

In Australian banking and finance firms, which have introduced new channels for engaging with clients and invested in new payment mechanism, nearly half (47 per cent) have technologists in their leadership ranks. Among consumer discretionary businesses, including many of the e-commerce and online gaming companies, the proportion of companies with technologist in leadership roles rises to 66 per cent.

Our study clearly shows that positive progress is being made, but with technology gaining pace and ubiquity, this trajectory needs to accelerate to ensure Australian businesses stay ahead of potential disruption.

Overseas, board composition is beginning to reflect the business environment. Our research of the UK FTSE 100 identified that 4 per cent of firms have allocated a board seat to a technologist, including “investment supermarket” Hargreaves Lansdown.

It’s positive to see an investment firm, already well known as being progressive, to recognise the strategic value of technology in this way. This brings the learning back to that of our managed funds community.

With innovative new technologies at different stages of evolution – e.g. blockchain, machine learning, artificial intelligence and robo-advice, it’s an important time for the managed funds community. The decisions that they make in how, when and indeed whether to apply these technologies are critically important for the future. Technology is a powerful enabler, but is most powerful to those who understand best how to apply it.

Implementing a culture that mobilises technology understanding and leadership at the executive level can empower firms to strategically self-disrupt, before disruptors force their hand.

(First published in The Australian Financial Review on September 19, 2017 – http://www.afr.com/leadership/how-to-deal-with-disruption-hint-find-leaders-who-know-about-tech-20170918-gyjg0g)