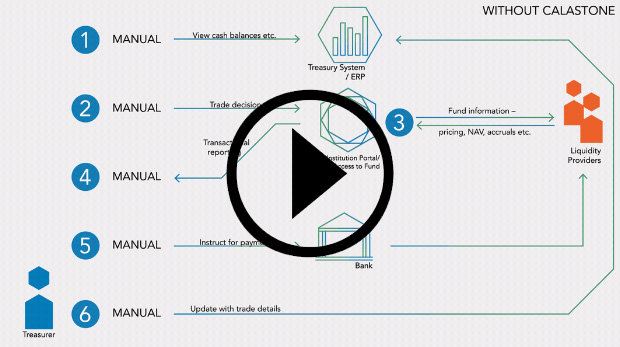

Calastone’ Money Market Services is changing the economics of the money market fund investment process for market fund investors and their treasury systems with a range of digital processes easily accessed by API, or another preferred file format.

By connecting almost 4,000 clients in 54 countries, our leading global mutual fund network lets treasurers and their TMS’ digitally connect to all the major liquidity fund providers and portals via their treasury system. This lets treasurers:

- Achieve greater investment certainty

- Cut risk with one automated and transparent process

- Access any fund more easily

- Get better levels of service from their portals and fund providers