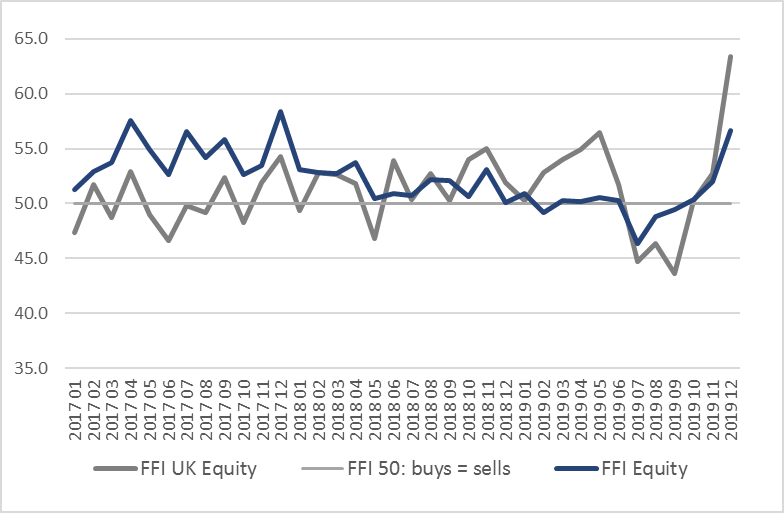

A dramatic turnaround in confidence saw UK investors pour more capital back into equity funds in December 2019 than at any other time in the last two years, according to the latest Fund Flow Index from Calastone, the largest global funds network. A net £2.0 billion flowed into the sector, making it the fifth best month on record; half of this capital was directed towards UK-focused funds, with the rest mainly directed towards global and North American funds. The FFI: Equity soared to 56.7, its highest level in two and a half years (a reading of 50 means inflows exactly balance outflows). For most of 2019 the index had been neutral or negative.

Figure 1: FFI: Equity v FFI: UK Equity

The Conservative Party’s decisive election victory meant that funds focused on UK equities saw the biggest turnaround after a year of political deadlock and economic uncertainty which had driven several months of outflows from UK-focused funds. Indeed, December 2019 saw the largest ever inflow of capital from domestic investors to UK equity funds. A net £1.0bn flooded into the sector, almost twice the previous best month (July 2015), as UK investors reappraised the prospects for the economy now the UK had a government able to command a majority in Parliament. The FFI: UK Equity jumped to 63.4, easily its highest ever reading. For the full year 2019, UK-focused funds saw inflows of £1.5bn, so December alone accounted for two thirds of the annual total.

There is no doubt the UK election was the main driver. Flows into UK-focused funds picked up strongly as soon as the election was called and strengthened as polls indicated a likely majority for the Conservative Party. But the only poll that counts is election day – and the decisive result it delivered drove net inflows in the 11 post-election trading days of the year to levels three times higher than in the first few days of the month running up to the election.

Edward Glyn, head of global markets at Calastone said: “December proved just how powerful the influence of politics is over investor activity. Hints of progress on US-China trade relations combined with a landslide victory for the Conservative Party generated a huge turnaround in appetite for equity funds.

“Regardless of the relative merits of Brexit or remaining in the EU, an end to the UK’s political deadlock and a clearer path for the country (at least in the short term) is unleashing enormous pent-up demand for UK equities in particular, whose performance has lagged far behind their peers elsewhere in the world. It is not all about Brexit, however. The Labour party’s historic defeat also had a positive impact on investor appetite for UK assets, and on valuations, as it removed the prospect of a wide-ranging left-wing programme that investors judged was negative for asset values.

“In truth, we are just at the end of the beginning of the Brexit journey. Which of the wide range of available paths the government chooses to take for its future relations with the EU will determine whether December was just a flurry of relief-driven excitement or the beginning of a sustainable trend back into favour for UK equities.”

Methodology

Calastone analysed over a million buy and sell orders every month from January 2015, tracking monies from IFAs, platforms and institutions as they flow into and out of investment funds. Data is collected until the close of business on the last day of each month. A single order is usually the aggregated value of a number of trades from underlying investors passed for example from a platform via Calastone to the fund manager. In reality, therefore, the index is analysing the impact of many millions of investor decisions each month.

More than two thirds of UK fund flows by value pass across the Calastone network each month. All these trades are included in the FFI. To avoid double-counting, however, the team has excluded deals that represent transactions where funds of funds are buying those funds that comprise the portfolio. Totals are scaled up for Calastone’s market share.

A reading of 50 indicates that new money investors put into funds equals the value of redemptions (or sales) from funds. A reading of 100 would mean all activity was buying; a reading of 0 would mean all activity was selling. In other words, £1m of net inflows will score more highly if there is no selling activity, than it would if £1m was merely a small difference between a large amount of buying and a similarly large amount of selling.

Calastone’s main FFI All Assets considers transactions only by UK-based investors, placing orders for funds domiciled in the UK. The majority of this capital is from retail investors. Calastone also measures the flow of funds from UK-based investors to offshore-domiciled funds. Most of these are domiciled in Ireland and Luxembourg. This is overwhelmingly capital from institutions; the larger size of retail transactions in offshore funds suggests the underlying investors are higher net worth individuals.

Figure 1: FFI: Equity v FFI: UK Equity

The Conservative Party’s decisive election victory meant that funds focused on UK equities saw the biggest turnaround after a year of political deadlock and economic uncertainty which had driven several months of outflows from UK-focused funds. Indeed, December 2019 saw the largest ever inflow of capital from domestic investors to UK equity funds. A net £1.0bn flooded into the sector, almost twice the previous best month (July 2015), as UK investors reappraised the prospects for the economy now the UK had a government able to command a majority in Parliament. The FFI: UK Equity jumped to 63.4, easily its highest ever reading. For the full year 2019, UK-focused funds saw inflows of £1.5bn, so December alone accounted for two thirds of the annual total.

There is no doubt the UK election was the main driver. Flows into UK-focused funds picked up strongly as soon as the election was called and strengthened as polls indicated a likely majority for the Conservative Party. But the only poll that counts is election day – and the decisive result it delivered drove net inflows in the 11 post-election trading days of the year to levels three times higher than in the first few days of the month running up to the election.

Edward Glyn, head of global markets at Calastone said: “December proved just how powerful the influence of politics is over investor activity. Hints of progress on US-China trade relations combined with a landslide victory for the Conservative Party generated a huge turnaround in appetite for equity funds.

“Regardless of the relative merits of Brexit or remaining in the EU, an end to the UK’s political deadlock and a clearer path for the country (at least in the short term) is unleashing enormous pent-up demand for UK equities in particular, whose performance has lagged far behind their peers elsewhere in the world. It is not all about Brexit, however. The Labour party’s historic defeat also had a positive impact on investor appetite for UK assets, and on valuations, as it removed the prospect of a wide-ranging left-wing programme that investors judged was negative for asset values.

“In truth, we are just at the end of the beginning of the Brexit journey. Which of the wide range of available paths the government chooses to take for its future relations with the EU will determine whether December was just a flurry of relief-driven excitement or the beginning of a sustainable trend back into favour for UK equities.”

Methodology

Calastone analysed over a million buy and sell orders every month from January 2015, tracking monies from IFAs, platforms and institutions as they flow into and out of investment funds. Data is collected until the close of business on the last day of each month. A single order is usually the aggregated value of a number of trades from underlying investors passed for example from a platform via Calastone to the fund manager. In reality, therefore, the index is analysing the impact of many millions of investor decisions each month.

More than two thirds of UK fund flows by value pass across the Calastone network each month. All these trades are included in the FFI. To avoid double-counting, however, the team has excluded deals that represent transactions where funds of funds are buying those funds that comprise the portfolio. Totals are scaled up for Calastone’s market share.

A reading of 50 indicates that new money investors put into funds equals the value of redemptions (or sales) from funds. A reading of 100 would mean all activity was buying; a reading of 0 would mean all activity was selling. In other words, £1m of net inflows will score more highly if there is no selling activity, than it would if £1m was merely a small difference between a large amount of buying and a similarly large amount of selling.

Calastone’s main FFI All Assets considers transactions only by UK-based investors, placing orders for funds domiciled in the UK. The majority of this capital is from retail investors. Calastone also measures the flow of funds from UK-based investors to offshore-domiciled funds. Most of these are domiciled in Ireland and Luxembourg. This is overwhelmingly capital from institutions; the larger size of retail transactions in offshore funds suggests the underlying investors are higher net worth individuals.