As global stock markets closed their best quarter in at least a decade in Q2, fund flows suggested that investors preferred to bank their gains and take their seats on the sidelines, according to the latest Fund Flow Index (FFI) from Calastone, the largest global funds network.

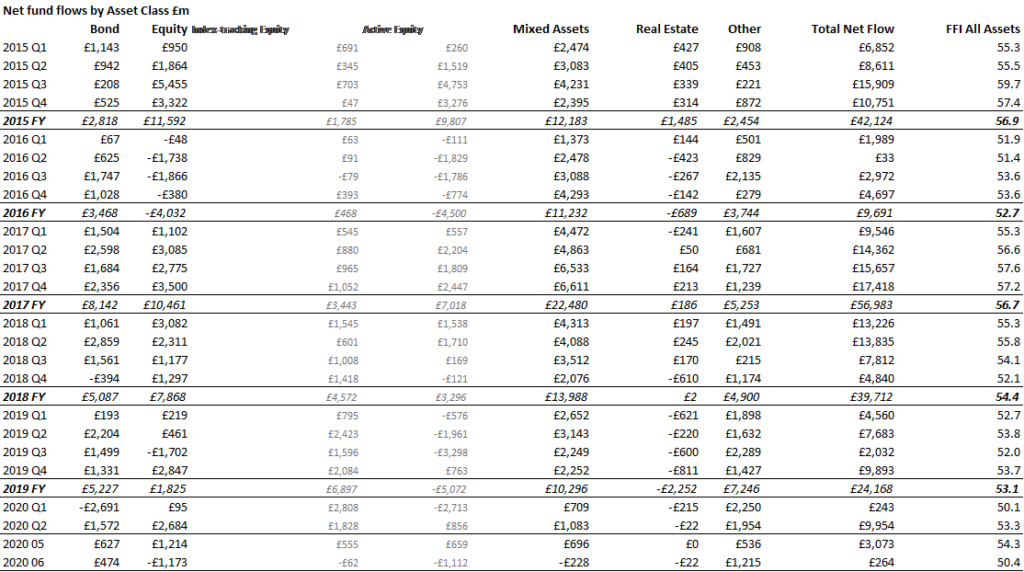

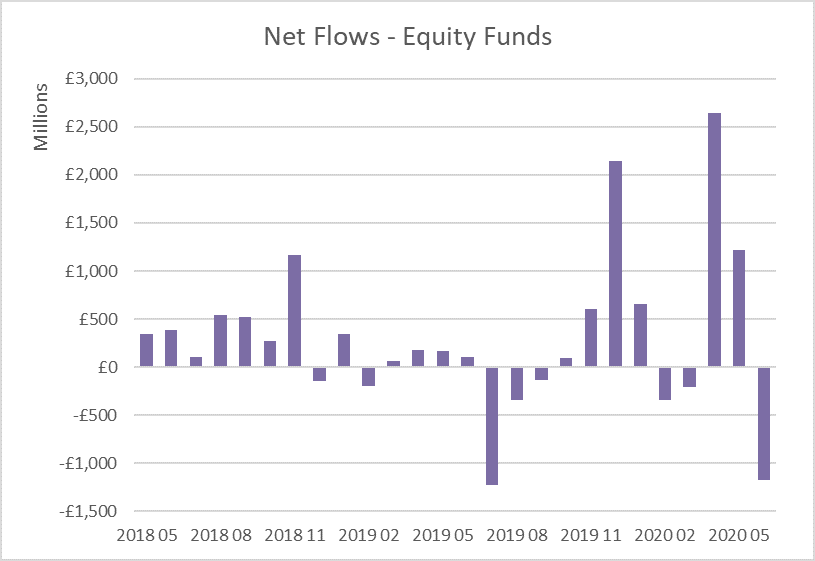

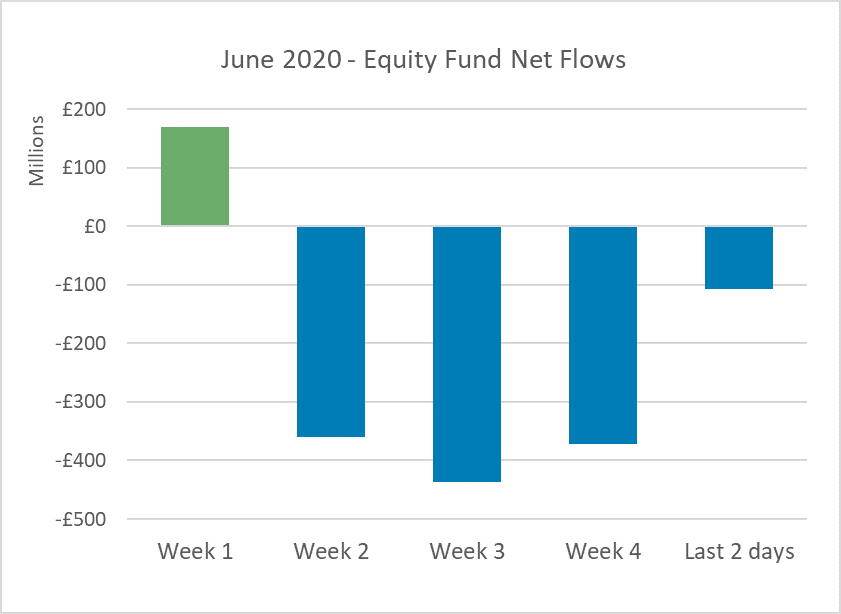

By the end of June, the MSCI World Index had recovered around two thirds of its 2020 losses, and ended the quarter down only 7% year-to-date. The UK market is lagging a long way behind, still down by almost a fifth, but it too has bounced back from late March lows. In April and May investors in equity funds bought enthusiastically into the rally, adding a net £3.9bn to their holdings, the largest two-month period of inflows on Calastone’s record. Almost all of this buying took place before the first May bank holiday. The rest of May saw a buyer’s strike and by June, investors were taking profits and selling down in large volumes.

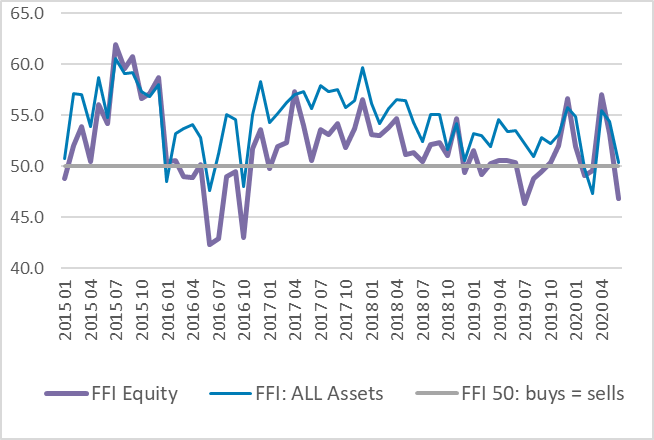

Profit-taking in June saw a net £1.2bn of cash leave equity funds, making it the fifth worst month on Calastone’s record. At 46.8, Calastone’s FFI:Equity registered its worst month this year – a reading of 50 means inflows equal outflows.

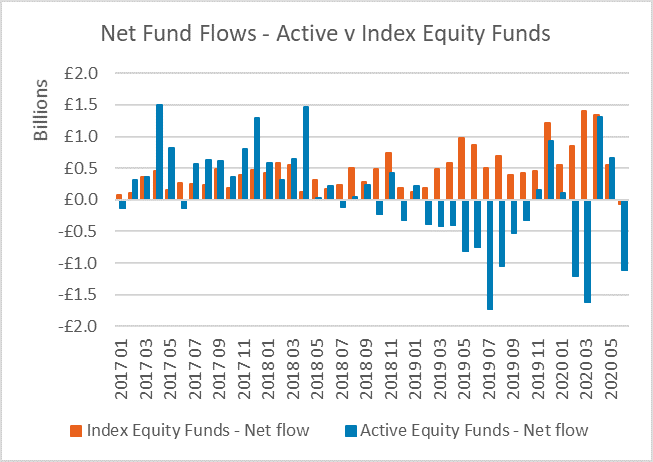

Actively managed equity funds bore the brunt of June’s outflows, shedding £1.1bn, but even index funds suffered a rare negative month. June saw investors pull £62m from index funds, the first outflow since October 2016. UK equity and equity income funds felt the worst impact, each suffering record outflows of £679m and £671m respectively, but every category of equity fund saw investor selling (except global funds).

Actively managed equity funds bore the brunt of June’s outflows, shedding £1.1bn, but even index funds suffered a rare negative month. June saw investors pull £62m from index funds, the first outflow since October 2016. UK equity and equity income funds felt the worst impact, each suffering record outflows of £679m and £671m respectively, but every category of equity fund saw investor selling (except global funds).

Overall trading volumes were lower in June than at any time since January, but were still well above the long-run average, indicating that investors remain very engaged with their holdings during volatile times for markets. Transaction values (buys plus sells) in equity funds were £18.5bn in June, more than a quarter more than the monthly average in 2019.

Mixed asset funds followed suit, also seeing outflows. They shed £228m of cash in June, only the second month on Calastone’s record to have seen this happen. The last time was March this year. Like passive equity funds, mixed asset funds are favourites in pension and ISA savings plans, so they benefit from monthly direct debits and rarely see outflows.

Most of the cash pulled out of equity funds was switched for the relative safety of fixed income and money market options. These saw inflows of £927m between them in June, split roughly equally. The FFI: Fixed Income and FFI:Money Market jumped to 54.3 and 64.4 respectively. Thanks to floods of Central Bank cash (which has seen the US Federal Reserve buying even junk-rated corporate debt), fixed income funds have now recovered half the outflows they suffered in March when credit markets were badly impacted by the COVID-19 shock. The greater confidence policymakers have engendered in the bond markets has allowed outflows from equities to be directed to the fixed income funds. The market crash in March saw the largest inflow to money market funds on Calastone’s record, but in May and June the inflows were unusually large too as the value of buy orders outweighed sell orders almost 2:1. This shows they were considered safe havens by investors taking profits elsewhere.

Edward Glyn, head of global markets at Calastone said: “In the middle of a global economic and health crisis of this ferocity there’s no doubt investors are banking the big gains they have made on the billions they have ploughed into the market since its lows in March. Almost all the trading signals across Calastone’s network pointed in the same direction in June – investors bailing out of riskier fund categories into safer ones, even affecting segments like index funds and mixed asset funds that almost never see outflows. In March, investors were reactive, getting caught out by the sudden market drop. Now they seem to be anticipating a significant renewed market correction – we will see in due course if that materialises.

The very high transaction volumes we have seen all year testify to opportunistic trading – investors are currently unusually engaged with their holdings and unusually liable to switch from one fund to another, or to cash and back.

The record outflows from UK funds seems to be explained by a combination of three factors. First, the economic news from the UK was especially bad in June, second a no-deal (or “Australia-style”) Brexit is increasingly likely, and third, the impact of dividend cuts is greater in the UK than in most other parts of the world. This third factor also explains the record outflow from income funds. This category has been out of favour for a long time, but with global dividends set to fall by a fifth or more this year according to Janus Henderson, there is less allure from equity income.”

Overall trading volumes were lower in June than at any time since January, but were still well above the long-run average, indicating that investors remain very engaged with their holdings during volatile times for markets. Transaction values (buys plus sells) in equity funds were £18.5bn in June, more than a quarter more than the monthly average in 2019.

Mixed asset funds followed suit, also seeing outflows. They shed £228m of cash in June, only the second month on Calastone’s record to have seen this happen. The last time was March this year. Like passive equity funds, mixed asset funds are favourites in pension and ISA savings plans, so they benefit from monthly direct debits and rarely see outflows.

Most of the cash pulled out of equity funds was switched for the relative safety of fixed income and money market options. These saw inflows of £927m between them in June, split roughly equally. The FFI: Fixed Income and FFI:Money Market jumped to 54.3 and 64.4 respectively. Thanks to floods of Central Bank cash (which has seen the US Federal Reserve buying even junk-rated corporate debt), fixed income funds have now recovered half the outflows they suffered in March when credit markets were badly impacted by the COVID-19 shock. The greater confidence policymakers have engendered in the bond markets has allowed outflows from equities to be directed to the fixed income funds. The market crash in March saw the largest inflow to money market funds on Calastone’s record, but in May and June the inflows were unusually large too as the value of buy orders outweighed sell orders almost 2:1. This shows they were considered safe havens by investors taking profits elsewhere.

Edward Glyn, head of global markets at Calastone said: “In the middle of a global economic and health crisis of this ferocity there’s no doubt investors are banking the big gains they have made on the billions they have ploughed into the market since its lows in March. Almost all the trading signals across Calastone’s network pointed in the same direction in June – investors bailing out of riskier fund categories into safer ones, even affecting segments like index funds and mixed asset funds that almost never see outflows. In March, investors were reactive, getting caught out by the sudden market drop. Now they seem to be anticipating a significant renewed market correction – we will see in due course if that materialises.

The very high transaction volumes we have seen all year testify to opportunistic trading – investors are currently unusually engaged with their holdings and unusually liable to switch from one fund to another, or to cash and back.

The record outflows from UK funds seems to be explained by a combination of three factors. First, the economic news from the UK was especially bad in June, second a no-deal (or “Australia-style”) Brexit is increasingly likely, and third, the impact of dividend cuts is greater in the UK than in most other parts of the world. This third factor also explains the record outflow from income funds. This category has been out of favour for a long time, but with global dividends set to fall by a fifth or more this year according to Janus Henderson, there is less allure from equity income.”