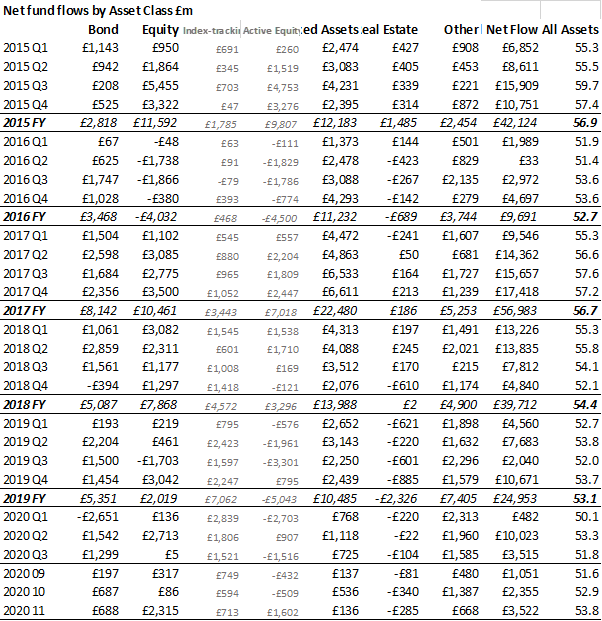

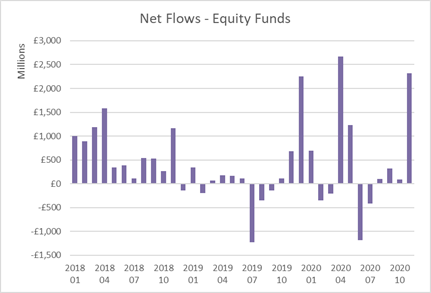

The announcement of three safe, effective vaccines against Covid-19 spurred a near-record flood of new capital into equity funds in November, according to the latest Fund Flow Index from Calastone, the largest global funds network. Investors added a net £2.3bn to equity funds, the second highest month of inflows on record after April 2020[1], when global markets reacted euphorically to the vast economic and financial support packages from governments and central banks.

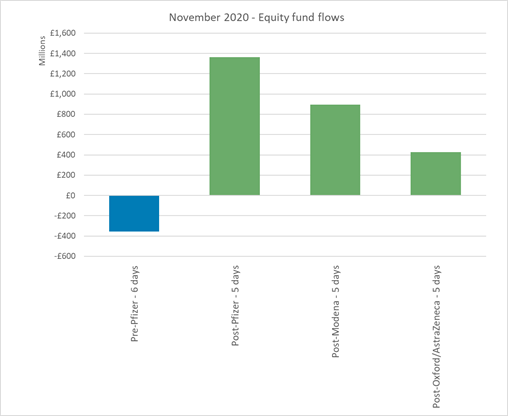

The link to vaccine announcements is clear to see. Calastone’s daily trading data shows. In the five days preceding the announcement of Pfizer’s success, equity funds saw outflows of £389m. In the five days after it, inflows totalled £1.4bn. Another £897m flowed in in the five days following the Moderna announcement. The Oxford/Astrazeneca news spurred another £429m. The US election, by contrast, caused a more muted reaction. The knife-edge initial outcome followed by the growing likelihood that the perceived less market-friendly Biden would secure the Presidency for the Democrats caused cash to flow out of equity funds and into safe-haven alternatives.

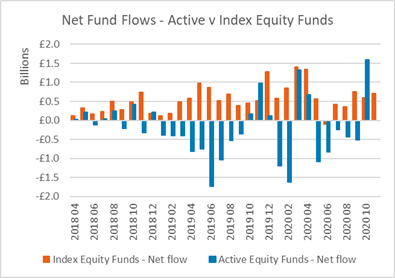

Active equity funds had their best month in more than five years, garnering £1.6bn of new capital. The last time they enjoyed such success was July 2015. This was enough to reverse half the cumulative outflows since May 2020. Most of the active money went into active global funds, which saw an all-time record £1.5bn of inflows, but active emerging market funds, sector funds and north American funds also saw large amounts of new capital. The £713m inflow to index tracking funds was exactly in line with the monthly average over the last year.

ESG funds also broke new records. The £820m of new capital investors added to the category was more in a single month than in the entire 5 years to January 2020, and was more than double the monthly average this year so far.

The large inflows came on the back of huge turnover in equity funds, suggesting high levels of switching between funds, as well as the addition of new capital. Investors placed buy and sell orders totalling £24.0bn, making November one of just two months on Calastone’s record that turnover in equity funds has exceeded £20bn. The only month to see higher turnover was March 2020 – the Covid-19 crash.

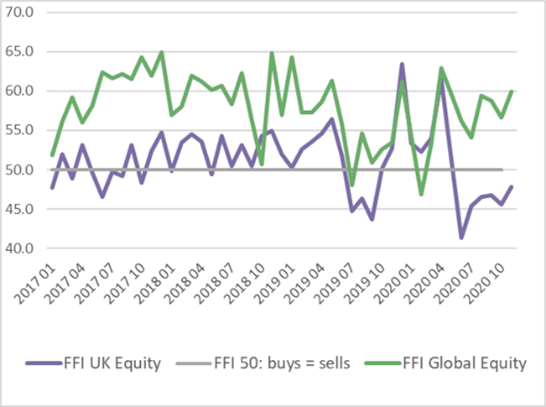

UK-focused equity funds remained unloved. Along with the largely UK-focused income category, UK funds were the only major equity fund category to see outflows in November (-£222m and -£465m respectively).

Active equity funds had their best month in more than five years, garnering £1.6bn of new capital. The last time they enjoyed such success was July 2015. This was enough to reverse half the cumulative outflows since May 2020. Most of the active money went into active global funds, which saw an all-time record £1.5bn of inflows, but active emerging market funds, sector funds and north American funds also saw large amounts of new capital. The £713m inflow to index tracking funds was exactly in line with the monthly average over the last year.

ESG funds also broke new records. The £820m of new capital investors added to the category was more in a single month than in the entire 5 years to January 2020, and was more than double the monthly average this year so far.

The large inflows came on the back of huge turnover in equity funds, suggesting high levels of switching between funds, as well as the addition of new capital. Investors placed buy and sell orders totalling £24.0bn, making November one of just two months on Calastone’s record that turnover in equity funds has exceeded £20bn. The only month to see higher turnover was March 2020 – the Covid-19 crash.

UK-focused equity funds remained unloved. Along with the largely UK-focused income category, UK funds were the only major equity fund category to see outflows in November (-£222m and -£465m respectively).

Meanwhile, safe-haven money market funds saw their biggest outflows on record in November. Investors sold £695m of units with sell orders worth three times as much as buy orders. Money market outflows were especially strong following the Pfizer news. Real estate funds, now reopened for business, continued to suffer significant outflows, though the pace slowed as appetite from pent-up sellers is showing signs of being sated. Fixed income funds continued to enjoy inflows.

All this added up to a sharply increased appetite for risk. With the exception of April, which saw the snap-back from the March market crash, November saw investors add more capital to the riskiest categories of funds for almost three years, while withdrawals from the lowest risk categories were the third highest ever.

Edward Glyn, Calastone’s head of global markets commented: “The long-awaited vaccine news could scarcely have been any better. Despite languishing in renewed lockdown confinement, investors went off to the races to celebrate. Record fund turnover, record inflows for some of the biggest equity fund categories and near-record inflows for equity funds overall add up to a huge sigh of relief that the end may finally be in sight for the pandemic and its devastation of the global economy. A big switch from safe-haven to riskier assets is all part of this excitement. Active fund managers will also celebrate such a successful month after enduring months of outflows. Anchored in monthly savings plans, index-tracking fund flows tend to be steady and positive, but active funds benefit much more when there is a big positive swing in sentiment.”

[1] In April 2020 investors added a net £2.7bn to equity funds.

Meanwhile, safe-haven money market funds saw their biggest outflows on record in November. Investors sold £695m of units with sell orders worth three times as much as buy orders. Money market outflows were especially strong following the Pfizer news. Real estate funds, now reopened for business, continued to suffer significant outflows, though the pace slowed as appetite from pent-up sellers is showing signs of being sated. Fixed income funds continued to enjoy inflows.

All this added up to a sharply increased appetite for risk. With the exception of April, which saw the snap-back from the March market crash, November saw investors add more capital to the riskiest categories of funds for almost three years, while withdrawals from the lowest risk categories were the third highest ever.

Edward Glyn, Calastone’s head of global markets commented: “The long-awaited vaccine news could scarcely have been any better. Despite languishing in renewed lockdown confinement, investors went off to the races to celebrate. Record fund turnover, record inflows for some of the biggest equity fund categories and near-record inflows for equity funds overall add up to a huge sigh of relief that the end may finally be in sight for the pandemic and its devastation of the global economy. A big switch from safe-haven to riskier assets is all part of this excitement. Active fund managers will also celebrate such a successful month after enduring months of outflows. Anchored in monthly savings plans, index-tracking fund flows tend to be steady and positive, but active funds benefit much more when there is a big positive swing in sentiment.”

[1] In April 2020 investors added a net £2.7bn to equity funds.