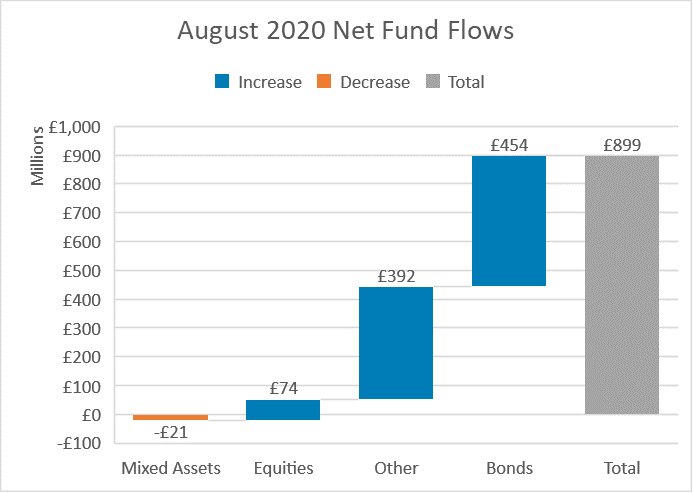

Inflows to fixed income funds were almost equal to all other fund categories combined in August, as investors continued to shun riskier assets, according to the latest Fund Flow Index from Calastone, the largest global funds network. Net inflows to bond funds were £454m out of the total across all fund categories of £920m. This was the fifth month in a row that has seen bond-fund inflows well above the long run average, generating an FFI: Bonds of 55.9, well above the neutral 50 mark where the value of buy orders equals sells. Even so, year-to-date, strong inflows into fixed income in nearly every month have barely compensated for the enormous £3.6bn that flooded out in March when the bond markets seized up at the beginning of the Covid-19 crisis.

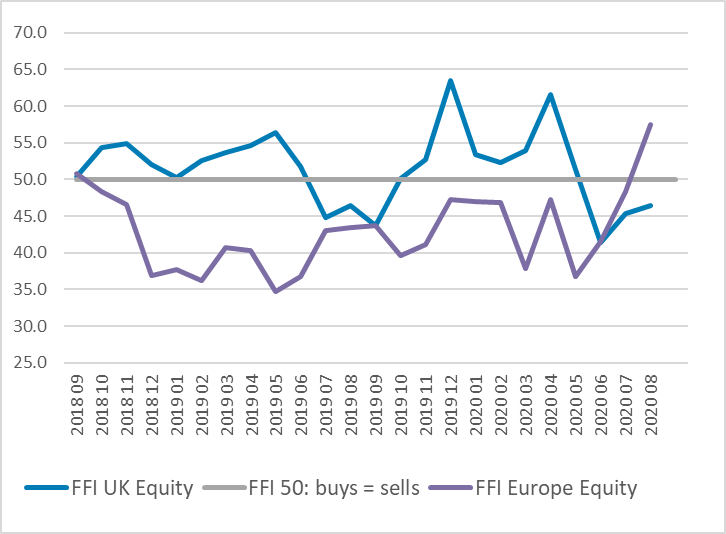

After two months of outflows, equity funds were spared further investor selling in August. Investors added just £74m to their holdings, however, only one sixth of the long-run monthly average. The winning categories were active global funds, almost half of whose £580m inflow was driven by purchases of ESG funds, and crucially a turnaround for European funds, driven mainly by purchases of index funds. European funds enjoyed £170m of net inflows, the first time in two years that investors have added new money to funds specialising in European shares. These funds have accumulated outflows of over £5bn since the summer of 2018, however, so there is still a long way to go to recoup lost ground. UK equities were again among the categories to see the biggest shedding of capital, though the speed of the outflow has slowed. £195m left the category in August, making the £1.2bn in capital that has left since June the worst three-month period for funds investing in UK equities on Calastone’s record. Equity income funds continued to see strong outflows too.

After two months of outflows, equity funds were spared further investor selling in August. Investors added just £74m to their holdings, however, only one sixth of the long-run monthly average. The winning categories were active global funds, almost half of whose £580m inflow was driven by purchases of ESG funds, and crucially a turnaround for European funds, driven mainly by purchases of index funds. European funds enjoyed £170m of net inflows, the first time in two years that investors have added new money to funds specialising in European shares. These funds have accumulated outflows of over £5bn since the summer of 2018, however, so there is still a long way to go to recoup lost ground. UK equities were again among the categories to see the biggest shedding of capital, though the speed of the outflow has slowed. £195m left the category in August, making the £1.2bn in capital that has left since June the worst three-month period for funds investing in UK equities on Calastone’s record. Equity income funds continued to see strong outflows too.

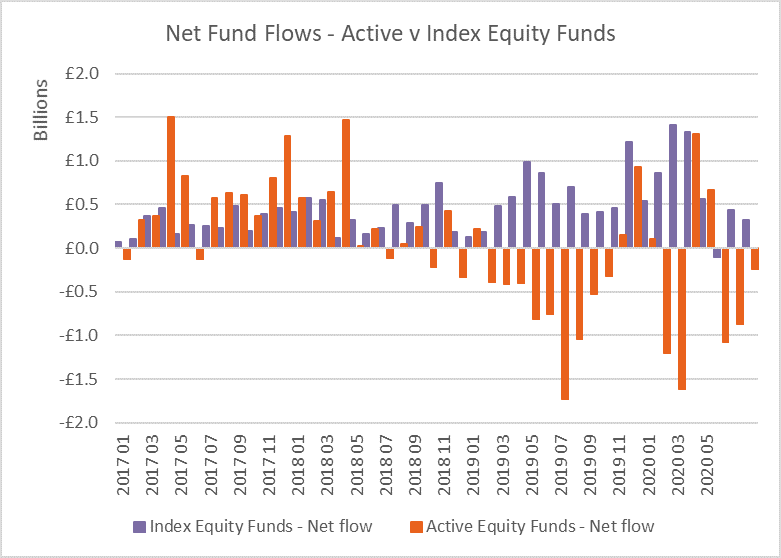

In total, equity index funds continued to beat their active counterparts in August, gathering £318m of new capital in contrast to outflows of £244m from index funds. Passive funds have now beaten active funds in 24 of the last 26 months.

Overall trading volumes across all fund types were unusually low in August, even allowing for seasonal patterns. Turnover dropped by almost a third month-on-month, much more than the 5-10% decline Calastone usually sees flowing across its network during the holiday season. Bond and equity funds saw the biggest drops in activity, while mixed assets remained characteristically more stable.

Edward Glyn, head of global markets at Calastone said, “Implied volatility in the bond markets as measured by the Move Index is near record lows as bond markets are calmed by central bank stimulus. This calm is attracting investors. Meanwhile, the Vix ‘fear’ index suggests huge implied volatility for equities in the months ahead and that is dampening investor enthusiasm for equity funds.

Even so, fixed income is not quite the risk-off trade it used to be, though bonds of course still come with greater certainty than equities, at least if they are held for their full term. With interest rates near or even below zero on the most creditworthy bonds, there is little or no income to be had, so most of the returns from bonds are coming in the form of capital gains as falling rate expectations have pushed up prices. Changing perceptions of credit risk can also push prices up or down, particularly for bonds with lower credit ratings. The hunt for yield is driving bond investors into these riskier categories.

On the face of it, the inflow to European funds seems strange given rising infection rates but European equities are relatively cheap compared to their record-priced US counterparts and the dollar is in decline. Funds focused on US equities had one of their worst months in the last year in August so investors may be switching focus as a hedge against the political, social and economic upheaval in the US, though we will need to see several more months of solid inflows to Europe before we can be sure this is a new trend. Low valuation alone is not enough to tempt investors as unloved UK equity funds can testify.

Financial markets have been exceptionally calm in recent weeks after a year of extreme volatility, so it seems that investors have taken a breather, perhaps steeling themselves for a very eventful final quarter bringing the US election, the northern hemisphere winter and its risk of a resurgent pandemic, as well as greater clarity on the extent of the economic damage caused by the outbreak.”

In total, equity index funds continued to beat their active counterparts in August, gathering £318m of new capital in contrast to outflows of £244m from index funds. Passive funds have now beaten active funds in 24 of the last 26 months.

Overall trading volumes across all fund types were unusually low in August, even allowing for seasonal patterns. Turnover dropped by almost a third month-on-month, much more than the 5-10% decline Calastone usually sees flowing across its network during the holiday season. Bond and equity funds saw the biggest drops in activity, while mixed assets remained characteristically more stable.

Edward Glyn, head of global markets at Calastone said, “Implied volatility in the bond markets as measured by the Move Index is near record lows as bond markets are calmed by central bank stimulus. This calm is attracting investors. Meanwhile, the Vix ‘fear’ index suggests huge implied volatility for equities in the months ahead and that is dampening investor enthusiasm for equity funds.

Even so, fixed income is not quite the risk-off trade it used to be, though bonds of course still come with greater certainty than equities, at least if they are held for their full term. With interest rates near or even below zero on the most creditworthy bonds, there is little or no income to be had, so most of the returns from bonds are coming in the form of capital gains as falling rate expectations have pushed up prices. Changing perceptions of credit risk can also push prices up or down, particularly for bonds with lower credit ratings. The hunt for yield is driving bond investors into these riskier categories.

On the face of it, the inflow to European funds seems strange given rising infection rates but European equities are relatively cheap compared to their record-priced US counterparts and the dollar is in decline. Funds focused on US equities had one of their worst months in the last year in August so investors may be switching focus as a hedge against the political, social and economic upheaval in the US, though we will need to see several more months of solid inflows to Europe before we can be sure this is a new trend. Low valuation alone is not enough to tempt investors as unloved UK equity funds can testify.

Financial markets have been exceptionally calm in recent weeks after a year of extreme volatility, so it seems that investors have taken a breather, perhaps steeling themselves for a very eventful final quarter bringing the US election, the northern hemisphere winter and its risk of a resurgent pandemic, as well as greater clarity on the extent of the economic damage caused by the outbreak.”