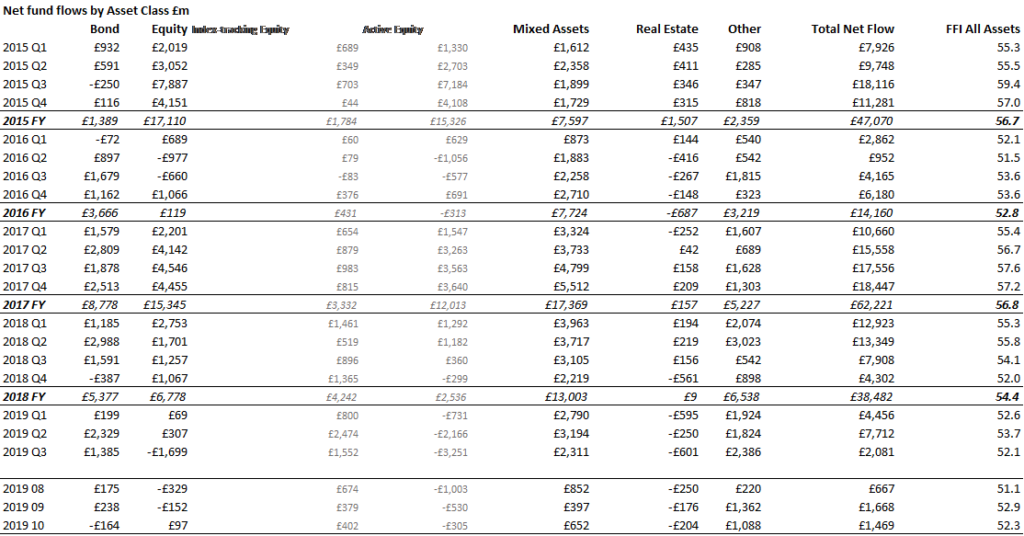

A flurry of optimism meant investors hit the pause button on their flight from equity funds in October, according to the latest Fund Flow Index (FFI) from Calastone, the largest global fund network. Investors also pulled back from bond funds for the first time since January. Despite, however, the change in sentiment, higher risk funds remained firmly out of favour.

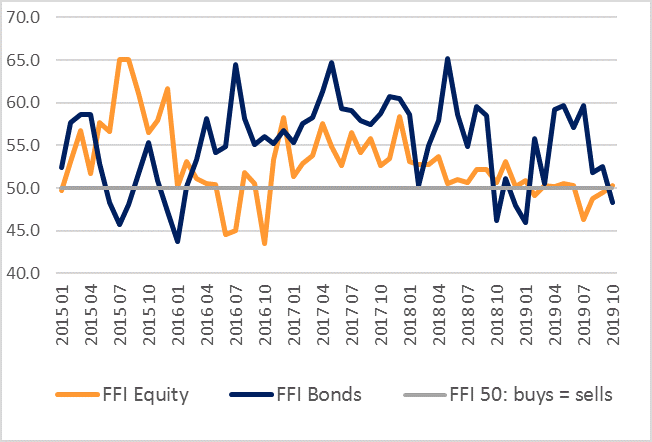

The change in investor sentiment towards fixed-income funds was particularly marked. As a perceived relative safe haven, bond funds have benefited all year from investor concerns over Brexit and the global economy, attracting a net £4.2bn of inflows between February and September. A jump in bond yields during October (pushing the price of bonds down) accompanied a sudden moment of progress on Brexit and a brief surge of optimism over US-China trade tensions. Optimism is bad for bonds, so for the full month, investors sold down a net £164m of their fixed-income funds, the first month of net outflows since January 2019. The FFI: Bond dropped five points to 48.3 for the month (a reading of 50 means inflows are exactly balance by outflows).

Figure 1: FFI: Bonds v FFI: Equity

Brexit newsflow is a key determinant. After modest inflows to bond funds until 17th October, the announcement that Boris Johnson had secured an amended version of May’s EU exit agreement spurred an immediate and very large reversal. UK Investors sold bond funds heavily, dumping £162m on 18th October alone, with a similar amount again over the following week. However, the announcement of a UK election, combined with developments on world markets slowed the exodus by the end of the month.. Chinese doubts about the trade outlook, a rate cut from the Fed, and the shelving of the Withdrawal Agreement Bill all encouraged capital to trickle back into bond funds in the final days of October.

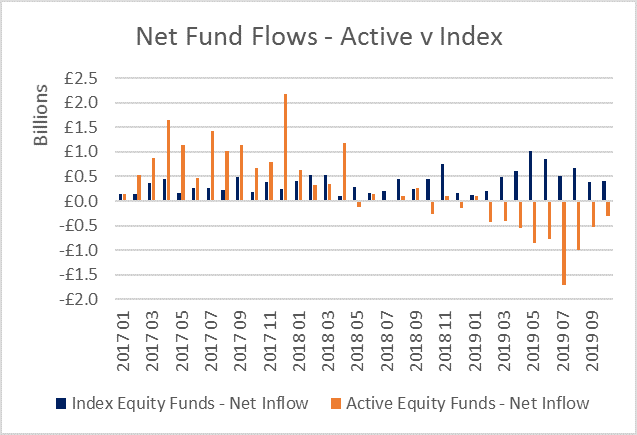

For equity funds, flows were positive, but not by much. Investors added a net £97m to their equity-fund holdings. This is, however, almost a rounding error when set against the £14.4bn of turnover in equity funds during the month. Our FFI: Equity was therefore a neutral 50.3 in October, meaning that buys were almost the same value as sells in the context of the overall volume traded. This still was good news for the sector, as it follows an unprecedented three consecutive months of outflows. Moreover, the outflows from active funds slowed to their lowest pace since January, while inflows to passive funds were steady month-on-month.

UK-equity funds saw their first inflows since June as the UK’s Brexit deadlock began to show signs of movement. At only £16m, this was the smallest net inflow into the sector that Calastone has ever recorded and follows £1.0bn of outflows during Q3, suggesting that investor sentiment towards the UK remains very fragile. Asia-Pacific and North American equity funds saw the strongest inflows (along with global funds which are perennial favourites among investors). This suggests that the reduction in pessimism about the US-China dispute directed investor attention to these markets in particular. European and equity-income funds saw continued outflows (for the 13th and 34th consecutive months respectively).

Figure 1: FFI: Bonds v FFI: Equity

Brexit newsflow is a key determinant. After modest inflows to bond funds until 17th October, the announcement that Boris Johnson had secured an amended version of May’s EU exit agreement spurred an immediate and very large reversal. UK Investors sold bond funds heavily, dumping £162m on 18th October alone, with a similar amount again over the following week. However, the announcement of a UK election, combined with developments on world markets slowed the exodus by the end of the month.. Chinese doubts about the trade outlook, a rate cut from the Fed, and the shelving of the Withdrawal Agreement Bill all encouraged capital to trickle back into bond funds in the final days of October.

For equity funds, flows were positive, but not by much. Investors added a net £97m to their equity-fund holdings. This is, however, almost a rounding error when set against the £14.4bn of turnover in equity funds during the month. Our FFI: Equity was therefore a neutral 50.3 in October, meaning that buys were almost the same value as sells in the context of the overall volume traded. This still was good news for the sector, as it follows an unprecedented three consecutive months of outflows. Moreover, the outflows from active funds slowed to their lowest pace since January, while inflows to passive funds were steady month-on-month.

UK-equity funds saw their first inflows since June as the UK’s Brexit deadlock began to show signs of movement. At only £16m, this was the smallest net inflow into the sector that Calastone has ever recorded and follows £1.0bn of outflows during Q3, suggesting that investor sentiment towards the UK remains very fragile. Asia-Pacific and North American equity funds saw the strongest inflows (along with global funds which are perennial favourites among investors). This suggests that the reduction in pessimism about the US-China dispute directed investor attention to these markets in particular. European and equity-income funds saw continued outflows (for the 13th and 34th consecutive months respectively).

Figure 2: Net fund flows - Active Equity v Equity Index

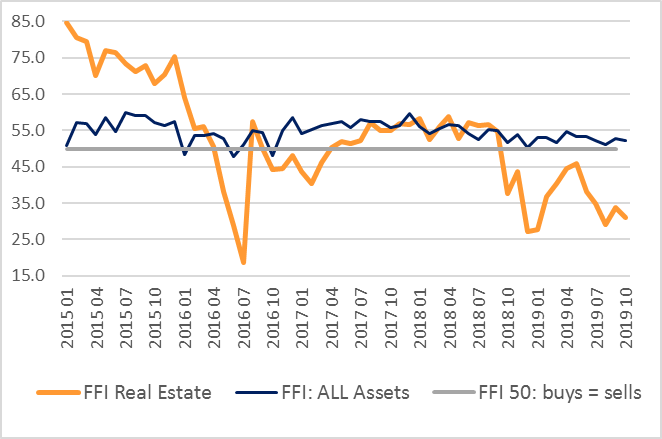

Despite more positive news for equity funds, October saw no respite for property funds. The sector lost a net £204m, and the FFI: Real Estate fell to 31.0, its fifth-lowest reading on record. Investors have now withdrawn money out of real-estate funds for a record 13 consecutive months.

Figure 2: Net fund flows - Active Equity v Equity Index

Despite more positive news for equity funds, October saw no respite for property funds. The sector lost a net £204m, and the FFI: Real Estate fell to 31.0, its fifth-lowest reading on record. Investors have now withdrawn money out of real-estate funds for a record 13 consecutive months.

Figure 3: FFI: Real Estate

Edward Glyn, head of global markets at Calastone said: “Despite a slight improvement in October, it’s too soon to call a turning point in investor appetite to commit capital to riskier assets. Uncertainties abound and that is likely to weigh on sentiment in the months ahead. This was already clear by the end of the October as investors had already begun to buy bond funds again in the last three or four days. The overall improvement for equity funds in October was also mainly driven by a reduction in selling, rather than a pick-up in buying - we don’t think it’s likely that equity funds will avoid outflows for the full year 2019.

Fund flows are marked by sudden squalls, shifting tides and long-range currents. Investors are well served by steadily investing, month by month into categories of fund that will deliver good returns over the long-term. This is why we see relatively little turnover in passive funds and mixed assets – inflows into these classes are structurally positive. The shifting tides occur over the economic cycle as investor thinking adapts to the ebb and flow of economic activity – the move out of real estate funds is a case in point. It is the sudden squalls that are the big events that intrude and drive opportunistic trading, such as the reaction to the UK government’s unexpected October announcement of a Brexit withdrawal agreement.

The sensitivity investors are showing day-by-day to the Brexit crisis shows that and signs that a clear solution may pass through Parliament, one way or the other, there is likely to be a marked shift in appetite for UK assets. The outcome of the UK election will provide the first indication of how likely that will be.”

Figure 3: FFI: Real Estate

Edward Glyn, head of global markets at Calastone said: “Despite a slight improvement in October, it’s too soon to call a turning point in investor appetite to commit capital to riskier assets. Uncertainties abound and that is likely to weigh on sentiment in the months ahead. This was already clear by the end of the October as investors had already begun to buy bond funds again in the last three or four days. The overall improvement for equity funds in October was also mainly driven by a reduction in selling, rather than a pick-up in buying - we don’t think it’s likely that equity funds will avoid outflows for the full year 2019.

Fund flows are marked by sudden squalls, shifting tides and long-range currents. Investors are well served by steadily investing, month by month into categories of fund that will deliver good returns over the long-term. This is why we see relatively little turnover in passive funds and mixed assets – inflows into these classes are structurally positive. The shifting tides occur over the economic cycle as investor thinking adapts to the ebb and flow of economic activity – the move out of real estate funds is a case in point. It is the sudden squalls that are the big events that intrude and drive opportunistic trading, such as the reaction to the UK government’s unexpected October announcement of a Brexit withdrawal agreement.

The sensitivity investors are showing day-by-day to the Brexit crisis shows that and signs that a clear solution may pass through Parliament, one way or the other, there is likely to be a marked shift in appetite for UK assets. The outcome of the UK election will provide the first indication of how likely that will be.”