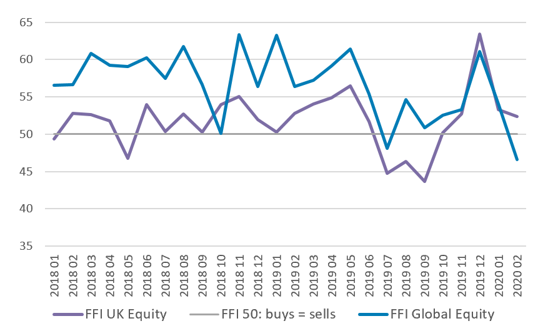

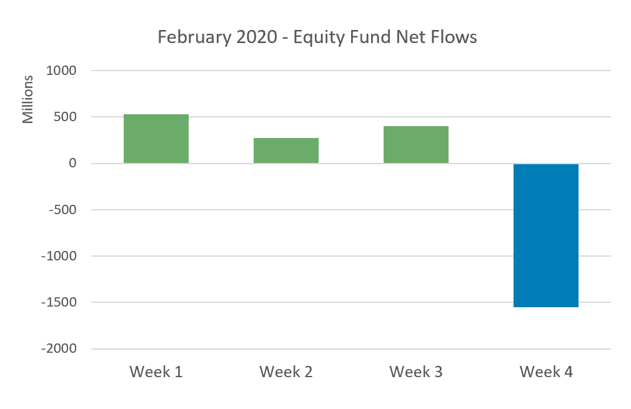

The market crash caused by a dramatic reassessment of the potential economic impact of the coronavirus prompted a flood of outflows from equity funds in February, according to the latest Fund Flow Index (FFI) from Calastone, the largest global funds network. The apparently modest £348m net outflow for February belied the extent of the reversal in investor sentiment, however. Investors bought equity funds enthusiastically in the first three weeks of February, having shrugged off an initial flutter of virus-induced nerves at the end of January. But when, on Monday 24th February, the markets began their worst week in over a decade as the virus took hold in one country after another, investors withdrew their capital from equity funds at their fastest rate on Calastone’s record: in the last week of February alone they sold an unprecedented net £1.55bn of equity holdings. Calastone’s FFI: Equity dropped to 49.1 for the full month, but in the last week was just 37.7, its lowest ever reading (a score of 50 means buys equal sells).

The impact was felt most strongly on active equity funds. They shed £1.18bn of capital in February, while passive funds enjoyed £832m of inflows. Nevertheless, even passive funds saw outflows in the last week of February, though the damage was limited to a mere £25m. Active funds bore the brunt of the disruption.

Calastone’s analysis shows that institutional investors reacted more strongly than retail investors. Over the whole month, institutions were net sellers of equities, while retail investors were modest net buyers. This in large part reflects the regular savings plans embedded in retail investor accounts, as evidenced by the relatively muted impact on passive funds, but may also indicate that institutions were quicker off the mark in reacting to the news as it developed.

In keeping with the global nature of the crisis, global equity funds were hardest hit, suffering their worst month on Calastone’s record. A net £309m left the sector in February, but £881m flowed out in the last five days alone (reversing inflows earlier in the month). Funds focused on Asia, Europe and specialist regional (which include funds focussed on China) and sector funds were also heavily affected. UK funds escaped relatively unscathed, however. For the full month, UK funds enjoyed inflows of £227m, and only suffered significant selling (£107m) on the very last day of the month, as the top 100 index of leading shares dropped to its lowest level in almost five years.

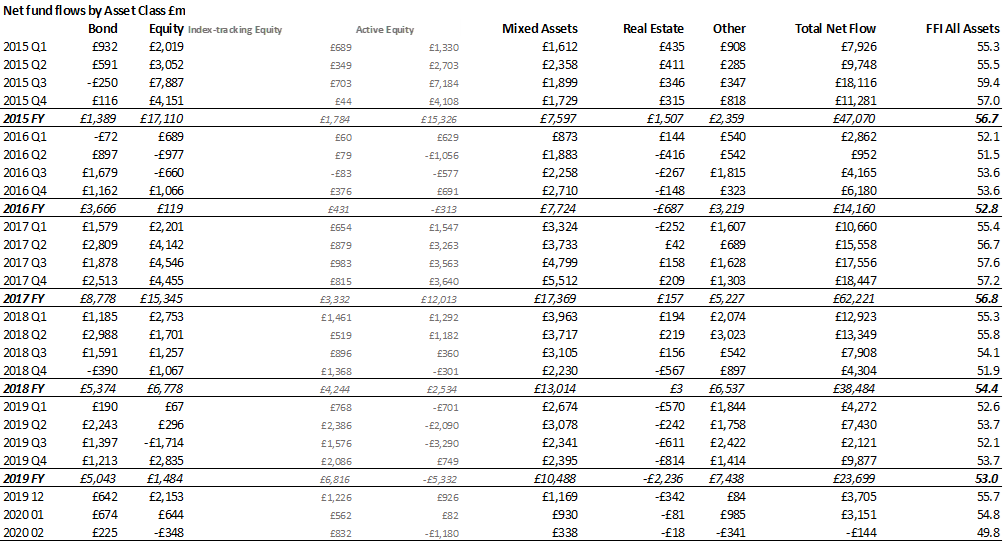

Elsewhere, modest buying of fixed-income and mixed-asset funds was not enough to offset the reversal in equities. Funds invested in other asset classes followed equity funds out the door - alternatives, commodity funds and absolute return all saw outflows. Real estate funds suffered a record 17th consecutive month of outflows, though the final week of the month saw capital flow back into the sector as investors perceived property to be a relative safe haven.

Added all together, February 2020 was only the fourth month on record to see net outflows across the sum of all types of fund, the last time being October 2016. UK investors pulled a net £144m out of their fund holdings, opting to sit out the volatility in cash.

Edward Glyn said: “Fear ate greed for lunch in the last few days of February, as equity funds saw outflows at their most ferocious in five years. After an initial flurry of outflows in January, funds benefited from extreme complacency over the coronavirus outbreak. But the news that the epidemic had taken hold in Italy and then quickly spread across the world caused a dramatic reassessment of its potential impact on the global economy. Investors have voted with their feet.

The curiously relaxed approach to funds focused on UK equities reflected the limited number of infections, as well as the extremely low valuations for UK shares. That was enough to keep the sellers at bay for a time, but by the last day of the month there were signs of capitulation even for this sector too.

It’s impossible to predict what will happen next, or whether the market has over- or underreacted to the epidemic. The Calastone Fund Flow Index can keep investors informed of the latest developments as they happen.”

The impact was felt most strongly on active equity funds. They shed £1.18bn of capital in February, while passive funds enjoyed £832m of inflows. Nevertheless, even passive funds saw outflows in the last week of February, though the damage was limited to a mere £25m. Active funds bore the brunt of the disruption.

Calastone’s analysis shows that institutional investors reacted more strongly than retail investors. Over the whole month, institutions were net sellers of equities, while retail investors were modest net buyers. This in large part reflects the regular savings plans embedded in retail investor accounts, as evidenced by the relatively muted impact on passive funds, but may also indicate that institutions were quicker off the mark in reacting to the news as it developed.

In keeping with the global nature of the crisis, global equity funds were hardest hit, suffering their worst month on Calastone’s record. A net £309m left the sector in February, but £881m flowed out in the last five days alone (reversing inflows earlier in the month). Funds focused on Asia, Europe and specialist regional (which include funds focussed on China) and sector funds were also heavily affected. UK funds escaped relatively unscathed, however. For the full month, UK funds enjoyed inflows of £227m, and only suffered significant selling (£107m) on the very last day of the month, as the top 100 index of leading shares dropped to its lowest level in almost five years.

Elsewhere, modest buying of fixed-income and mixed-asset funds was not enough to offset the reversal in equities. Funds invested in other asset classes followed equity funds out the door - alternatives, commodity funds and absolute return all saw outflows. Real estate funds suffered a record 17th consecutive month of outflows, though the final week of the month saw capital flow back into the sector as investors perceived property to be a relative safe haven.

Added all together, February 2020 was only the fourth month on record to see net outflows across the sum of all types of fund, the last time being October 2016. UK investors pulled a net £144m out of their fund holdings, opting to sit out the volatility in cash.

Edward Glyn said: “Fear ate greed for lunch in the last few days of February, as equity funds saw outflows at their most ferocious in five years. After an initial flurry of outflows in January, funds benefited from extreme complacency over the coronavirus outbreak. But the news that the epidemic had taken hold in Italy and then quickly spread across the world caused a dramatic reassessment of its potential impact on the global economy. Investors have voted with their feet.

The curiously relaxed approach to funds focused on UK equities reflected the limited number of infections, as well as the extremely low valuations for UK shares. That was enough to keep the sellers at bay for a time, but by the last day of the month there were signs of capitulation even for this sector too.

It’s impossible to predict what will happen next, or whether the market has over- or underreacted to the epidemic. The Calastone Fund Flow Index can keep investors informed of the latest developments as they happen.”