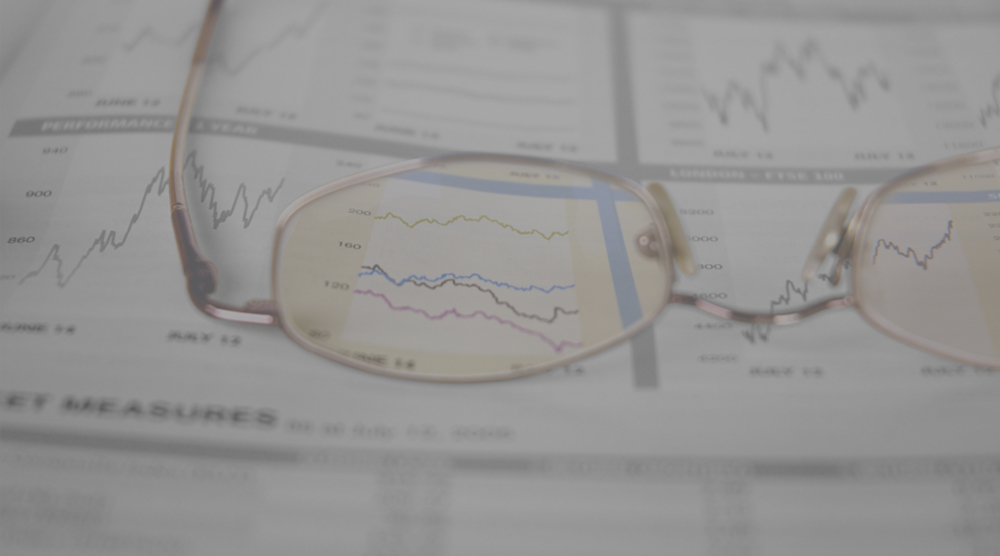

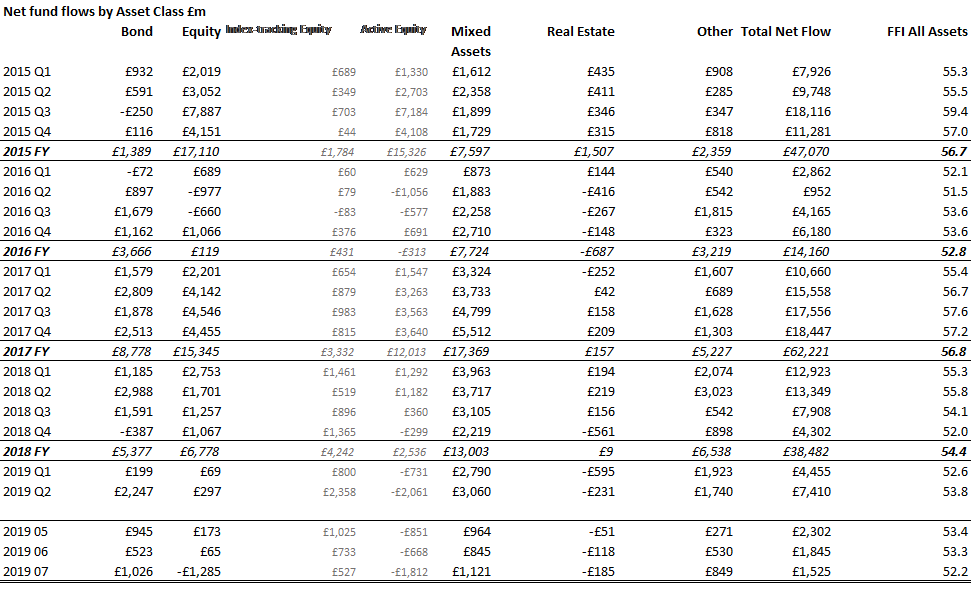

Political upheaval in the UK and the sharply rising likelihood of a no-deal Brexit caused a dramatic outflow of capital from equity funds in July, according to the latest Fund Flow Index (FFI) from Calastone, the largest global funds transaction network. UK investors rushed to sell their holdings at their fastest rate since October 2016. A net £1.3bn flowed out of equity funds, on the back of record trading volumes, pushing the FFI: Equity down to just 46.1. This was its lowest level in over two and a half years (a reading of 50 means the value of buys equals the value of sells). The worst impact was felt in funds focused on UK equities, which accounted for about half the total outflow. Other riskier asset types such as commodity funds, alternatives and real estate also saw outflows. Investors sought out the relative safety of fixed-income, money-market and mixed-asset funds. And the flow of funds offshore surged higher.

Figure 1: FFI: Equity v FFI: UK Equity

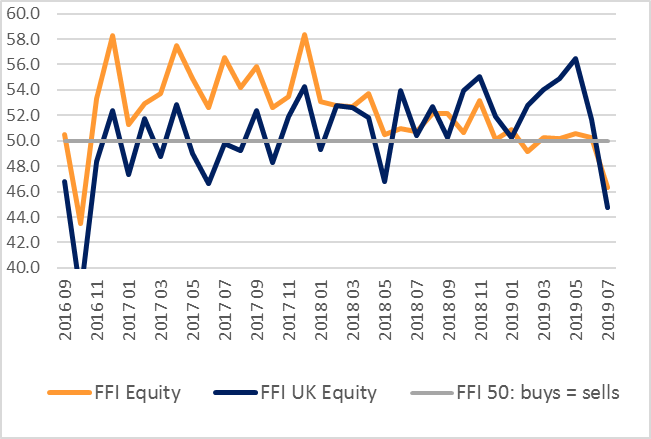

Figure 2: FFI: Bonds v FFI: All Assets

Figure 2: FFI: Bonds v FFI: All Assets

Every category of equity fund, except Asia and emerging markets, saw outflows in July, even perennially popular global funds. UK-equity funds were by far the hardest hit, however. £410m left the sector, easily the largest outflow in over two and a half years. Investors have recently been adding to their UK-equity fund holdings as MPs voted in the spring to rule out a no-deal withdrawal from the EU. Now no-deal is considered by many to be official government policy, there is a flood of withdrawals from UK-focused funds. The daily trading patterns underline this interpretation. As the race to succeed Theresa May as prime minister led the two remaining leadership candidates to compete for the toughest line on dealing with the EU, so outflows turned from a steady stream to a flood. In the first half of the month they totalled £90m, but in the final fortnight, a period which included the coronation of the victor, they rose to £320m. The equity-income sector, which is dominated by funds investing in UK equities too, saw £333m of outflows.

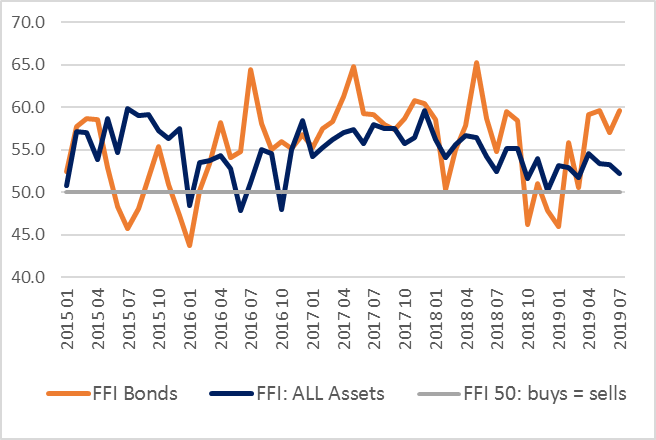

Active funds bore the brunt of the selling. Investors shed £1.8bn of their active equity funds in July alone, by far the biggest monthly outflow ever suffered by this category. One quarter of this came out of active UK-equity funds, with income funds contributing almost one fifth. No category of active equity fund escaped outflows. Index funds by contrast saw £526m of inflows, and no category saw outflows.

Fixed-income funds were the main beneficiaries of the cash leaving equity funds. £1.0bn flowed into the sector, the third largest monthly inflow on record. Other low-risk asset types also saw inflows.

Figure 3: Active v Index

Every category of equity fund, except Asia and emerging markets, saw outflows in July, even perennially popular global funds. UK-equity funds were by far the hardest hit, however. £410m left the sector, easily the largest outflow in over two and a half years. Investors have recently been adding to their UK-equity fund holdings as MPs voted in the spring to rule out a no-deal withdrawal from the EU. Now no-deal is considered by many to be official government policy, there is a flood of withdrawals from UK-focused funds. The daily trading patterns underline this interpretation. As the race to succeed Theresa May as prime minister led the two remaining leadership candidates to compete for the toughest line on dealing with the EU, so outflows turned from a steady stream to a flood. In the first half of the month they totalled £90m, but in the final fortnight, a period which included the coronation of the victor, they rose to £320m. The equity-income sector, which is dominated by funds investing in UK equities too, saw £333m of outflows.

Active funds bore the brunt of the selling. Investors shed £1.8bn of their active equity funds in July alone, by far the biggest monthly outflow ever suffered by this category. One quarter of this came out of active UK-equity funds, with income funds contributing almost one fifth. No category of active equity fund escaped outflows. Index funds by contrast saw £526m of inflows, and no category saw outflows.

Fixed-income funds were the main beneficiaries of the cash leaving equity funds. £1.0bn flowed into the sector, the third largest monthly inflow on record. Other low-risk asset types also saw inflows.

Figure 3: Active v Index

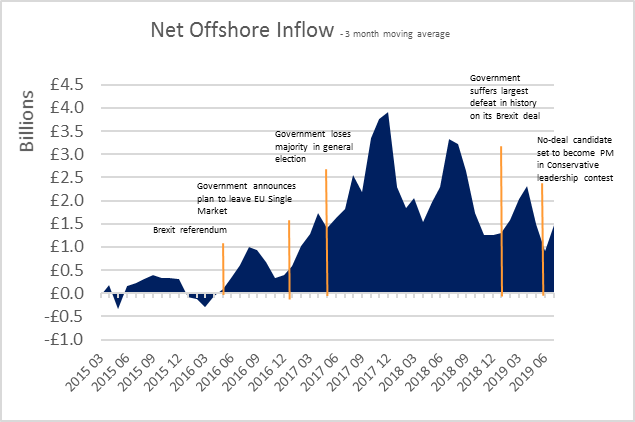

Figure 4: Flows of UK capital to offshore funds

Figure 4: Flows of UK capital to offshore funds

The rising risks of a no-deal Brexit also prompted a huge jump in the flow of capital into funds based outside the UK’s regulatory reach. £2.8bn flowed offshore in July, more than April, May and June combined. Almost all of this went into funds based in Dublin and Luxembourg, inside the EU’s regulatory framework. The flow of funds offshore has shown itself to be extremely sensitive to Brexit-related news in the last three years, with each negative development succeeded by a big increase in capital flight. July was no exception.

Edward Glyn, Calastone’s Head of Global Markets commented: “Investors are increasingly nervous about the outlook for the world in general and the UK in particular and so are intent on reducing the risk in their holdings. UK-equity funds are bearing the brunt of the outflows. This can only be ascribed to the government’s increasingly strident rhetoric over a no-deal Brexit, and the associated economic chaos investors expect it to unleash - at least in the short term. In periods when an orderly exit has looked ever more likely, investors have bought undervalued UK-equity funds. But they pass judgement swiftly when the no-deal rhetoric ramps up. The outflow from equity-income funds is part of this trend, though this also reflects negativity publicity surrounding the sector at present. Moreover, the flight of capital offshore is yet another sign of the impact Brexit is having on the UK funds industry.

Active funds are the big losers under the current conditions. Not only has active fund management suffered some reputational blows of late, but active funds are increasingly becoming a discretionary choice among investors, while passive funds are cementing their position in regular savings plans.

This means active funds are increasingly likely to shoulder more of the outflow burden when investor sentiment turns negative.”

The rising risks of a no-deal Brexit also prompted a huge jump in the flow of capital into funds based outside the UK’s regulatory reach. £2.8bn flowed offshore in July, more than April, May and June combined. Almost all of this went into funds based in Dublin and Luxembourg, inside the EU’s regulatory framework. The flow of funds offshore has shown itself to be extremely sensitive to Brexit-related news in the last three years, with each negative development succeeded by a big increase in capital flight. July was no exception.

Edward Glyn, Calastone’s Head of Global Markets commented: “Investors are increasingly nervous about the outlook for the world in general and the UK in particular and so are intent on reducing the risk in their holdings. UK-equity funds are bearing the brunt of the outflows. This can only be ascribed to the government’s increasingly strident rhetoric over a no-deal Brexit, and the associated economic chaos investors expect it to unleash - at least in the short term. In periods when an orderly exit has looked ever more likely, investors have bought undervalued UK-equity funds. But they pass judgement swiftly when the no-deal rhetoric ramps up. The outflow from equity-income funds is part of this trend, though this also reflects negativity publicity surrounding the sector at present. Moreover, the flight of capital offshore is yet another sign of the impact Brexit is having on the UK funds industry.

Active funds are the big losers under the current conditions. Not only has active fund management suffered some reputational blows of late, but active funds are increasingly becoming a discretionary choice among investors, while passive funds are cementing their position in regular savings plans.

This means active funds are increasingly likely to shoulder more of the outflow burden when investor sentiment turns negative.”

Methodology

Calastone analysed over a million buy and sell orders every month from January 2015, tracking monies from IFAs, platforms and institutions as they flow into and out of investment funds. Data is collected until the close of business on the last day of each month. A single order is usually the aggregated value of a number of trades from underlying investors passed for example from a platform via Calastone to the fund manager. In reality, therefore, the index is analysing the impact of many millions of investor decisions each month.

More than two thirds of UK fund flows by value pass across the Calastone network each month. All these trades are included in the FFI. To avoid double-counting, however, the team has excluded deals that represent transactions where funds of funds are buying those funds that comprise the portfolio. Totals are scaled up for Calastone’s market share.

A reading of 50 indicates that new money investors put into funds equals the value of redemptions (or sales) from funds. A reading of 100 would mean all activity was buying; a reading of 0 would mean all activity was selling. In other words, £1m of net inflows will score more highly if there is no selling activity, than it would if £1m was merely a small difference between a large amount of buying and a similarly large amount of selling.

Calastone’s main FFI All Assets considers transactions only by UK-based investors, placing orders for funds domiciled in the UK. The majority of this capital is from retail investors. Calastone also measures the flow of funds from UK-based investors to offshore-domiciled funds. Most of these are domiciled in Ireland and Luxembourg. This is overwhelmingly capital from institutions; the larger size of retail transactions in offshore funds suggests the underlying investors are higher net worth individuals.

Methodology

Calastone analysed over a million buy and sell orders every month from January 2015, tracking monies from IFAs, platforms and institutions as they flow into and out of investment funds. Data is collected until the close of business on the last day of each month. A single order is usually the aggregated value of a number of trades from underlying investors passed for example from a platform via Calastone to the fund manager. In reality, therefore, the index is analysing the impact of many millions of investor decisions each month.

More than two thirds of UK fund flows by value pass across the Calastone network each month. All these trades are included in the FFI. To avoid double-counting, however, the team has excluded deals that represent transactions where funds of funds are buying those funds that comprise the portfolio. Totals are scaled up for Calastone’s market share.

A reading of 50 indicates that new money investors put into funds equals the value of redemptions (or sales) from funds. A reading of 100 would mean all activity was buying; a reading of 0 would mean all activity was selling. In other words, £1m of net inflows will score more highly if there is no selling activity, than it would if £1m was merely a small difference between a large amount of buying and a similarly large amount of selling.

Calastone’s main FFI All Assets considers transactions only by UK-based investors, placing orders for funds domiciled in the UK. The majority of this capital is from retail investors. Calastone also measures the flow of funds from UK-based investors to offshore-domiciled funds. Most of these are domiciled in Ireland and Luxembourg. This is overwhelmingly capital from institutions; the larger size of retail transactions in offshore funds suggests the underlying investors are higher net worth individuals.