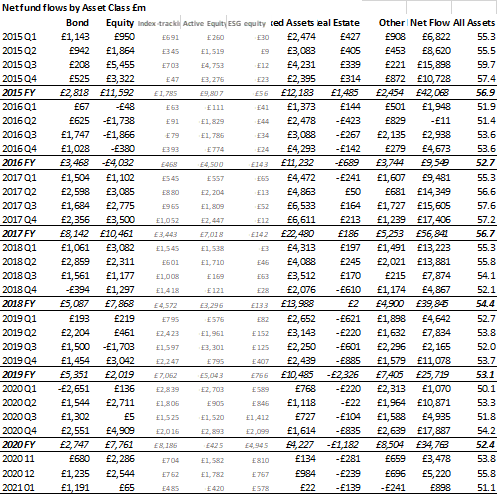

The vaccine-induced euphoria that saw equity funds enjoy their second-best month on record in December evaporated in January as contagious new Covid-19 variants prompted surging infection rates around the world. The latest Fund Flow Index from Calastone, the largest global funds network, showed that net inflows fell by 97.5% month-on-month to just £64.6m, no more than a rounding error in the context of busy trading volumes well above average at £21.8bn.

UK and European equity funds shunned by Covid-shy investors

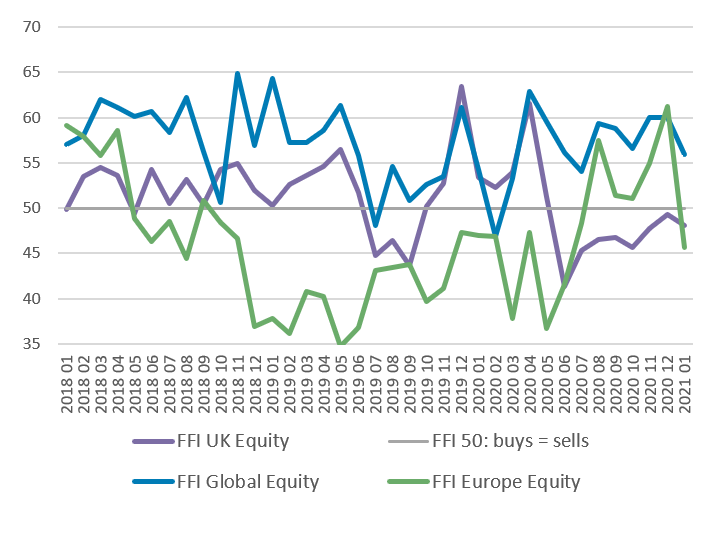

As the UK descended into a full national lockdown with no prospect of release for months to come, outflows from funds focused on UK equities accelerated to £179m, the eighth consecutive month in which investors have shed UK equities. Equity income funds, which are heavily weighed to UK shares, had their second-worst month on record, in effect a vote against UK equities too. Meanwhile, Europe’s vaccine debacle prompted a U-turn in investor sentiment towards funds focused on European shares. After months of accelerating inflows culminating in a record month in December, January saw investors once again bail out of European funds, selling down £141m. All other regions saw modest inflows. Global funds, however, had another good month, in line with the average for the last year. Two thirds of global fund inflows are driven by ESG.

Traditional active equity funds pummelled, giving up December’s inflows

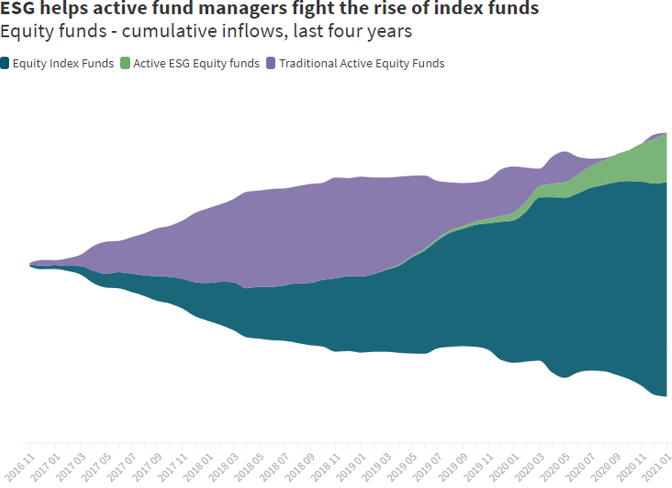

There was bad news for traditional active equity funds (ie those without an ESG mandate), as they gave up almost all the new capital they had garnered in December. Investors shed holdings to the tune of £965m in January, having added £1.0bn the previous month. The return to outflows marks a return to trend.

Traditional active equity funds pummelled, giving up December’s inflows

There was bad news for traditional active equity funds (ie those without an ESG mandate), as they gave up almost all the new capital they had garnered in December. Investors shed holdings to the tune of £965m in January, having added £1.0bn the previous month. The return to outflows marks a return to trend.

ESG boom continues

By contrast, the ESG boom continued, as active ESG equity funds enjoyed another strong month, with inflows of £545m, their third-best month on record. The value of buy orders was twice the size of sells, giving an exceptionally high FFI reading of 66.1. Active ESG equity funds have seen inflows almost as high in just the four months since October as the previous five-and-three-quarter years combined.

Index funds escape the selling

Index funds also did well, barely breaking their stride. Despite the sharp reversal of investor sentiment, they enjoyed inflows of £485m in January. Although this was lower than in recent months, reflecting the cooler sentiment towards equities overall, it was in line with the monthly average in recent years.

Bond funds enjoy a very strong month

Meanwhile, fixed income funds enjoyed another very strong month, with £1.2bn of inflows, almost matching the December total. These inflows strengthened sharply following a jump in bond yields early in the month.

Outflows from real estate funds continued to slow in January, dropping to £139m.

Edward Glyn, head of global markets at Calastone said: “The euphoria that characterised the huge inflows to equity funds in the last few weeks of 2020, including even unloved traditional active funds, dissipated with the cold light of the post-holiday hangover. Dry January proved true to type as inflows evaporated.

“The pandemic has increased in intensity in almost all parts of the globe, causing stock markets to falter and investors to curb their enthusiasm for equities. Despite the success of its vaccine rollout, the UK market remains firmly out of favour – a new lockdown, severe disruption caused by Brexit and the unfavourable complexion of the UK stock market dominated by slow growing value stocks all make it difficult to construct a compelling buy case for UK shares. But Europe is once again sinking into the doldrums too. We are likely to see outflows here continue in the short term.

“Meanwhile, the prospect of enormous fiscal stimulus in the US along with continued record borrowing across many major economies pushed bond yields higher in January. Investors are awash with cash and looking for any assets that can provide a return. With equities out of favour, more attractive yields quickly tempted additional buyers into bond funds.”

ESG boom continues

By contrast, the ESG boom continued, as active ESG equity funds enjoyed another strong month, with inflows of £545m, their third-best month on record. The value of buy orders was twice the size of sells, giving an exceptionally high FFI reading of 66.1. Active ESG equity funds have seen inflows almost as high in just the four months since October as the previous five-and-three-quarter years combined.

Index funds escape the selling

Index funds also did well, barely breaking their stride. Despite the sharp reversal of investor sentiment, they enjoyed inflows of £485m in January. Although this was lower than in recent months, reflecting the cooler sentiment towards equities overall, it was in line with the monthly average in recent years.

Bond funds enjoy a very strong month

Meanwhile, fixed income funds enjoyed another very strong month, with £1.2bn of inflows, almost matching the December total. These inflows strengthened sharply following a jump in bond yields early in the month.

Outflows from real estate funds continued to slow in January, dropping to £139m.

Edward Glyn, head of global markets at Calastone said: “The euphoria that characterised the huge inflows to equity funds in the last few weeks of 2020, including even unloved traditional active funds, dissipated with the cold light of the post-holiday hangover. Dry January proved true to type as inflows evaporated.

“The pandemic has increased in intensity in almost all parts of the globe, causing stock markets to falter and investors to curb their enthusiasm for equities. Despite the success of its vaccine rollout, the UK market remains firmly out of favour – a new lockdown, severe disruption caused by Brexit and the unfavourable complexion of the UK stock market dominated by slow growing value stocks all make it difficult to construct a compelling buy case for UK shares. But Europe is once again sinking into the doldrums too. We are likely to see outflows here continue in the short term.

“Meanwhile, the prospect of enormous fiscal stimulus in the US along with continued record borrowing across many major economies pushed bond yields higher in January. Investors are awash with cash and looking for any assets that can provide a return. With equities out of favour, more attractive yields quickly tempted additional buyers into bond funds.”