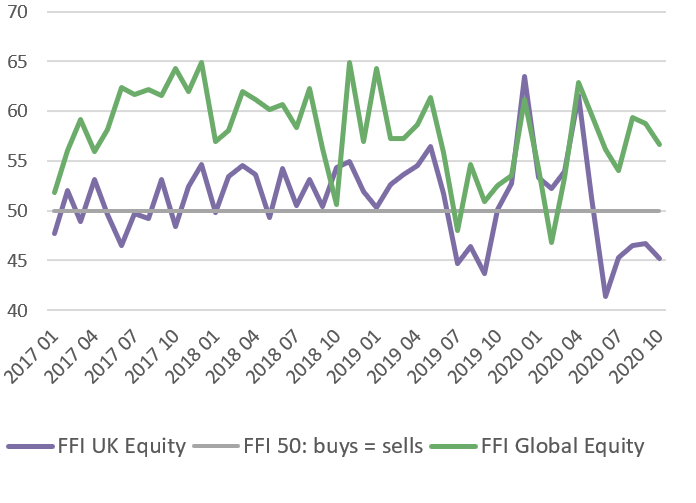

Surging Covid-19 infection rates and Brexit tensions prompted a flood of outflows from UK-focused equity funds in October, according to the latest Fund Flow Index from Calastone, the largest global funds network. Outflows totalled £358m during the month, making October the fourth-worst month on record for UK-focused equity funds. Along with income funds, they are the only categories now to have seen five consecutive months of outflows. The FFI:UK Equity fell to 45.2, one of its worst-ever readings. Income funds, which are disproportionately invested in UK equities suffered their worst ever month as £763m left the sector. FFI:Equity Income sank to 34.6, meaning that sell orders were roughly double the value of buy orders.

European equity funds also suffered outflows, albeit only £69m, but funds focused on North America and Asia, as well as those with a global approach, all saw investors add new capital. Across all types of equity funds, investors redeemed a net £82m of capital – a very small outflow considering that the total volume of funds traded was £19.8bn, but it was nevertheless the first outflow in three months.

Once again, the big winners were ESG funds and index funds. ESG equity funds garnered £542m in inflows compared to £625m of outflows for non-ESG funds. Meanwhile index equity funds enjoyed £378m of new capital, whilst their active counterparts shed £460m.

Across other asset classes, the caution investors expressed around equities benefited fixed income funds. Bond funds had their best month since November 2019, with £716m of inflows, boosted by the rapid growth in ESG bond investing. The last five months have seen record inflows to ESG fixed income funds – in October these funds absorbed £125m of new capital, the second-highest total after August. Mixed asset funds also had a strong month. Property funds, however, suffered outflows of £336m, their third-worst month on record.

Edward Glyn, head of global markets at Calastone commented: “Investors voted with their feet in October, both as they anticipated the second round of lockdowns being imposed across England and Wales and watched as Brexit brinkmanship from the EU and the UK dramatically increased the risk of a no-deal crash out when the UK’s departure transition period ends this year. The fact that UK-focused funds are suffering so much more than their European counterparts, despite the pandemic inflicting lockdowns equally severe in many parts of the continent, suggests that investors view the double whammy of Covid-19 and Brexit as uniquely damaging for Britain.

Global markets have been nervy in the last couple of weeks as concerns over the global economy have grown, but investors have not shown the same fear they did in March at the resurgent pandemic. Property funds have suffered a significant knock however, as many of them have just lifted their suspensions on trading, thereby facilitating pent-up demand for redemptions to take place.”

European equity funds also suffered outflows, albeit only £69m, but funds focused on North America and Asia, as well as those with a global approach, all saw investors add new capital. Across all types of equity funds, investors redeemed a net £82m of capital – a very small outflow considering that the total volume of funds traded was £19.8bn, but it was nevertheless the first outflow in three months.

Once again, the big winners were ESG funds and index funds. ESG equity funds garnered £542m in inflows compared to £625m of outflows for non-ESG funds. Meanwhile index equity funds enjoyed £378m of new capital, whilst their active counterparts shed £460m.

Across other asset classes, the caution investors expressed around equities benefited fixed income funds. Bond funds had their best month since November 2019, with £716m of inflows, boosted by the rapid growth in ESG bond investing. The last five months have seen record inflows to ESG fixed income funds – in October these funds absorbed £125m of new capital, the second-highest total after August. Mixed asset funds also had a strong month. Property funds, however, suffered outflows of £336m, their third-worst month on record.

Edward Glyn, head of global markets at Calastone commented: “Investors voted with their feet in October, both as they anticipated the second round of lockdowns being imposed across England and Wales and watched as Brexit brinkmanship from the EU and the UK dramatically increased the risk of a no-deal crash out when the UK’s departure transition period ends this year. The fact that UK-focused funds are suffering so much more than their European counterparts, despite the pandemic inflicting lockdowns equally severe in many parts of the continent, suggests that investors view the double whammy of Covid-19 and Brexit as uniquely damaging for Britain.

Global markets have been nervy in the last couple of weeks as concerns over the global economy have grown, but investors have not shown the same fear they did in March at the resurgent pandemic. Property funds have suffered a significant knock however, as many of them have just lifted their suspensions on trading, thereby facilitating pent-up demand for redemptions to take place.”