Asia’s asset management industry enters 2026 at a moment of accelerated change. ETF markets continue to scale rapidly, cross-border fund flows are becoming more complex, and digital market infrastructure is evolving at pace. Across the region in 2026, asset managers and distributors will be rethinking how they operate, distribute and service funds in response to rising volumes, regulatory change and the steady emergence of tokenised operating models.

Cross-border connectivity moves to the centre of strategy

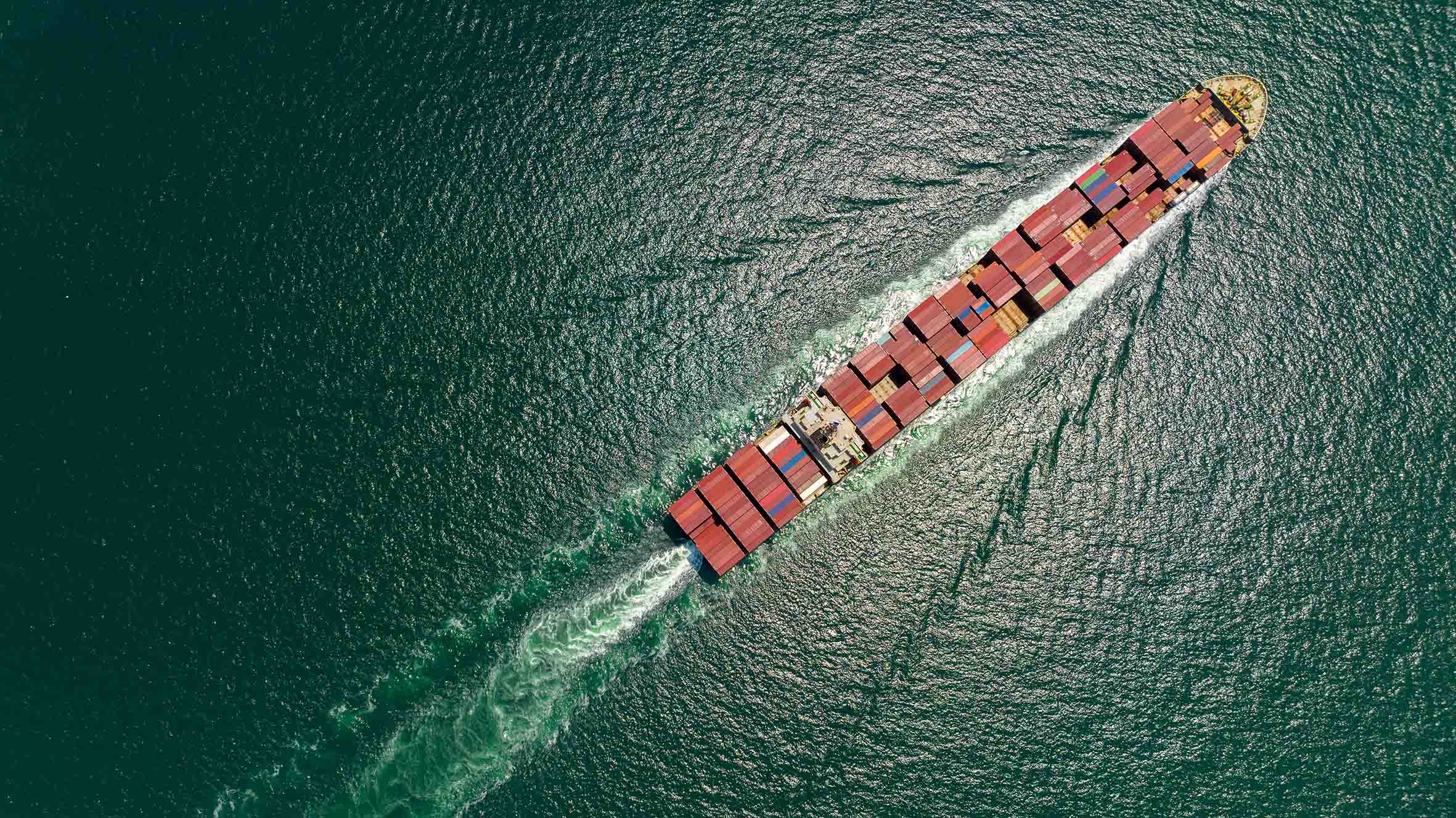

As Asia’s asset management industry matures, cross-border connectivity is becoming central to growth strategies. Managers are distributing products across multiple jurisdictions, while investors increasingly expect seamless access to regional and global investment opportunities.

Hong Kong continues to play a pivotal role as a gateway for cross-border fund activity in Asia, with China-related flows expected to remain a significant driver in 2026. Alongside its role as a distribution and connectivity hub, the city is also advancing digital market infrastructure that supports faster, more efficient cross-border interaction. Developments highlighted at Hong Kong FinTech Week, including the HKMA’s Fintech 2030 strategy, point to a market actively preparing for more digital, interconnected and settlement-efficient financial flows.

Singapore’s position as a regional distribution hub further reinforces the importance of cross-market connectivity. Discussions at the Singapore FinTech Festival in 2025 reflected strong industry focus on interoperability, scalability and digital infrastructure capable of supporting increasingly complex cross-border fund activity. As products are distributed across ASEAN and beyond, efficient order routing and post-trade connectivity are becoming essential enablers of regional growth.

The growing relevance of the Middle East as a global ETF growth region is also shaping cross-border strategies. Stronger connectivity between East Asian and Middle Eastern markets is opening new opportunities for issuers and distributors, reinforcing the increasingly global nature of fund distribution and servicing.

ETF growth reshapes operating models

ETFs remain one of the most powerful forces shaping Asia’s asset management landscape. Taiwan, in particular, has emerged as one of the world’s largest and fastest-growing ETF markets, driven by strong investor demand and an expanding range of products across equities, fixed income and thematic strategies. Its ETF ecosystem is now globally significant, both in terms of scale and sophistication.

Across Asia, rising ETF volumes are prompting asset managers to reassess their operating models and their primary market infrastructure in 2026. Higher trading frequency, tighter settlement expectations and greater transparency requirements are accelerating the shift toward automated, scalable infrastructure. In 2026, ETF growth is expected to continue acting as a catalyst for broader transformation across fund servicing, settlement and distribution functions.

Tokenisation moves from exploration to execution

Tokenisation is steadily transitioning from conceptual discussion to practical implementation across Asia, although markets are progressing at different speeds. What is consistent, however, is the growing seriousness with which regulators and market participants are engaging with digital and tokenised operating models.

Hong Kong has been particularly active in this space. At Hong Kong FinTech Week, the HKMA’s Fintech 2030 strategy highlighted tokenisation as a core pillar of future market infrastructure. Initiatives such as Project Ensemble, which is exploring real-value blockchain transactions using e-HKD, tokenised deposits and regulated stablecoins, point to a market actively testing how digital settlement and asset models could operate at scale. Regular issuance of tokenised government bonds and exploration of blockchain-based settlement for Exchange Fund papers further reinforce this direction of travel.

Elsewhere, Singapore continues to explore tokenised asset models with an emphasis on institutional robustness and interoperability, even as it takes a more measured approach to regulation. Taiwan is also engaging regulators and market infrastructure providers on how tokenisation and digital models may affect the future of ETF servicing and settlement.

In 2026, tokenised distribution models, digital collateral solutions and multi-product token structures are expected to move further into practical testing and early adoption. These developments offer the potential for more transparent, efficient and near real-time fund servicing, while also reshaping approaches to liquidity and collateral management.

Regulation shapes pace, not direction

Regulatory change will continue to influence how quickly digital transformation unfolds across Asia, but the overall direction is increasingly clear. Hong Kong is advancing rapidly with frameworks supporting tokenised settlement infrastructure and regulated stablecoins. Singapore, while more cautious, is expected to provide further clarity around digital assets, custody and interoperability.

This diversity of regulatory approaches reinforces the need for adaptable operating models capable of supporting different market requirements while remaining future-ready.

A defining year for Asia’s fund ecosystem

2026 is set to be a defining year for Asia’s asset management industry. Automation is becoming foundational, cross-border connectivity is central to growth, ETF markets – particularly in Taiwan – continue to scale rapidly, and tokenised models are moving steadily toward execution.

Rather than following a single path, Asia’s transformation will be shaped by how these themes interact across markets. What is clear is that the region remains one of the most dynamic and innovative centres in global asset management, well positioned for another year of meaningful evolution and opportunity.