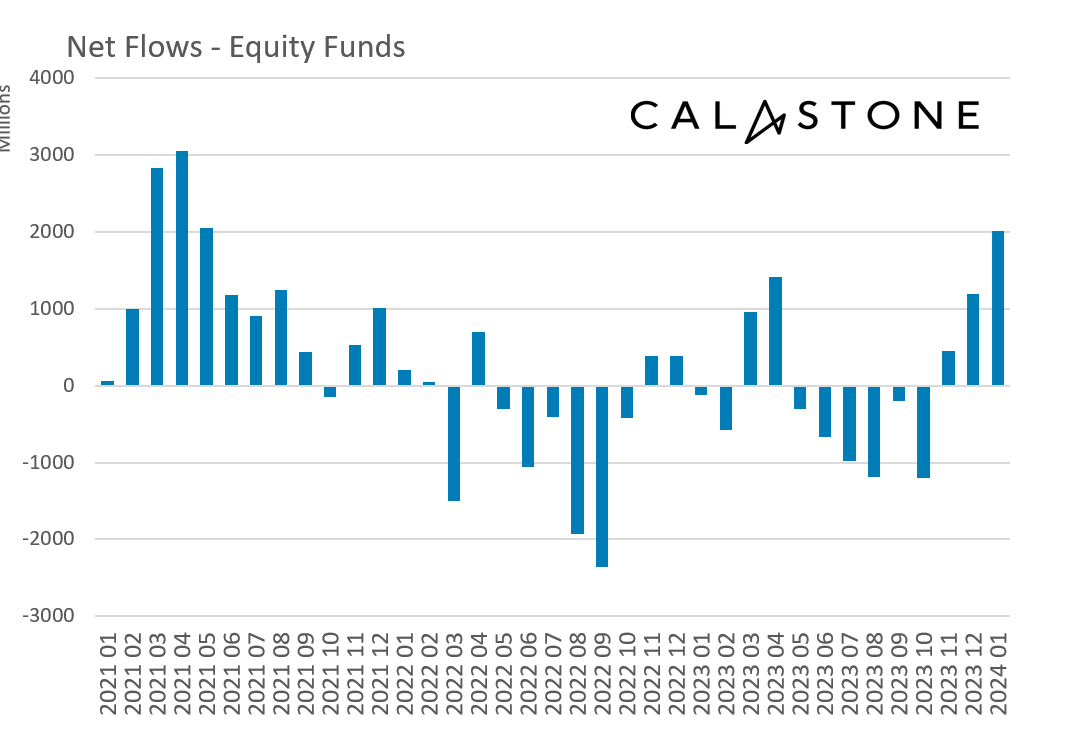

UK investors were at their most bullish in almost three years in January according to the latest Fund Flow Index from Calastone, the largest global funds network. November and December saw growing investor confidence as inflows to equity funds returned, but January saw the bulls return in full force. Inflows to equity funds surged to £2.01bn, the highest since April 2021 and the eighth strongest month for inflows to equity funds on Calastone’s nine-year record.

US equity funds saw record inflows whilst European equities had their third-best month

US equity funds were the main beneficiaries, enjoying record inflows of £1.40bn, while perennially favoured global funds absorbed £1.12bn of new capital. European funds had their third-best month on record in January with an inflow of £471m, following December’s second-highest monthly inflow.[1] Inflows to emerging market equity funds slowed to £184m, in line with the average of the last two years, but less than half November’s record inflow of £413m.

Weak China news meant outflows from Asia Pacific funds, while UK equities remained out of favour

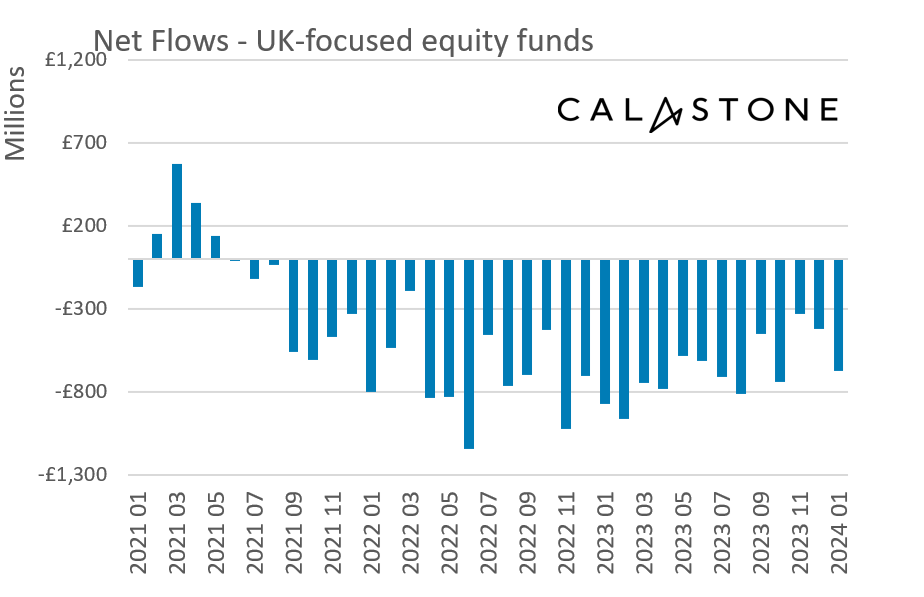

Meanwhile, China’s much discussed economic difficulties meant outflows from Asia-Pacific funds continued for a ninth consecutive month (-£211m). January was the fourth-worst month on Calastone’s record for the sector. It was once again, however, UK equity funds that did worst of all. Outflows accelerated to £673m in January, worse than the average £649m monthly outflow in 2023. Income funds saw ongoing outflows as well.

ESG funds enjoyed a sudden resurgence, seeing record inflows, but too soon to call a new trend after months of negativity

January was also the first month since April 2023 to see inflows to ESG funds. Outflows had swelled to £3.72bn between April and the end of the year, though they slowed to a mere trickle in December[2]. The rebound in January was so strong that ESG equity funds enjoyed record inflows of £1.63bn during the month and were a major contributor to the strength of US and European equity fund inflows overall. The picture was not limited to equities. ESG fixed income funds had already seen their first inflows for months in December, and these continued at a similar level in January (+£46m).

Changes in demand from buyers is more important than retreat from sellers in determining fund flows

January’s equity-fund inflows were primarily driven by a distinct surge in buying interest. The volume of buy orders jumped by one sixth compared to the monthly average in 2023, while the volume of sell orders was only 1% lower. This is a common feature of fund flows; just as inflows typically reflect much higher buying interest rather than much lower selling activity, outflows tend to reflect reduced buying rather than increased selling.

Inflows to safe-haven money market funds slowed to a trickle after months of strong buying

Consistent with the surge in risk appetite in January, inflows to safe-haven money-market funds slowed abruptly to just £56m, just one seventh of 2023’s average monthly inflow. Inflows to fixed income funds accelerated to £367m but were below the long-run average as investors diverted more of their cash to equity funds.

Edward Glyn, head of global markets at Calastone said: “Interest-rate bulls are creating the financial weather right now. The markets are convinced that disinflation will bring rate cuts earlier and faster than previously expected, especially in the US. This has driven an equity market rally, particularly among the US tech stocks whose share prices benefit most from lower bond yields. Inflows have surged as a result. The flipside is evaporating inflows to cautious money market safe havens. Central banks keep trying to dampen expectations of early rate cuts, but they are struggling to land the message with the markets.

“It’s not all about US tech. European equity funds are firmly in favour too – investors judge that the current weakness of the European economy is already priced and are looking beyond to the rate cuts that must follow. The UK is also experiencing a sharp disinflation, but the doom and gloom over the UK stock market seems firmly lodged in investors’ minds. UK equities are exceptionally cheap by historic and international comparisons, but buyers are nowhere to be found.

“The renewed flurry of interest in ESG in January should be treated with caution. Strong markets are good for ESG inflows, particularly if the market rally is driven by US technology companies. But none of the bigger questions about the sector such as the greenwashing debate has gone away. The FCA’s new rules on ESG fund marketing will help, but are yet to take effect. Longer term, greater clarity and better disclosure will be good for the sector, but the road is likely to be bumpy in the short term.”

[1] European equity inflow record £509m Dec 2020. Dec 2023 £476m

[2] ESG December outflow was -£54m, one tenth of the average outflow between April and November