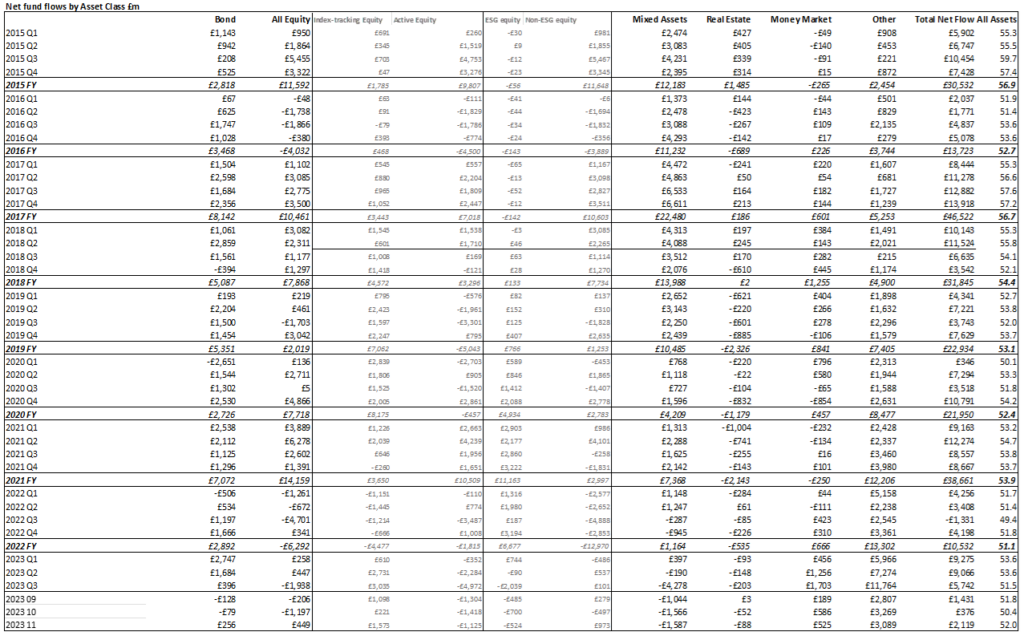

A strong recovery in global markets during November tempted UK investors back into equity and bond funds for the first time in months, according to the latest Fund Flow Index from Calastone, the largest global fund’s network. Confidence is fragile, however, so buying was selective, and investors favoured safe-haven money markets over both equities and bonds.

Equity funds saw £449m of inflows in November, following six months of net selling

After six months of net selling, investors dipped their toes back into equity funds in November, adding £449m to their holdings, just under one tenth of the net £4.54bn total they had withdrawn between May and October.

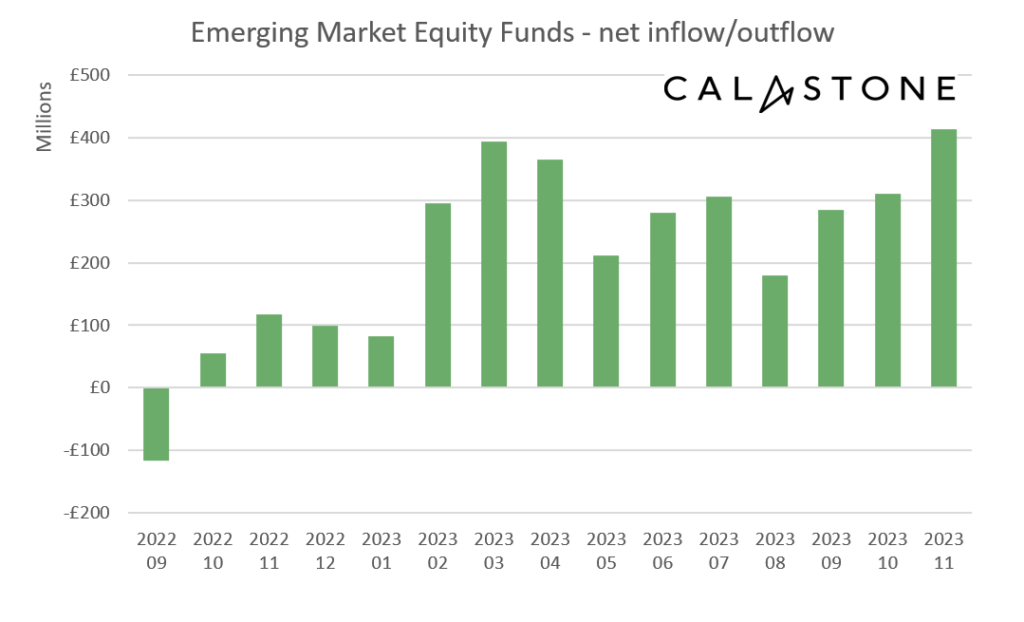

Investors were selective – emerging market funds saw record inflows, and North American, global and Japanese funds all enjoyed investor buying

Buying was selective, however. Investors added a record £414m to emerging markets funds, and have now been net buyers for 14 months in a row. Continued strength in the US economy, with rapid GDP growth and falling inflation, drove £481m of new capital into North American equity funds, their best month since June 2022 and their sixth best on Calastone’s record. Global funds also remained in favour, attracting £802m of new cash. Meanwhile, Japanese funds saw inflows of £111m accounting for almost £9 in £10 of the net cash flowing into specialist regional funds.

But Asia-Pacific, Europe, UK, income funds and infrastructure all suffered outflows

Many other equity sectors saw net selling, however. Outflows from Asia-Pacific funds accelerated to their second highest level on record[1], a net £229m during November. Sector funds had their worst ever month with outflows of £296m, driven mainly by selling of infrastructure funds. There were also ongoing outflows from European equities, income funds and UK-focused equities, though these were less severe than in October. Indeed, in the case of unloved UK equities, outflows reduced to £330m, their best reading since March 2023, though this was nevertheless the 30th consecutive month to see investors withdraw capital from the sector.

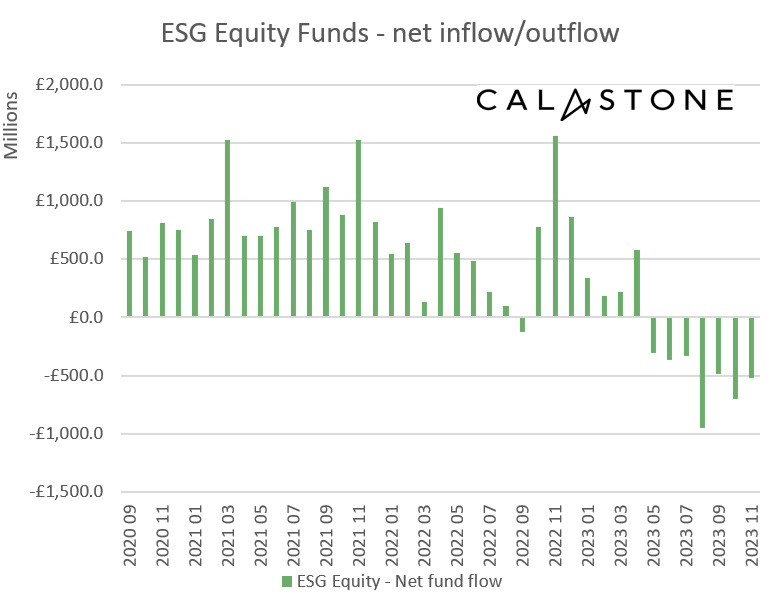

ESG saw the seventh consecutive month of net selling

As COP28 convenes in Dubai, investors appear increasingly sceptical about ESG funds. ESG equity funds suffered their seventh consecutive month of outflows in November, as investors withdrew £524m of capital.

November’s net selling took the total since outflows began in May to £3.66bn, compared to outflows from non-ESG equity funds of £431m in the same period. (year-to-date ESG -£2.34bn v non-ESG -£89m). The biggest outflows have come from ESG funds focused on North America, followed by UK-focused funds. Only ESG funds investing in emerging markets have continued to attract inflows this year, as part of a wider trend of record inflows to emerging market funds generally.

The trend is not restricted to equities alone. ESG fixed income funds have seen outflows for nine-months in a row as a net £483m has been withdrawn from the sector. This contrasts with £2.92bn of inflows to non-ESG fixed income funds. (year-to-date ESG -£332m v non-ESG +£4.83bn). ESG mixed asset funds are also seeing outflows, though this is in line with a wider market trends.

Falling bond yields prompted modest inflows to fixed income funds for the first time in four months

The fixed income sector had a better month in November too, after yields soared in October to their highest level since the time of the GFC, pushing down bond prices (bond prices move inversely to yields). November saw the first sustained decline in bond yields after a six-month period of painful increases and this drove capital back into fixed income funds for the first time since July. Investors added a modest £256m to their holdings as a result.

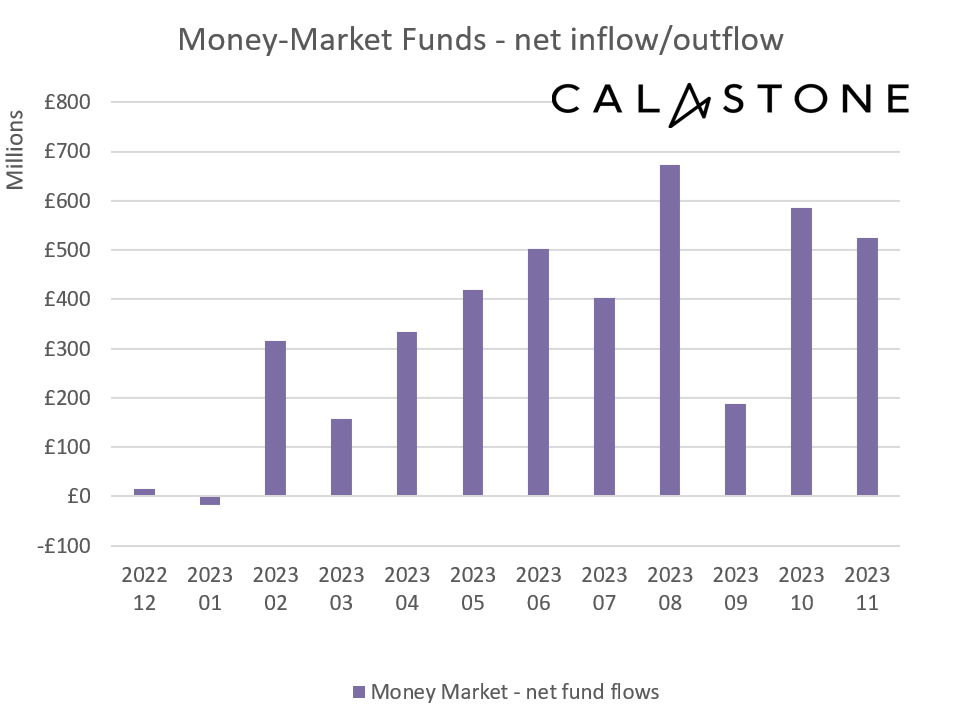

Yet investors remain cautious – ultra-low risk money market funds saw the most inflows of all

Despite the improvement in sentiment towards fixed income and equities, investors remained cautions. Money market funds, which are the least risky category of funds available, absorbed more than twice the amount that went into fixed income funds in November, with a net inflow of £525m. Year-to-date money market funds have absorbed £4.09bn of cash, more than in the previous eight years combined (£3.49bn).

Record outflows from mixed asset funds – correlated markets make investors question their value

Elsewhere, mixed asset funds suffered a record outflow of £1.59bn, reflecting investor scepticism over their ability to offer a superior risk/reward profile while bond and equity markets are moving in tandem. Finally, outflows from property funds rose again, reaching £88m.

Edward Glyn, head of global markets at Calastone said: “Investors are intent on both trying to plot the likely path central banks will take with short-term interest rates and on how much risk to price into longer-term bonds. This in turn determines both their assessment of how the economy is going to fare and their calculations for asset prices of all kinds. November saw good news on inflation in the US, the UK and in Europe which investors increasingly hope will stay the hand of policy makers deciding on the next move for rates. Inflows to fixed income reflect investors trying to lock into yields at 15-year highs and hoping for capital gains from here on.

“Perkier bond markets are good for equities too. Equity prices duly rebounded during the month, pushing the global index within a whisker of its high point for the year[2]. This has tempted investors back into equity funds, favouring those parts of the world with better growth characteristics, like the US, and those that benefit when US interest rates start to fall, like emerging markets. The surge in interest in Japanese equity funds reflects the flurry of excitement that Japan may finally be shrugging off its long stagnation. Regions like Europe, Asia and the UK, which are suffering a weaker outlook remain out of favour.

“But it’s clear investors are very cautious. There is a lot of concern that higher interest rates have not yet taken their full effect to suppress demand, which would impact company profits and therefore share prices. And of course, the returns on low-risk cash-focused money market funds are now better than at any time since the GFC, providing an attractive alternative magnet for nervous investors – with inflation falling, these returns are even turning positive in real terms now too.”

Edward Glyn added a word on ESG funds: “The FCA is now taking action to counter allegations of greenwashing in the ESG sector, but investors are way ahead of them – they have been voting with their feet for seven months now by selling down ESG funds. The FCA’s action is likely to cast a further pall over the sector in the months ahead, however, and we will be monitoring the extent to which fund flows react.”

[1] Record outflow August 2022, £234m

[2] MSCI World, 30/11/23 3024 v 31/7/23 3064.