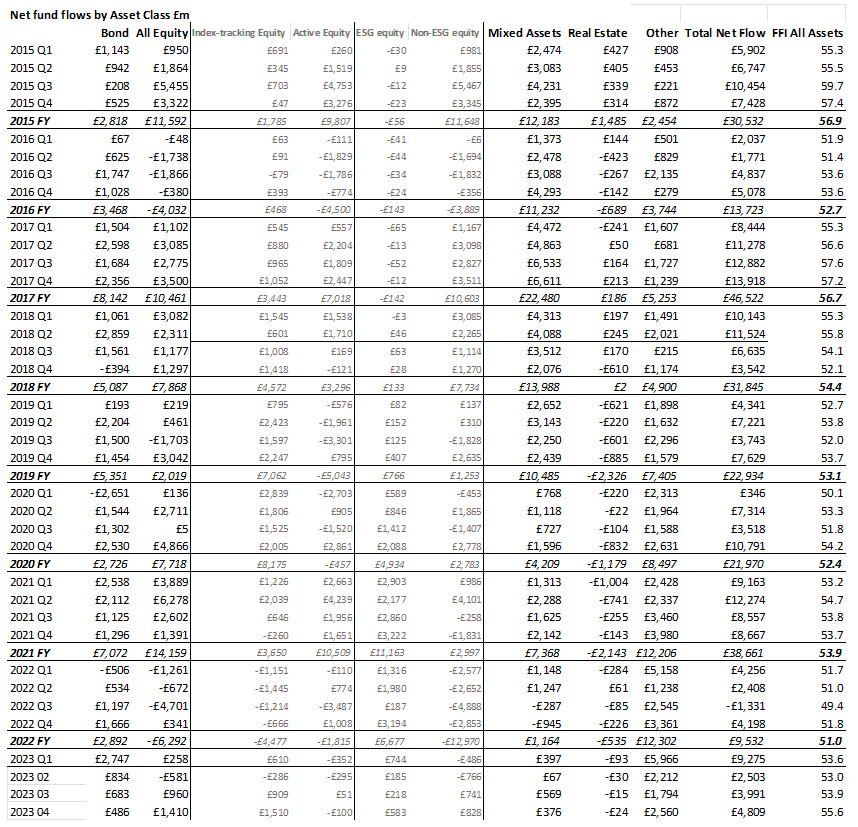

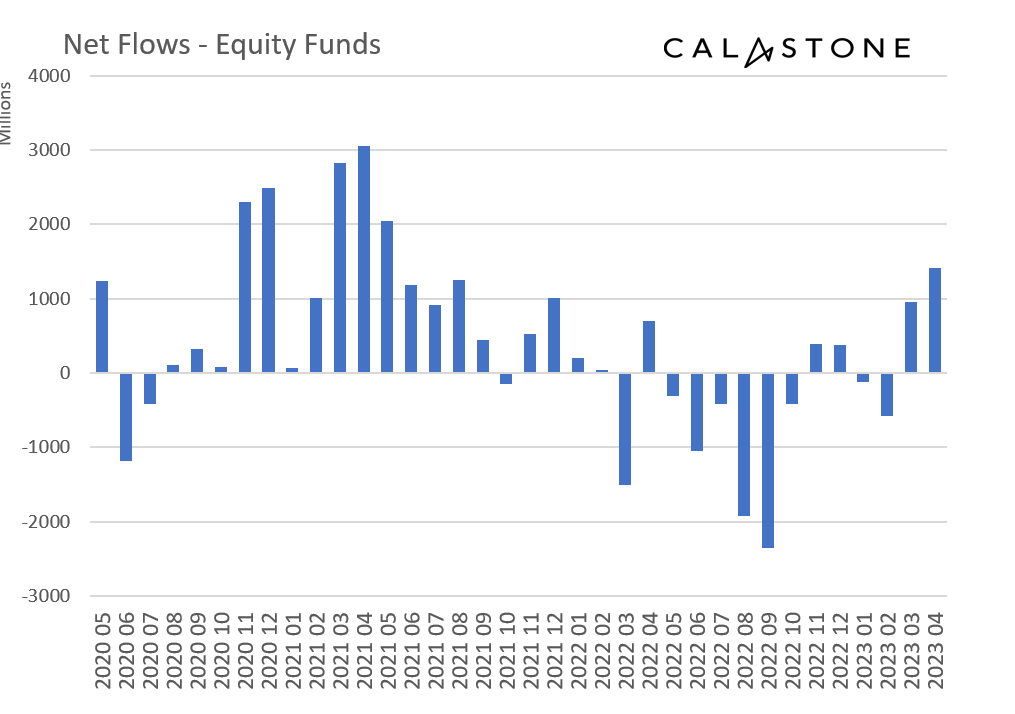

UK investors bought equity funds in April at the fastest pace since May 2021, according to the latest Fund Flow Index from Calastone, the largest global funds network. They added a net £1.41 billion in new capital to their holdings during the month.

Global funds scooped the most new cash (£1.58bn) but emerging markets, North America and technology funds are also enjoying renewed interest

Buying activity was selective. Global funds remain top of the preference list. Net inflows to this sector were £1.58bn during the month, the fourth highest on record (the third highest was in March). Emerging markets are also strongly in favour. Net inflows to emerging markets of £364m in April were the third highest on record (the second highest was in March). The most notable turnaround was in North American equities, that came despite cracks in the US banking system. Inflows of £253m in April followed outflows of £2.08bn over the previous nine months, during which nearly every month saw net selling. The resurgent interest in North American equities was also reflected in the first inflows of capital to specialist technology funds for the first time since August 2022. Asia-focused funds also enjoyed inflows. Meanwhile outflows from European equity funds shrank to their lowest since March 2022 when the bear market began taking hold in earnest.

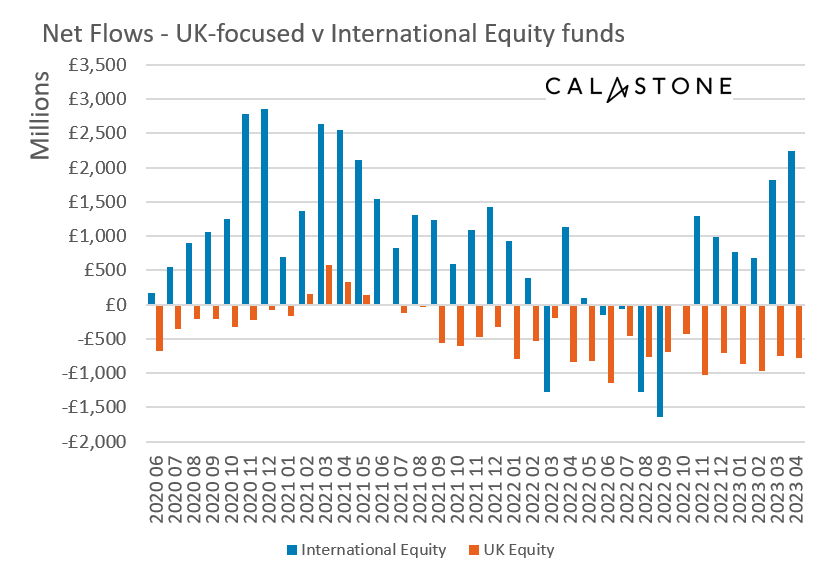

UK funds continue to suffer very significant outflows – the big switch to international funds continues apace

Despite growing appetite to switch back into equities from the safety of cash, investors nevertheless continued to shun UK-focused funds decisively. Outflows even accelerated in April, rising to £782m and marking the 23rd consecutive month of net selling, totalling an astonishing £13.86bn since June 2021. The big switch out of UK funds has been matched almost exactly by buying of internationally-focused equity funds over the same period. Since June 2021, internationally focused funds have enjoyed inflows of £13.93bn.

Trading volumes fell by a fifth in April – high March turnover reflected profits being crystallised

The strong net buying of equity funds in April came despite a substantial month-on-month drop in trading activity overall. The total value of buy orders plus sell orders (known as turnover) fell 19.5% month-on-month from £24.9bn to £20.0bn. In March investors were rushing to use up their capital gains tax allowance as this has now halved for the new tax year and this drove turnover up.

Money market funds are competing strongly for surplus bank deposits – inflows have surged

Among other assets classes, money market funds attracted ten times more capital than their long run average in April – an inflow of £333m, taking the year-to-date total to £806m. The surge in buying of money market funds reflects investor interest in the high yields they are offering at present as well as diversification of cash deposits by savers with deposits above the insurance threshold. Concerns over the health of the global banking system are behind this move.

Inflows to bond and mixed asset funds were in line with the long-run average. Property funds suffered further outflows.

March and April 2023 have marked the first time in a year that investors have switched from funds with lower risk ratings to those in higher risk categories.

Edward Glyn, head of global markets at Calastone said: “Capital markets largely traded sideways in April after a strong March – yet fund flows show risk appetite is on the rise. Inflows to equity funds have surged as a result. Global funds are typically the first go-to for new cash. Meanwhile, the sharp turnaround in interest in North American and specialist tech funds reflects the strong response of growth-company share prices to falling long-term bond rates . Emerging markets hold a number of attractions at present. They tend to benefit when the dollar weakens; valuations are low relative to developed-market counterparts; investors are under-allocated to them; and the rate-tightening cycle is ending sooner in emerging countries that took swifter action against inflation.”

“The horizon is not unclouded however. Company profits are under pressure and there remains a lot of uncertainty over the likelihood and severity of any potential economic downturn. The resurgent optimism is therefore rather fragile. Indeed, markets plunged at the beginning of May as US banking failures continued.”