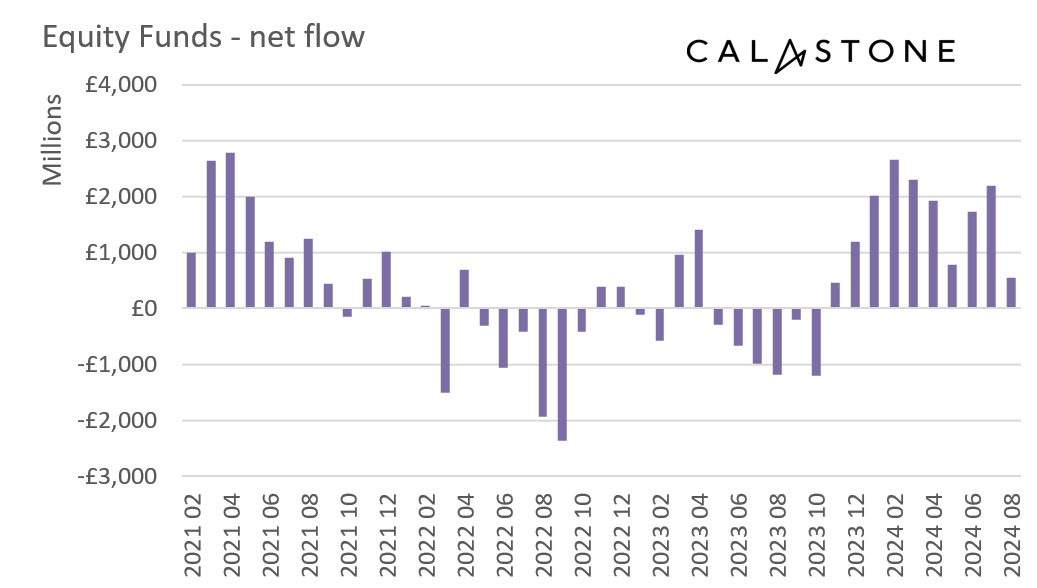

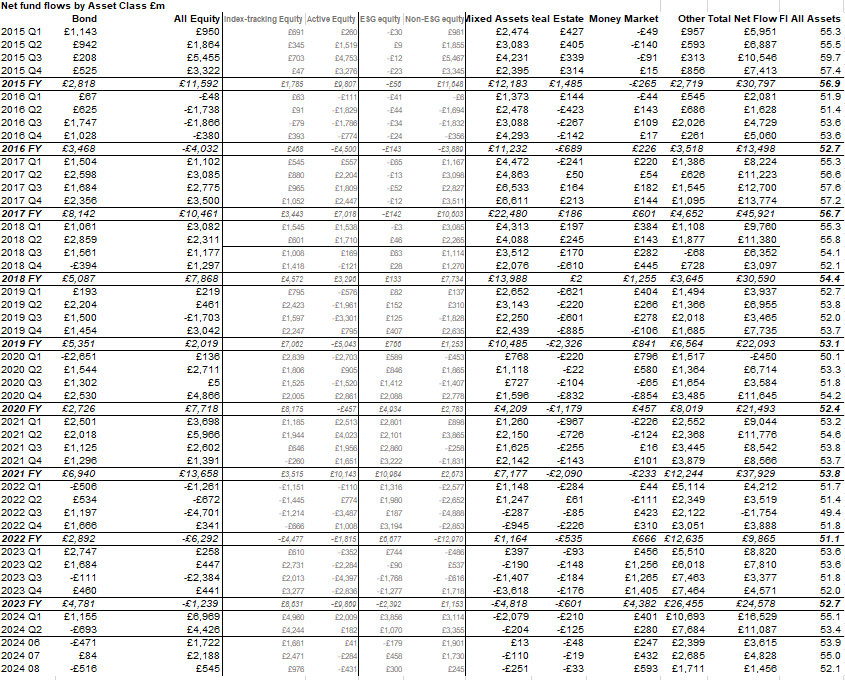

Inflows to equity funds fell sharply in August, according to the latest Fund Flow Index from Calastone, the largest global funds network. The short-lived market panic at the beginning of the month that saw stock markets worldwide fall sharply before rebounding knocked confidence and meant equity-fund inflows fell to £545m, down by three quarters (75.1%) month-on-month and to their lowest level since November 2023[1]. But it is important to note that there were still inflows.

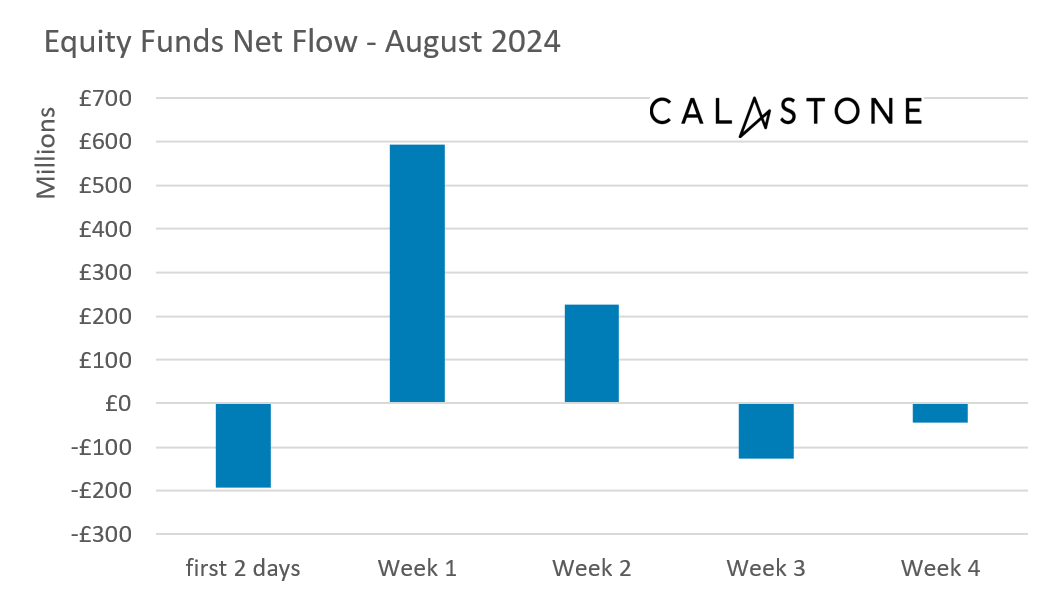

Calastone’s detailed data shows investors sold down equity funds only very modestly during the sharp falls in the first three days of the month, pulling a net -£206m from their holdings. Moreover, this was followed swiftly by renewed buying – they added a net £592m to equity funds in the following five days. Later in August after markets had bounced back, some investors opted to take profits which led to modest renewed outflows in the second half of the month.

The impact was felt across most equity fund sectors, with inflows down by just over a third for global equity funds (-35%) to £639m, by half for North American equity funds (-50%) to £564m, and by just under three fifths (-58%) for European funds to £155m and similarly for emerging market funds (-59%) to £174m. Meanwhile, Asia-Pacific funds suffered a 16th consecutive month of outflows, which almost quadrupled (+260%) month-on-month to -£184m.

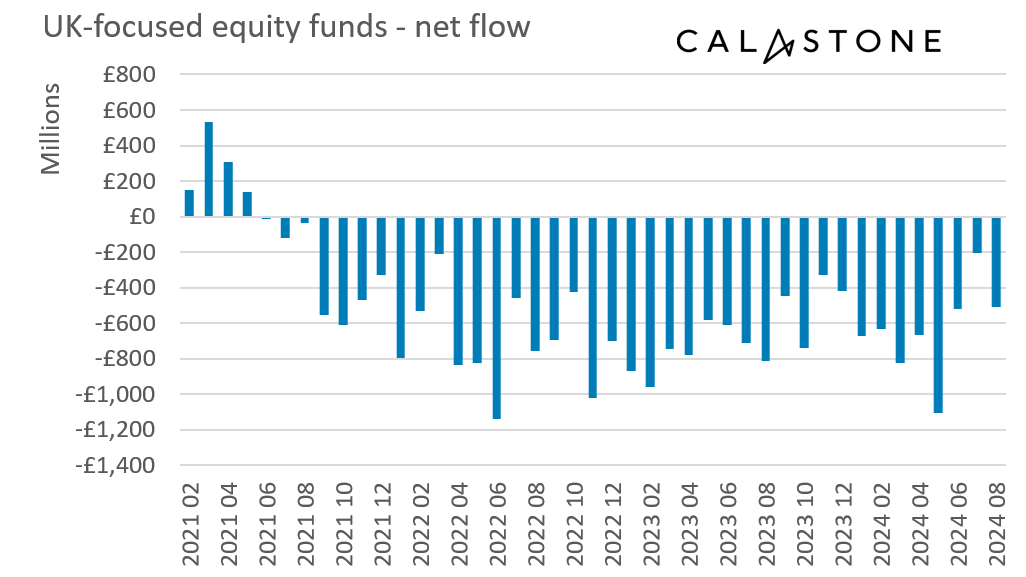

UK-focused equity funds saw outflows once again on the rise in August after July had seen their least-bad month in three years. Net selling of -£510m was more than double the July total, but this was still well below the -£660m monthly average since outflows began in earnest in September 2021.

Surprisingly, bond funds saw significant outflows during the month, totalling a net -£516m, the third worst month on record[2]. This came despite a sharp fall in US bond yields as markets anticipated faster and steeper cuts in US interest rates. This pushed US bond prices up while the bond market remained broadly steady in Europe and the UK.

Elevated risk aversion meant safe-haven money-market funds were popular. Net purchases were £593m, the highest level since August 2023.

Edward Glyn, head of global markets at Calastone said: “Investors flinched when global markets convulsed in early August, pushing equity prices worldwide down sharply and hitting Mag 7 tech names in the US especially hard. They initially responded by pulling some cash from equity funds, but there was no wholesale rout. In the first three days of the month, equity fund trading volumes across our network spiked by around a third as nervous sellers took flight while opportunistic buyers simultaneously took the plunge. Between them, the elevated levels of selling and buying boosted two-way trade. Outflows turned to inflows as markets calmed and sellers melted away, but nerves have clearly been rattled. What’s more, once markets rebounded, investors chose to sit on the sidelines in the second half of the month, clearly wary of renewed turbulence.

“The weaker month-on-month figure for UK-focused equity funds should be seen in this context. Not only is the outflow less than the average for the last three years, but it was also less severe than might have been expected given the sharply reduced buying activity across other kinds of equity funds in August. It’s not yet time to break out the champagne – the government’s gloomy statements about the UK’s allegedly dire predicament are hardly going to boost confidence – and we are still seeing net selling after all, but two months of better figures for fund flows might herald the start of improving sentiment.”

[1] Nov 2023 £449m

[2] May 2024 -643m; March 2020 -£3.59bn (pandemic market seizure)