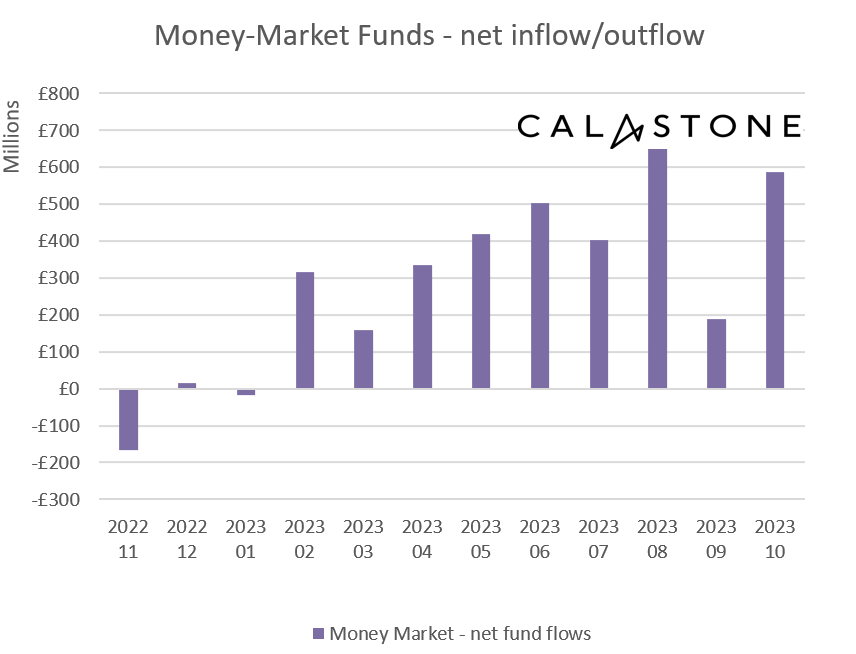

Investors fled for the exits in droves in October as soaring market interest rates put asset prices of all kinds under ever more intense pressure. The latest Fund Flow Index from Calastone, the largest global funds network, registered the largest outflows from equity funds in over a year, record selling of mixed asset funds and ongoing withdrawals from property funds. Fixed income funds suffered further outflows too, though there are signs of buying interest following the dramatic bond-market repricing of recent months. Meanwhile, safe haven money market funds enjoyed their third best month on records as investors looked for a low-risk, high-yield home for their cash.

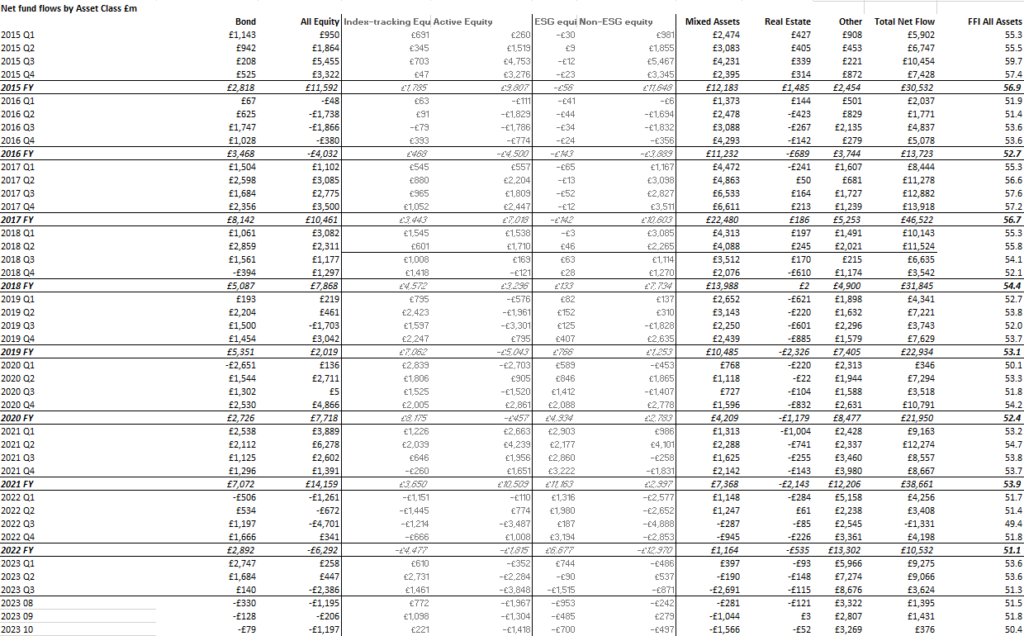

Equity funds see largest outflows in October 2023 since September 2022 mini-budget chaos

Equity funds suffered outflows of £1.20bn in October, the sixth consecutive month of net selling and the largest since September 2022’s mini-budget scare. Year-to-date equity funds have shed £2.88bn of capital.

UK-focused equity funds hit hardest, but income funds, European equities and sector funds also suffered large outflows

Unloved UK-focused equity funds once again bore the brunt of the selling. The £739m outflow was the highest since April. Equity income funds were also hit hard – the £475m of outflows in October marked the 16th consecutive month of net selling from the sector. August, September and October have been the three worst months for outflows from income funds since early 2021. Elsewhere, European equity funds had their worst month of the year with outflows of £318m and specialist sector funds had their worst month on record (-£275m) – funds investing in infrastructure accounted for almost one third of withdrawals from sector funds.

ESG equities saw sixth consecutive month of net selling as ESG hype fades

ESG equity funds had their second worst month on record with outflows of £700m, (after August, -£953m). £3.14bn has left the sector in six consecutive months of selling, in what has become a clear trend away from the sector after its three-and-a-half year boom. ESG fixed income and mixed asset funds are also being hit with outflows.

Global equity funds and emerging markets bucked the selling trend – enjoyed inflows

Global funds and emerging market funds continued to attract new capital, however. After a £311m inflow in October, the latter is on track to have its best year on Calastone’s record, if November and December do not see significant net selling.

Fixed income funds shed capital as yields continued to surge – but buyers are hovering

Among other asset classes, fixed income outflows dropped to -£79m, having roughly halved each month since August (see table in appendix). Indeed, investors were net buyers on most days of the month, but buying quickly turned to selling by 23rd October when the US 10 Year Treasury yield surged by one sixth (pushing down bond prices) and set the scene for a rocky week for the asset class.

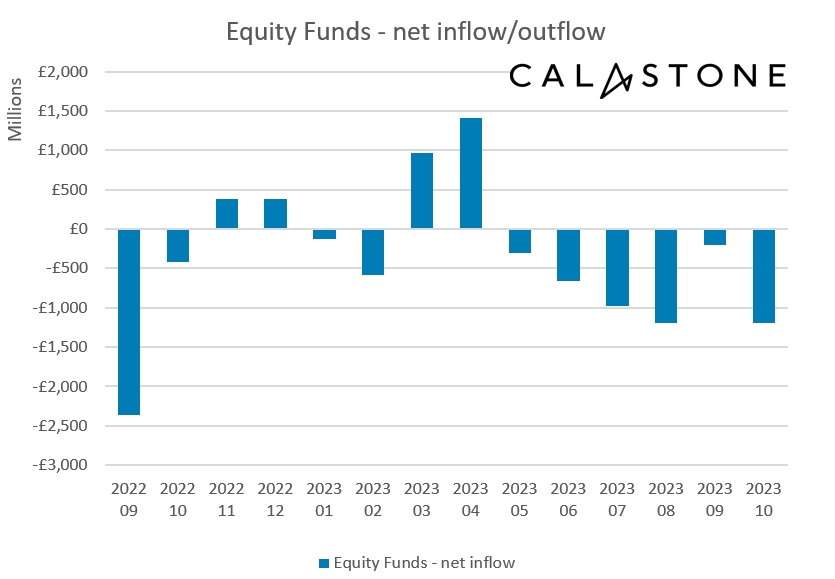

Mixed asset funds saw record outflows

Meanwhile mixed asset fund outflows hit a record £1.57bn and were up by 50.0% month-on-month. 2023 is likely to be the first year in Calastone’s data history that the sector sees net outflows.

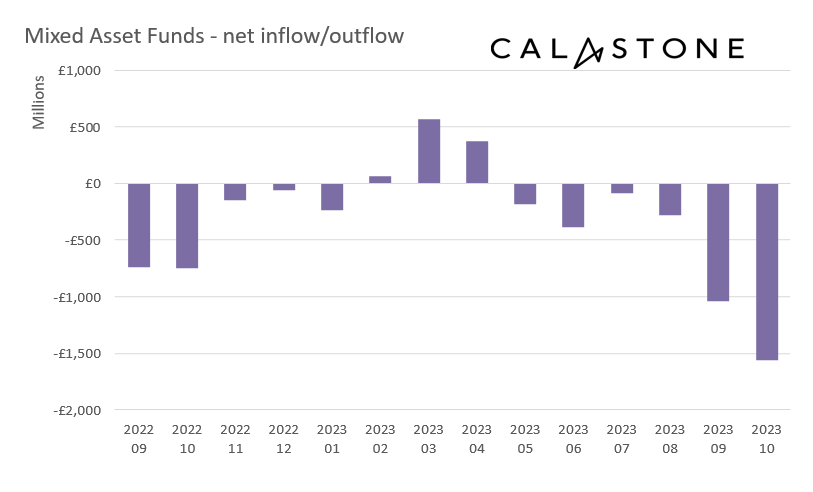

Safe-haven money markets saw third best month of inflows on record

Money market funds were the biggest beneficiaries of investor cash in October. Investors consider them a safe haven and added £586m of new capital, the third best month for the sector in Calastone’s record.

Edward Glyn, head of global markets at Calastone said: “The bond-market crunch has brought a deepening sense of crisis to capital markets, even though the real economy has held up relatively well in the face of higher interest rates and tighter credit conditions. Investors are no longer only fretting about persistent inflation but now increasingly fear unsustainable fiscal deficits in the US, the UK and much of Europe. The higher risk premium they demand in compensation is pushing bond yields up and prices down. And when longer-term market interest rates rise like this, asset prices of all kinds come under pressure.

“Some investors clearly judge that the bond market has fallen too far – willing bond buyers are hovering in the wings trying to snap up bargains. If the global economy falls into recession, they are likely to make strong capital gains as well as locking into high yields. That’s a tempting prospect, but those who dipped their toes in earlier in the year on this same premise are already nursing losses. Timing is notoriously difficult!

“Equity fund outflows are inevitable when bond markets are experiencing this wrenching repricing. But what about income funds, which are lower risk than high growth propositions? Despite dividend income in the UK and around the world looking healthy, income funds are suffering by comparison to the interest income investors can earn on bonds, money markets and cash. The valuation of dividend stocks is actually less sensitive to bond yields than high growth companies, but investors looking for income now have alternatives that come with lower risk. Similar factors are at play in closed-ended funds – income-focused investment trusts have seen discounts widen significantly recently.

“Record outflows from mixed asset funds reflect a growing investor perception that their strong record for a favourable balance of risk and rewards is breaking down as asset markets become increasingly correlated.”