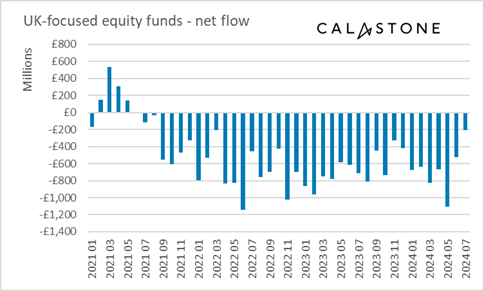

Outflows from UK-focused equity funds fell to their lowest level in July since investors turned their backs decisively on their home market three years ago, according to the latest Fund Flow Index. Investors sold a net £207m of their UK-focused fund holdings, the best result for the sector since August 2021, and less than one third of the average monthly outflow year-to-date.

Election effect sees post-poll buying

The best day for UK equity funds was Friday 5th July, the day after the General Election that saw Labour sweep to power with a large majority. Investors added a net £59m to their UK-focused holdings on that day, more than half the net buying of equity funds of all kinds.

Selling fell and buying rose – an especially positive combination

July’s net improvement was driven both by a reduction in selling by existing holders – it fell a tenth below its long-run monthly average, and by an increase in buying which was a tenth above average. It is especially positive when both indicators move in this way.

Edward Glyn, head of global markets at Calastone said: “One swallow doesn’t make a summer and we did still see outflows from UK-focused funds in July, but the improvement is consistent with the groundswell of positive commentary surrounding the investment case for UK equities. Growth indicators suggest the economy is outperforming its peers, while the arrival of a new government with a huge majority is in stark contrast to today’s political turmoil in many other major G7 countries and in the UK’s recent past. Last Thursday’s first cut in interest rates in four years also vindicated optimists who had begun to turn their attention back to their home market.

Wider market factors are also at play. The last few weeks have also seen a significant rotation from very expensive US large-cap stocks to cheaper small- and mid-caps. This same trend benefits markets such as the UK which are trading at a significant discount to international peers.

“The big question now is whether momentum can grow enough in the coming months for UK-focused funds to see buying outweigh selling for the first time in years.”

Record seven months for inflows to all equity funds between January and July

The positive development for UK-focused funds came against a backdrop of enthusiastic buying of equity funds in general. July’s inflows of £2.19bn were the highest since March this year and were consistent with 2024’s pattern of record buying. The strong buying took the January to July net inflow to £13.58bn, the best seven-month period on Calastone’s ten-year record. Moreover, four of the best ten months for equity funds in the last decade have been in 2024, including July.

Record inflows to emerging market funds in July

The fund sectors which benefitted the most included North America (+£1.12bn), where inflows rebounded after drying up in June and emerging markets which saw record net buying of £424m. In both cases, inflows ramped up in the second half of the month following a sharp correction in the S&P 500 and global emerging market stock indices respectively. Asia-Pacific was the only other geographical equity fund sector to see outflows in the month.

Other asset classes

Among other asset classes, money market funds had their best month of the year (+£432m) and fixed income funds, buoyed by hopes of rate cuts finally arriving, saw inflows return (+£84m) after two months of net selling. Meanwhile, property funds had their least bad month since September 2023, with outflows shrinking to £19m.

Edward Glyn added: “UK households are sitting on record volumes of cash deposits worth £1.8 trillion, up £74 billion over the last year alone. This reflects wage growth well ahead of inflation in recent months and it helps explain why investors have so much firepower to invest into funds at present. Hopes for a soft landing for the global economy are seemingly unlocking some of that firepower for investment. Some markets, especially the US large caps, are already very expensive and have been extremely volatile in recent days, however, so investors must be alive to the risks of chasing high valuations higher.”