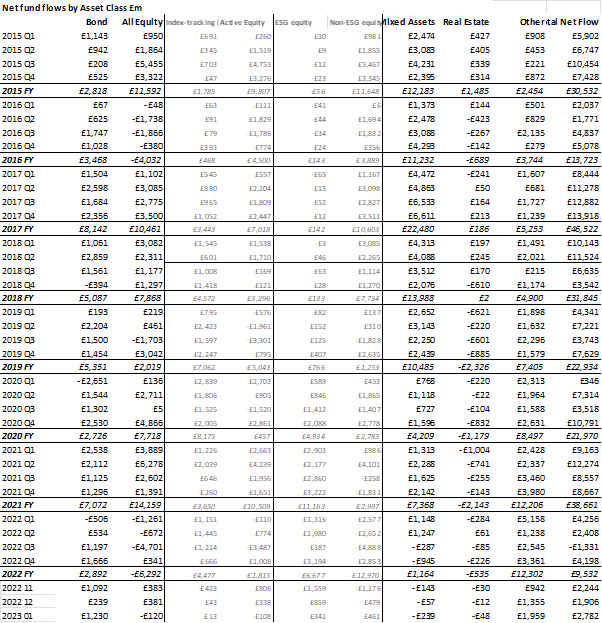

Despite the FTSE 100 recently reaching an all-time high, UK-focused equity funds nevertheless suffered their third-worst month of outflows on record in January[1]. Investors withdrew a net £868m from their holdings, according to the latest Fund Flow Index from Calastone, the largest global funds network. For every £1 of sell orders of UK-focused funds, Calastone saw just 59p of buy orders in January – no other fund sector saw a mismatch this large, and not a single trading day saw net buying.

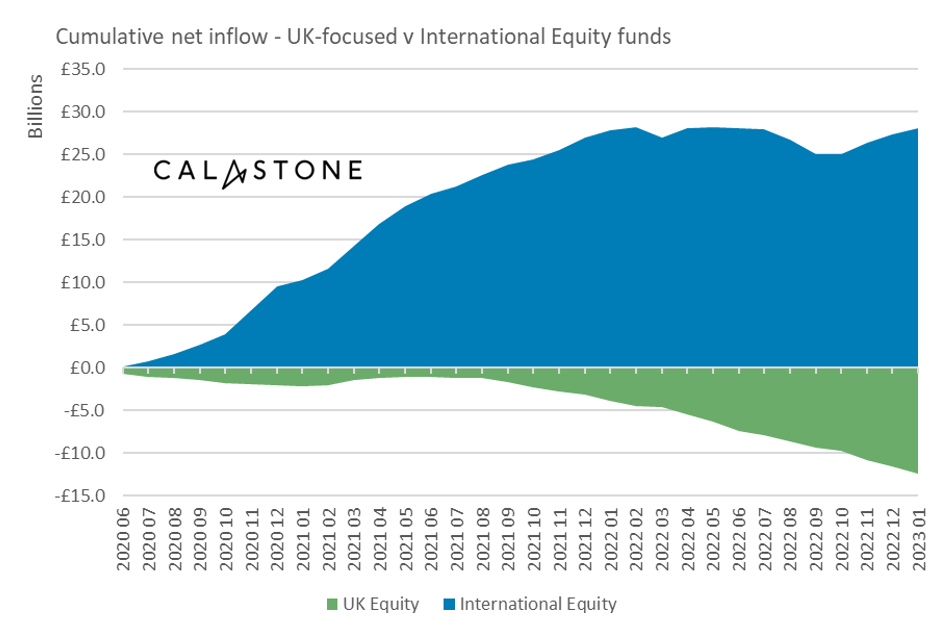

Since 2015, investors have sold £7.3bn of UK-focused funds and bought £58.0bn of international funds

The longer-term picture is one of decline too. UK-focused funds have now seen capital outflows for a record 20 consecutive months and over the last eight years have shed a net £7.28bn, while equity funds focused globally or on other geographies have enjoyed inflows of £58.04bn.

Global funds enjoyed inflows in January as world markets continued their rebound

The big winners in January were global funds. Global stock markets had their second-best January in three decades, continuing the recovery that began in October 2022. The MSCI World had risen 18% from its October low by the end of last month. Investors have bought into the rally, adding a net £969m to global equity funds since the new year, building on strong buying from mid-October onwards. Global funds with no ESG mandate garnered just under half the overall net inflow, one of

only two months out of the last twelve where they held up so well relative to ESG funds. This reinforces the notion that the net buying in January reflected optimism on global equities, rather than simply the material preference for ESG strategies that has been a feature of the funds industry since 2019.

Meanwhile the reopening of the Chinese economy sparked January inflows to equity funds focused on Asia-Pacific and emerging markets.

Edward Glyn, head of global markets at Calastone said: “UK equities used to be a core holding for global investors, but, dominated by a few big cyclical sectors like oil and commodities or slow-growth giants like banking, pharma and tobacco, they now occupy a dusty and diminished corner of these big portfolios. Political instability and a sense of unstoppable decline are keeping investors away from the UK too.

UK shares have now seemingly lost their allure for domestic savers as well. The combination of January’s near record high for the UK market with near-record outflows smacks of opportunistic selling against a backdrop of chronic pessimism, exploiting a moment of higher prices to head for the exits. Weightings to UK equity funds are coming from a high base, so even relatively attractive valuations may not be enough to persuade domestic savers to add more cash to their home market.

“What’s more, 2022 was a good year to hide in UK equities so there is some rotation going on as UK investors switch to global funds that are more likely to benefit from a return to bull-market conditions – we have seen selling of UK funds ramp up at the same pace as buying of global ones. This confidence may be premature, however, as although interest rates globally are still on the up and corporate earnings are coming under pressure – this is not yet fully reflected in global markets.”

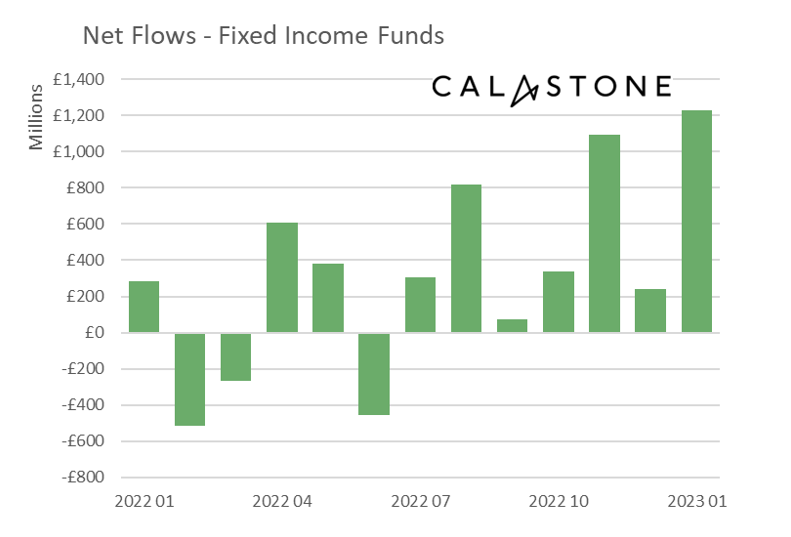

Fixed income funds saw second highest inflow on record in January

Fixed income funds had a very strong January. Investors added £1.23bn to their holdings, the second-largest net inflow to bond funds on record[2]. Over the last twelve months, inflows to bond funds have totalled £3.84bn, while equities have shed a net £6.62bn over the same period.

Edward Glyn added: “Fixed income certainly looks much attractive today. Bonds are now offering the best yields in over a decade and this is clearly tempting investors keen to lock them in. Central banks are still raising policy rates, though dovish comments from the governor of the Bank of England have also raised hopes that the UK’s rate-tightening cycle is at or near its peak. The developing slowdown in the economy and moderating inflation are also likely to push market interest rates lower in the months ahead. All this could signal capital gains to bondholders over time too.

“The bond funds most in favour in January were tilted to the higher quality end of the market – sovereign or investment grade corporate debt – suggesting investors are content to sidestep riskier high-yield corporate bonds at present.”

[1] Record outflow – June 2022, £1.14bn; Second largest outflow November 2022, £1.02bn

[2] Record inflow – May 2018, £1.57bn