The growth of the decentralised finance (DeFi) ecosystem has been one of the financial stories of the decade. Total value locked – the dollar value of assets staked on blockchains or related applications – passed $120bn in 2025, up from hundreds of millions in 2020, while weekly DeFi transaction value has been estimated at around $48bn. Blockchain-based finance is a flourishing market that has grown well beyond cryptocurrency trading to encompass lending, payments, credit scoring and identity management.

With that maturity and expanding asset base has come the need for more advanced financial tools. DeFi platforms now have large balance sheets and a growing need for effective treasury management. The opportunity for asset managers to serve that demand is clear, and in doing so to reach untapped investor cohorts in the DeFi space, an entirely new pipeline of customer acquisition. But to connect with this market they must first become compatible with it, offering products that can be traded and held on blockchain – tokenised versions of their traditional funds.

This process is already underway: multiple asset managers have launched tokenised funds since the beginning of 2024 and inflows have begun to accelerate, with AUM up by 85% since December 2024 [1]. With the industry potentially at an inflection point in its adoption of tokenisation, we commissioned research to understand the depth of this development: the scale of the opportunity in tokenised fund distribution, the approach asset managers are taking, and the appetite for such products among DeFi providers.

Key findings of the survey of asset managers included:

The report also surveyed DeFi and Web3 platforms to assess their appetite for tokenised funds, finding:

As asset managers look for a foothold in the DeFi market, and DeFi platforms seek treasury solutions compatible with their rails, tokenised funds are emerging as a significant point of convergence and a common strategic imperative. This report explores how that trend is growing, examining not only the infrastructure, but the mindset shifts, strategy pivots, and ecosystem partnerships required to put tokenised distribution into practice.

[1] Accessible on public chains

It is almost three years since Larry Fink, the head of the world’s largest asset manager, declared that ‘the next generation for markets… will be the tokenization of securities.’

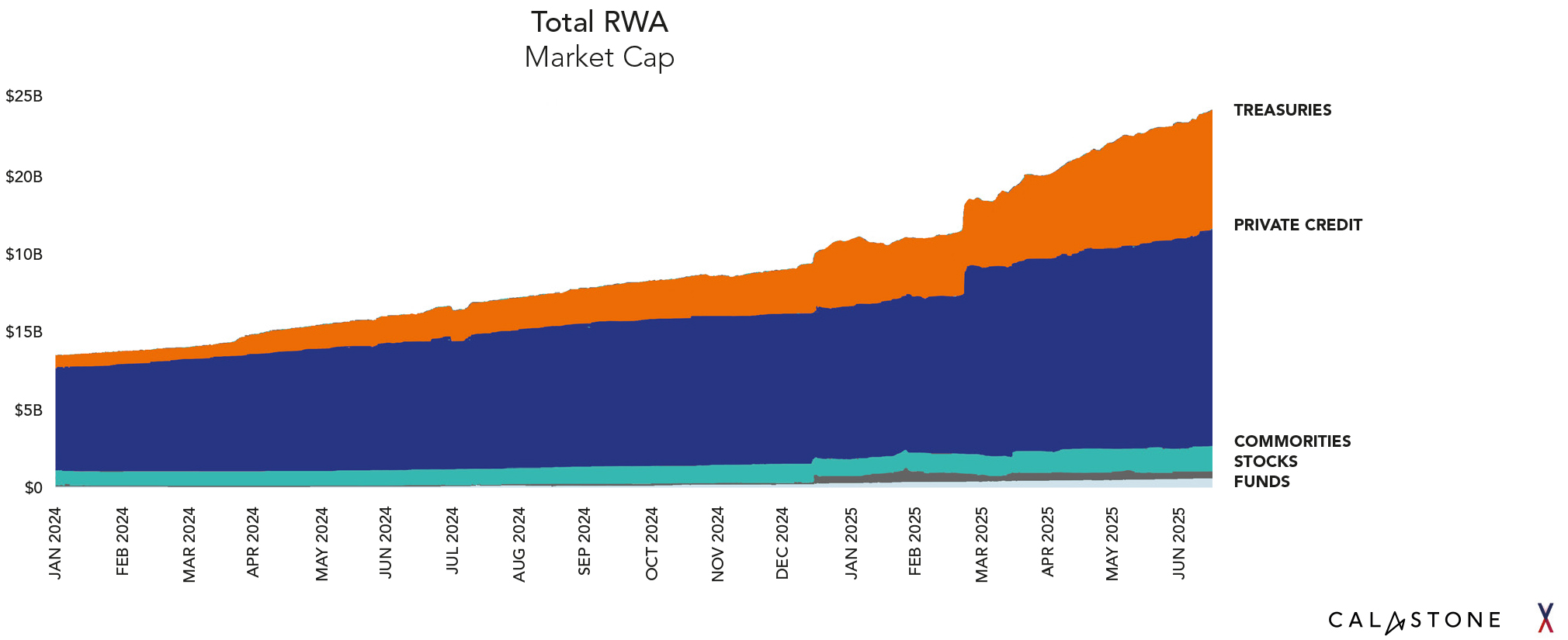

Now that prediction is becoming reality. Tokenised vehicles were estimated to command over $24bn assets under management (AUM) as of June 2025, up 85% in just six months (Figure 1). Private credit made up the lion’s share at over $14bn, followed by money market and Treasury bond funds ($7.4bn) and commodities ($1.5bn).

Figure 1: The growth in tokenised AUM, January 2024-June 2025 (RWA.xyz)

Those figures represent a clear underlying trend: participants in the decentralised finance (DeFi) market, who have until recently focused almost exclusively on stablecoins and cryptocurrencies, are now looking for a broader menu of assets, including staples of traditional finance such as money market funds. As this demand crystallises, asset managers are moving quickly to make their products available in tokenised form, allowing them to be traded and held on blockchains.

BlackRock launched BUIDL, a tokenised money market fund, in March 2024: within a year it had exceeded $1bn AUM and as of June 2025 that figure had grown to $2.9bn. In January 2025, Apollo introduced ACRED, a vehicle offering tokenised shares of an existing private credit fund, which accrued over $100m AUM within its first six months.

Such rapid traction is helping to set the direction of travel for tokenisation, the process by which assets are converted into digital tokens that can be held and traded on blockchains. In totality, the potential for tokenisation is long-term and wide-reaching, encompassing all aspects of the value chain in asset management. Calastone’s research has estimated that asset managers stand to unlock a $135bn boost to P&L by harnessing tokenisation – through realising significant cost savings in areas including fund accounting and trade execution, and gaining the ability to bring new products to market much more quickly and cost-effectively.

Yet asset managers cannot reasonably expect to tackle a transformation of this breadth in one go. They need an entry point and a first step which will allow them to realise tangible benefits from tokenisation. This report shows that the immediate opportunity for asset managers is in the distribution of tokenised funds, which allows them to access a new market of DeFi investors through a fast, cost-efficient approach in line with traditional distribution.

In this model, only the fund unit is tokenised, with the underlying structure unchanged. It enables asset managers to tap into new investor cohorts rapidly and without making major changes to their infrastructure or products – in some cases without even creating new share classes.

Having observed that asset managers in our network were working to fill a gap in the market for funds that DeFi investors could access on chain, we commissioned research to understand the trend: the scale of the opportunity to distribute tokenised funds, the perspective and preferred approach of asset managers, and the extent of demand among DeFi platforms.

Based on a survey conducted exclusively for Calastone by ValueExchange, this report highlights how asset managers are turning to distribution as a first step towards tokenisation and to access the DeFi market. It explores the products they want to make available in tokenised form, the distribution partners they are seeking and the new investor cohorts they are hoping to engage. It shows asset managers and DeFi platforms becoming more closely aligned, with the distribution of tokenised funds a key point of convergence for traditional providers who are seeking new markets for their products, and innovators who are looking to access a broader range of financial instruments.

It illuminates a trend that is rapidly taking flight, as technical theory becomes commercial reality.

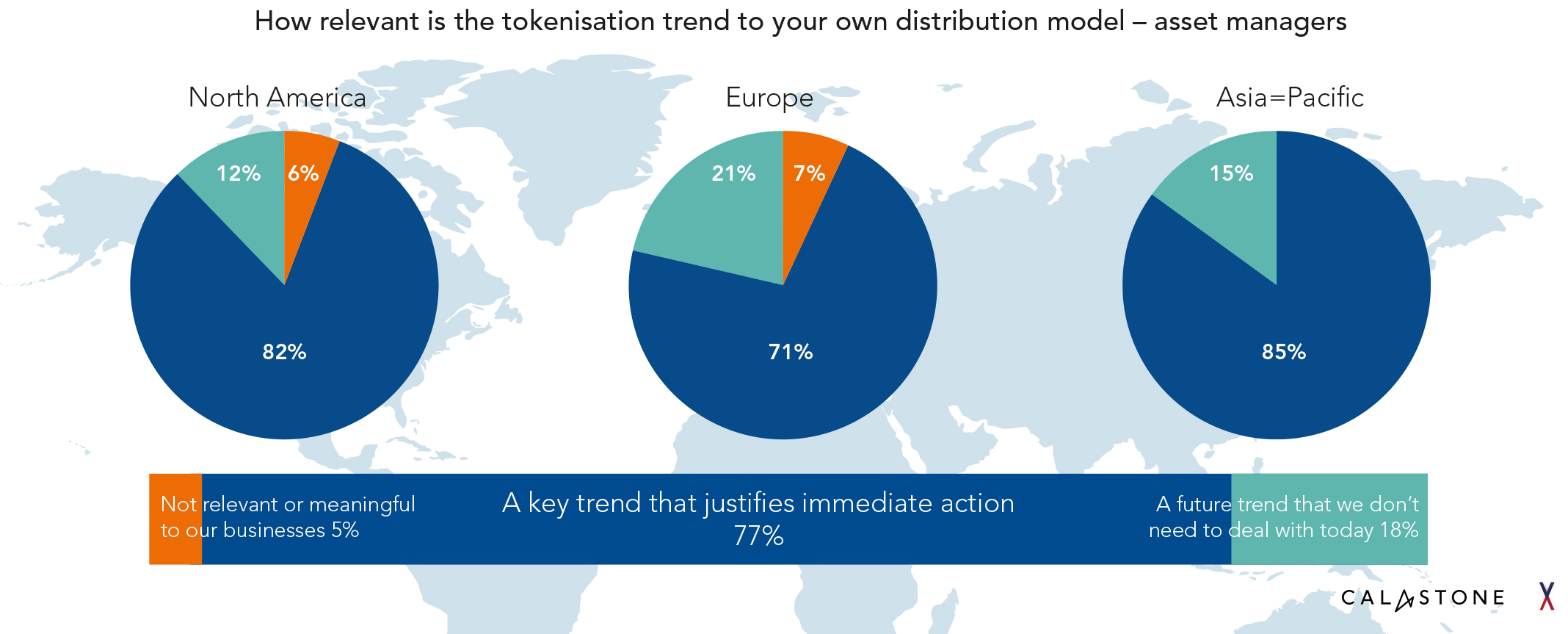

Tokenisation is no longer a future trend, but one asset managers are moving swiftly to implement. According to this research, 77% believe it is ‘a key trend that justifies immediate action’, against just 5% who believed that it is ‘not relevant or meaningful to our business’ (Figure 2).

Figure 2

Those numbers contain some regional variation, with 21% of asset managers in Europe calling tokenisation ‘a future trend that we don’t need to deal with today’, versus 15% in Asia-Pacific and just 12% in North America.

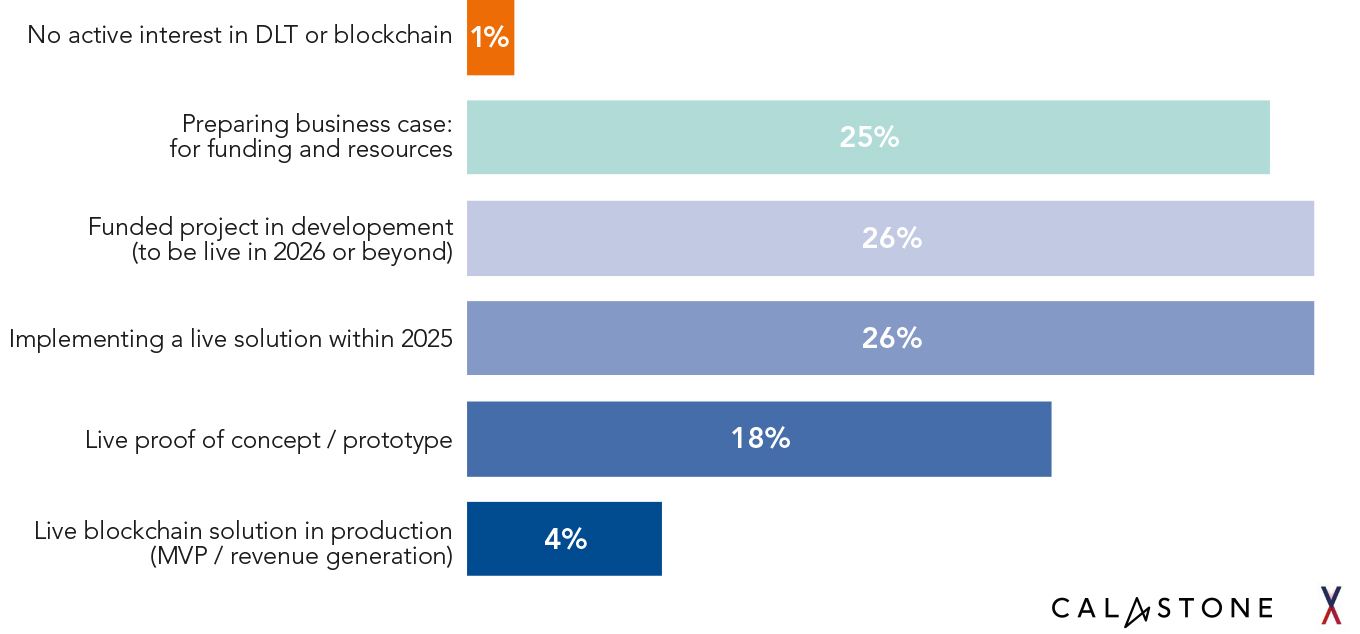

The clear message is that most asset managers are already working to try and put tokenisation into practice. Almost three quarters have reached the point where they have at least put a tokenised project in motion: 26% have invested in something set to be live by 2026, another 26% are implementing a live solution this year, 18% have reached proof-of-concept or prototype and 4% have a live blockchain solution in production (Figure 3).

Figure 3

While those are self-reported figures which may be regarded as ambitious, tangible progress can be measured in the product launches that have been seen across 2024 and 2025. In that time, both the largest and the third-largest asset managers in the world, BlackRock and Fidelity Investments, have launched tokenised money market funds. Tokenised debt has emerged as a category, with J.P. Morgan and State Street partnering to enable companies to issue and settle debt securities on blockchain. Access to tokenised equities is also becoming a feature, with Robinhood having introduced the capability for European clients to trade tokenised versions of 200 stocks and ETFs.

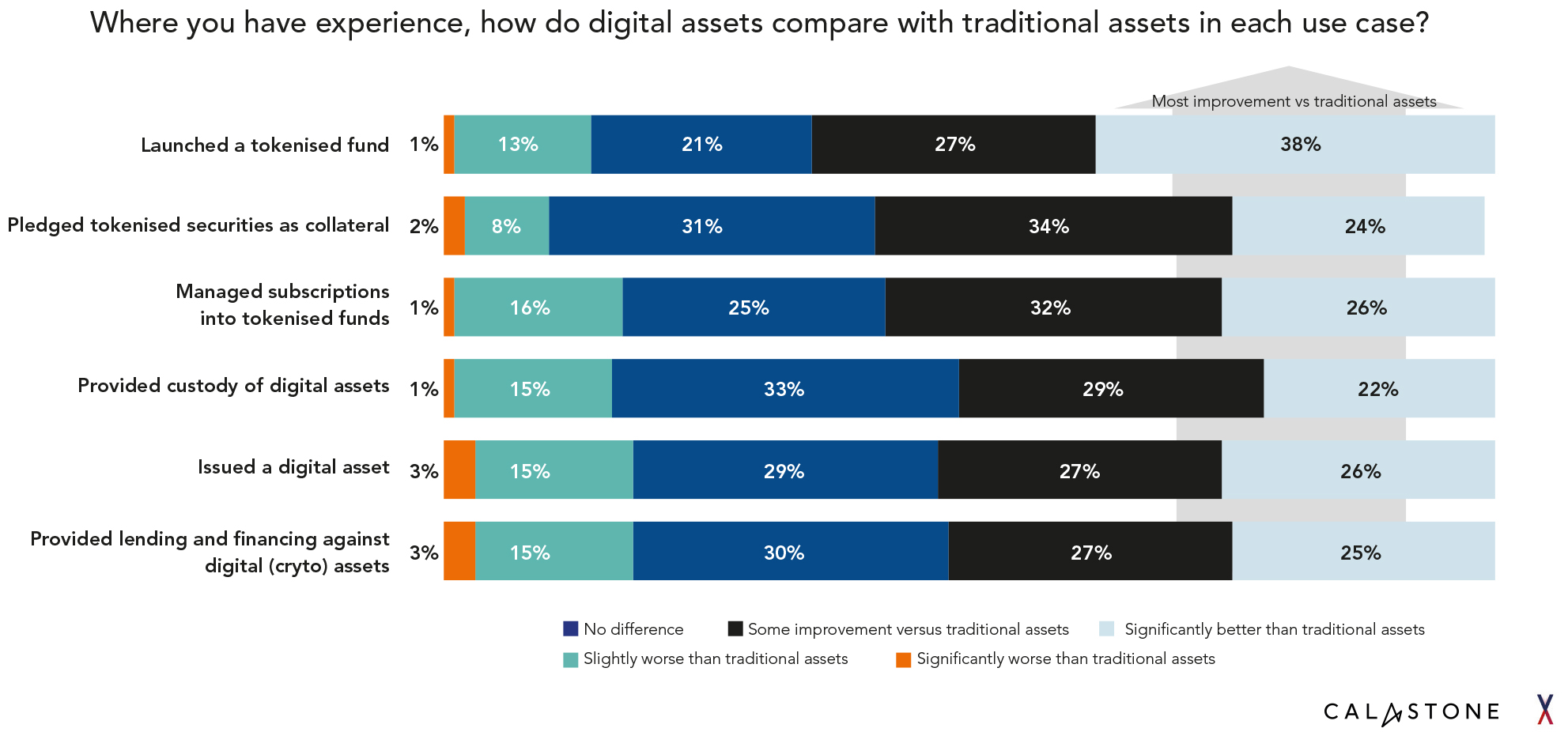

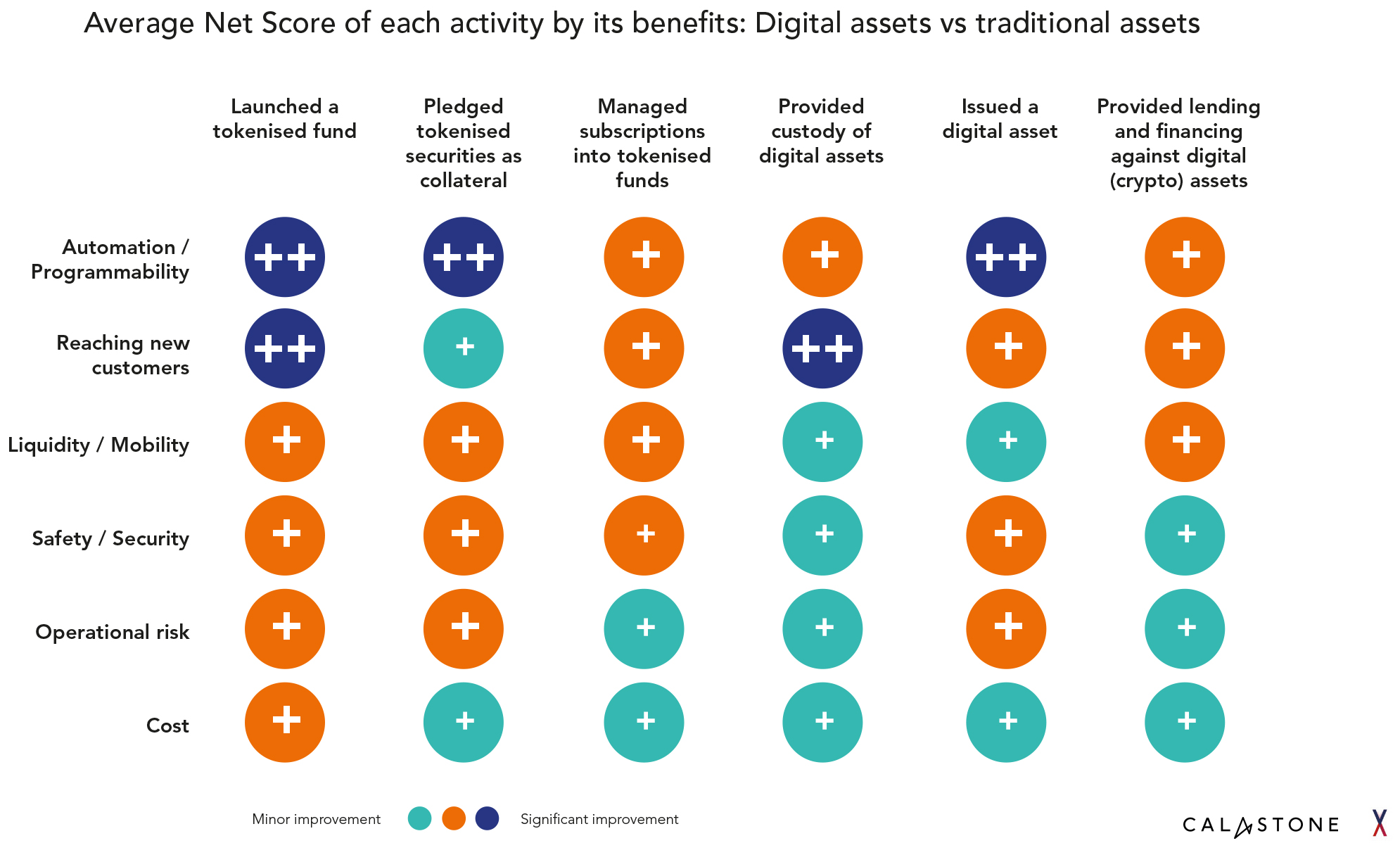

Increasingly, asset managers are motivated not just by the potential of tokenisation but by their early experiences of working with digital assets. Among survey respondents, 65% of those who have already launched a tokenised fund said that it was either significantly better (38%) or represented some improvement (27%) on a traditional model (Figure 4). Only 14% said that it was a worse experience. Asset managers that have launched a tokenised fund said the greatest benefits were seen in automation and programmability and the ability to reach new customers, alongside improvements in liquidity, security, operational risk and cost.

Figure 4

Figure 5

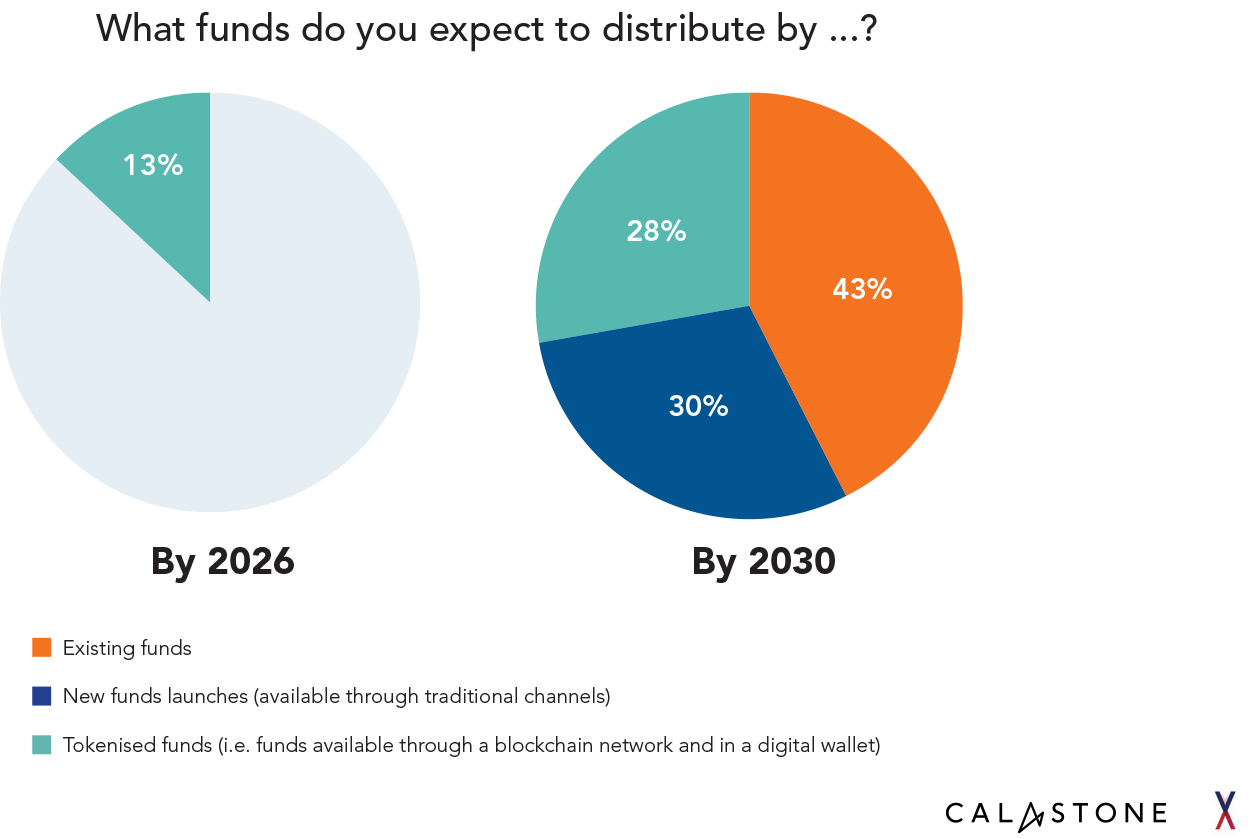

While this indicates the breadth of benefits that tokenisation makes possible, it is on just one of them that the market is increasingly focused – the ability to reach new customers. Asset managers are seizing the quickest route to market, taking their existing funds and making them available on blockchain, as tokens. According to this research, the share of asset managers distributing tokenised funds is set to reach 13% by 2026 and rise to 28% by 2030 (Figure 6).

Figure 6

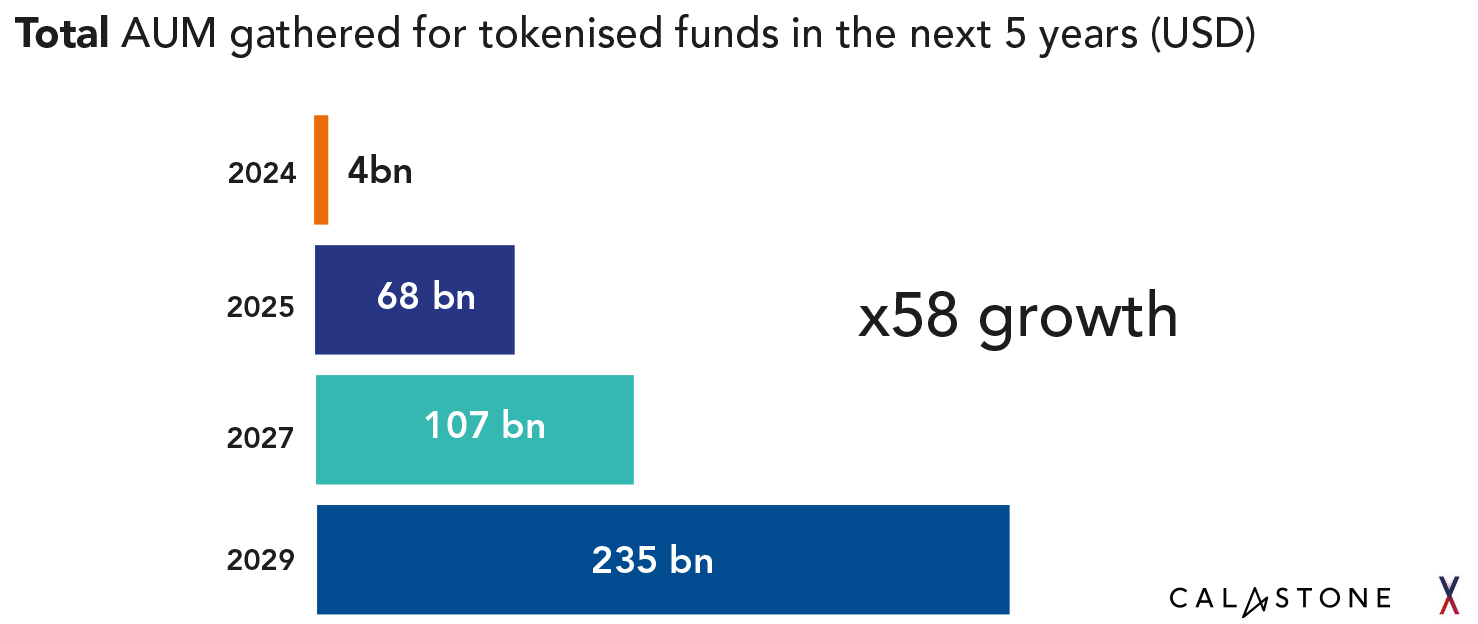

This focus on distribution is set to attract flows amounting to hundreds of billions of dollars into tokenised products. According to this research, the AUM of tokenised funds is set to rise from $4bn in 2024 to $235bn by 2029 – a 58x increase (Figure 7). Other estimates have been even more bullish: a BCG study last year projected AUM of $600bn in 2030, while McKinsey research suggested that the total market capitalisation of tokenised assets – including funds, bonds and debt but excluding crypto and stablecoins – could hit $2tn in 2030.

Figure 7

While estimates may vary, the direction of travel is clear: asset managers are pressing ahead with the distribution of tokenised products and expect to capture major flows from the booming DeFi market.

By prioritising distribution, they are speeding up access to that market. The end-to-end tokenisation of a fund, digitising the entire value chain, is potentially transformative but also a longer process involving multiple parties, whose full benefits will take more time to realise. By contrast, distribution – making the same fund available through digital tokens on chain – is an immediate opportunity which allows asset managers to move quickly.

A solution such as Calastone Tokenised Distribution can facilitate this process in a matter of weeks, without the need for technical or operational overhauls, and benefiting from the reach of the world’s largest funds network. In this way, asset managers can get tokenised versions of their products into the hands of customers quickly and efficiently, tapping into new investor cohorts that traditional products could not reach.

The distribution of tokenised funds is an attractive recipe for asset managers who are seeking to access new markets and explore tokenisation without incurring the burden of major investment. Yet it can only gain traction when the willingness to supply is matched by robust demand. Our study found that just such a convergence is taking place in the market for tokenised funds. As eager as asset managers are to provide tokenised versions of their funds, blockchain-based finance platforms are now willing to consume them.

Asset managers are not racing to distribute tokenised products in a vacuum. Our research found that they are responding to clear demand signals from DeFi and Web3 providers.

Platforms that have pioneered the era of blockchain finance, such as cryptocurrency exchanges and stablecoin issuers, have experienced an extraordinary growth journey: in 2024, the transaction volume in stablecoins reached $27.6tn, surpassing the combined level of the Visa and Mastercard networks.

With that success has come a challenge familiar to any major corporation: how to effectively manage a large balance sheet. For example, Tether, the largest stablecoin issuer, now holds more US Treasury bills than South Korea – a total of $127bn. In 2024, it was the seventh largest buyer of the asset class, ahead of Canada, Taiwan, Mexico, Norway and Hong Kong.

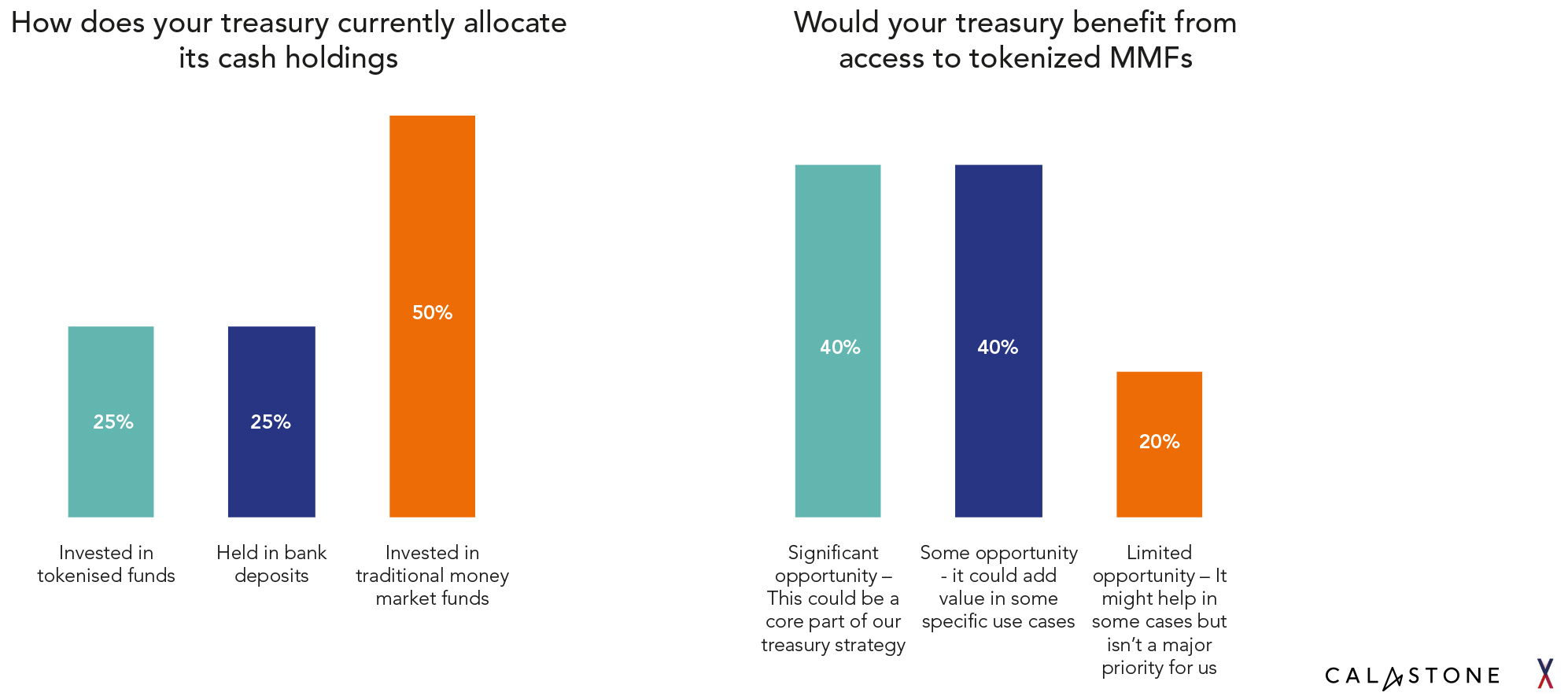

Like their peers in traditional finance, DeFi treasuries are seeking safety, liquidity and yield in their cash management. Yet our research found that most are struggling to find blockchain-compatible solutions. Just a quarter of DeFi and Web3 survey respondents said that they currently allocate cash to tokenised funds, while three quarters are holding cash either in traditional money market funds (50%) or bank deposits (25%). In other words, platforms that have enjoyed huge success by pioneering a new, decentralised financial model are still having to resort to traditional intermediaries to manage their own assets, at a cost to liquidity, transparency and speed of settlement.

Our survey found that there is clear appetite to change this and recognition that tokenised funds could be the answer. The vast majority of DeFi respondents saw advantages in allocating cash holdings to tokenised money market funds, with 40% saying it could be a core part of their treasury strategy and another 40% that it could add value in specific use cases. Within the next five years, all plan to be investing in tokenised funds, with half saying that they will increase their allocation by at least 25% (Figure 8).

Figure 8

Figure 9

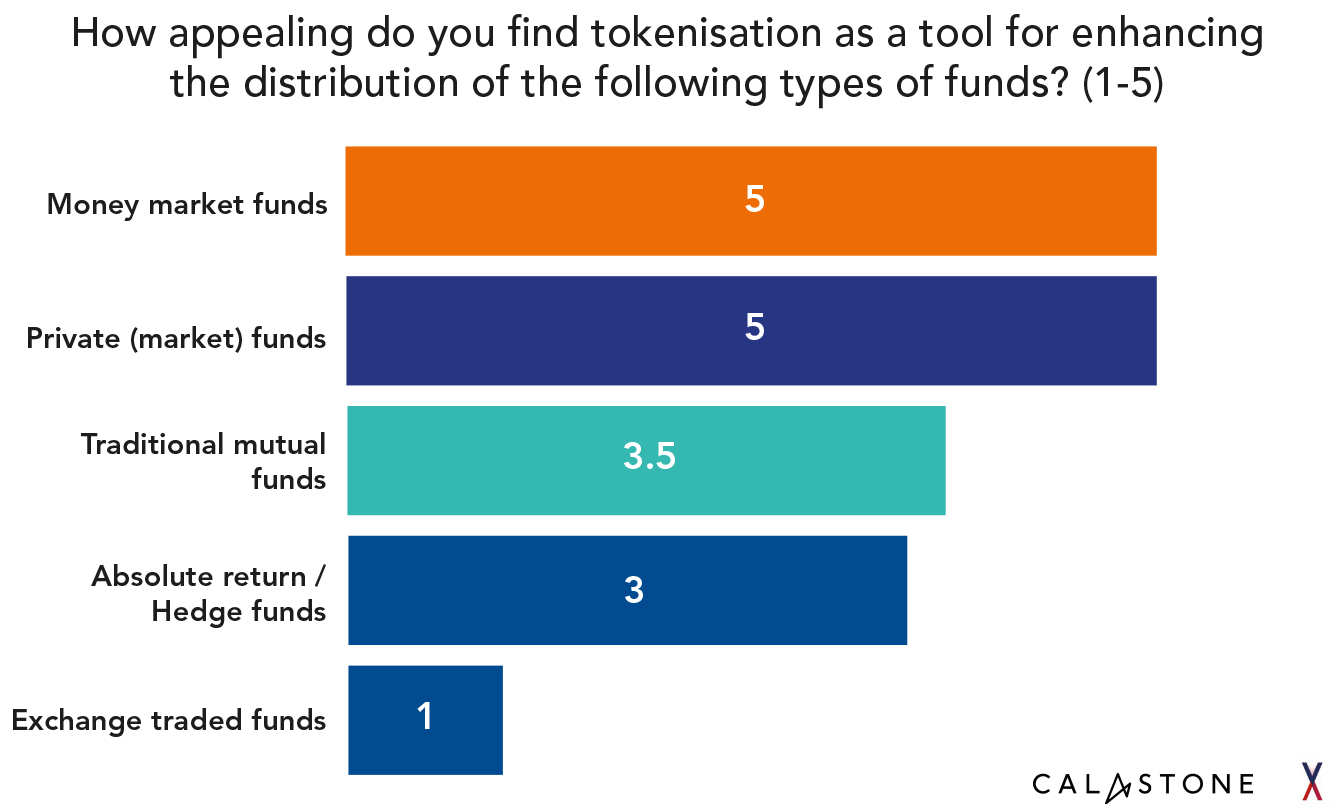

These sentiments underline why money market funds (MMFs) are at the front of the queue when asset managers consider which products to distribute in tokenised form. Ranked out of 5, respondents to our survey placed MMFs equal top with private funds as the products they are most keen to distribute as tokens, ahead of mutual funds, absolute return funds and ETFs (Figure 10). A fifth of asset managers in our survey said they are using tokenised MMFs as digital cash equivalents this year, up from just 4% in 2024.

That can in large part be explained by demand from the DeFi market, turning tokenised MMFs from an interesting test case into a product that can rapidly gain traction. For DeFi platforms, tokenised MMFs offer the core advantages of a traditional product – low risk, liquid and yield-bearing – with the additional benefits of direct integration with digital wallets, improved transparency and the ability to purchase using stablecoins. They represent something close to the best of both worlds, combining the security of the old with the flexibility of the new.

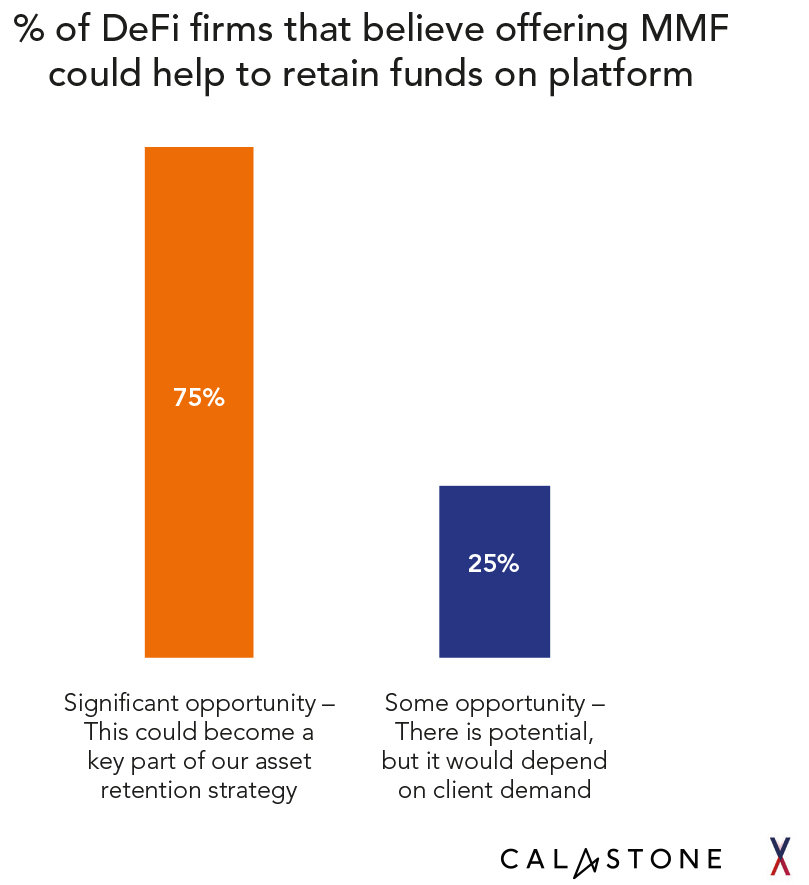

Figure 10

The DeFi providers we surveyed believed that tokenised MMFs can help them not just with treasury management but customer retention and acquisition. Three quarters said that offering MMFs on their platform ‘could become a key part of our asset retention strategy’, and 40% that it could help them to expand their client base.

Tokenised MMFs offer advantages for all parties. Asset managers already have the products in place, and through solutions such as Calastone Tokenised Distribution can make them available as tokens quickly, without any underlying changes. While for DeFi platforms and their customers, MMFs that can be traded on-chain and held in digital wallets represent a cash alternative with the flexibility and transparency to which they are accustomed.

MMFs are an obvious entry point for tokenised funds, but far from the only asset class under consideration. The research showed that asset managers are equally enthusiastic about the potential to tokenise private markets funds, and the way this promises to improve efficiency, transparency and liquidity in areas of the market historically inaccessible to many investors. The partnership announced in May 2025 between Citi and digital assets exchange SDX, which plans to make pre-IPO equities available to investors as tokens, is one indicator of the direction of travel.

From MMFs to private markets, therefore, momentum is building behind the distribution of tokenised funds. In the final section, we look at how asset managers will approach this opportunity in practice: the distribution channels and partners they will look to work through, the cash options they will consider and the challenges they face.

With assets already flowing into tokenised funds, the debate around tokenised distribution has swiftly moved from theory to practicalities.

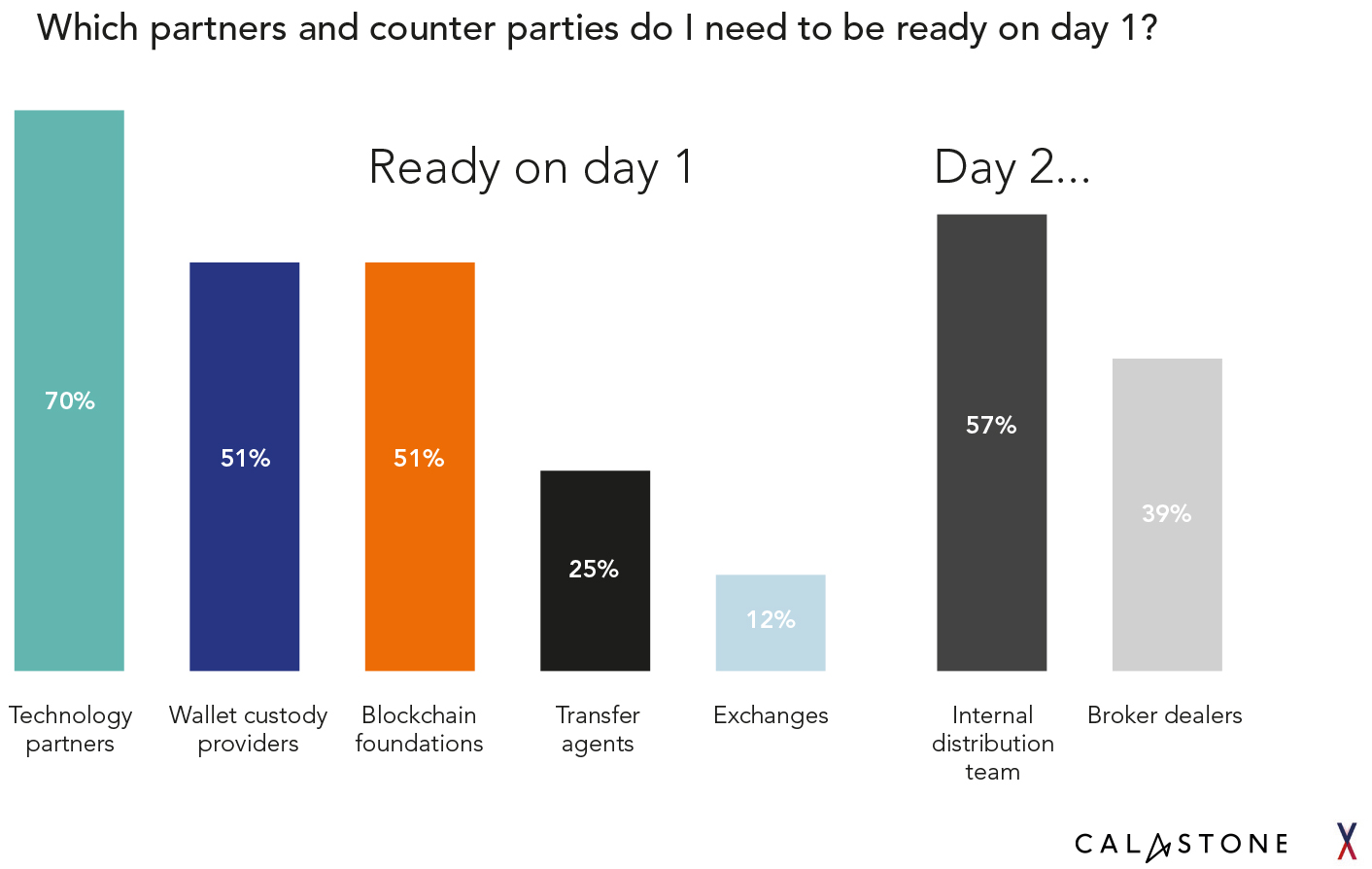

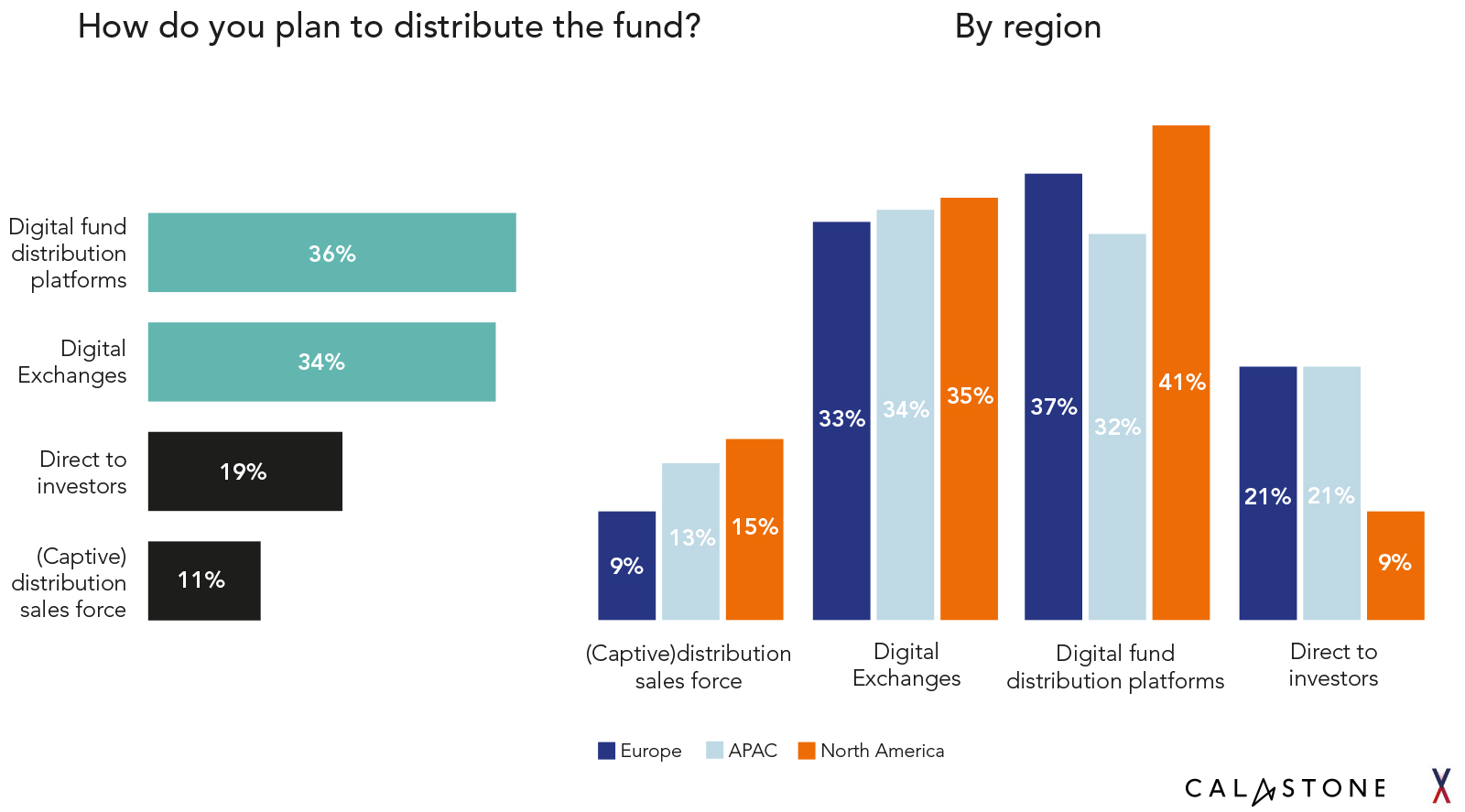

The asset managers we surveyed showed a clear preference to work with third-parties to facilitate distribution of tokenised funds. Asked what resources they wanted in place as a Day 1 priority, the most popular response – identified by 70% – was technology partners (Figure 11). The same share of respondents said they plan to distribute through intermediaries, with 36% preferring digital fund distribution platforms and 34% digital exchanges.

Figure 11

Rather than making extensive investments into internal resources and capabilities, this suggests a desire to lean on third parties when it comes to the distribution of tokenised funds, with an emphasis on getting to market quickly and leveraging partners already active in the market.

By contrast, just 19% of asset managers said they would go direct to investors and 11% that they intended to rely on a captive distribution sales force. The preference for intermediaries was especially marked in North America, where 76% of respondents said they would utilise digital exchanges or fund distribution platforms, against 9% who plan to go direct to investors.

Figure 12

By focusing on a digital distribution model, asset managers are also hoping to overcome some of the issues of the traditional model, which can include slow and costly onboarding, the challenge of regional regulatory variation and limited data transparency. Digital intermediaries that are already accustomed to working across different territories can help to ensure speed to market, as well as facilitating greater transparency for customers and personalised investor journeys.

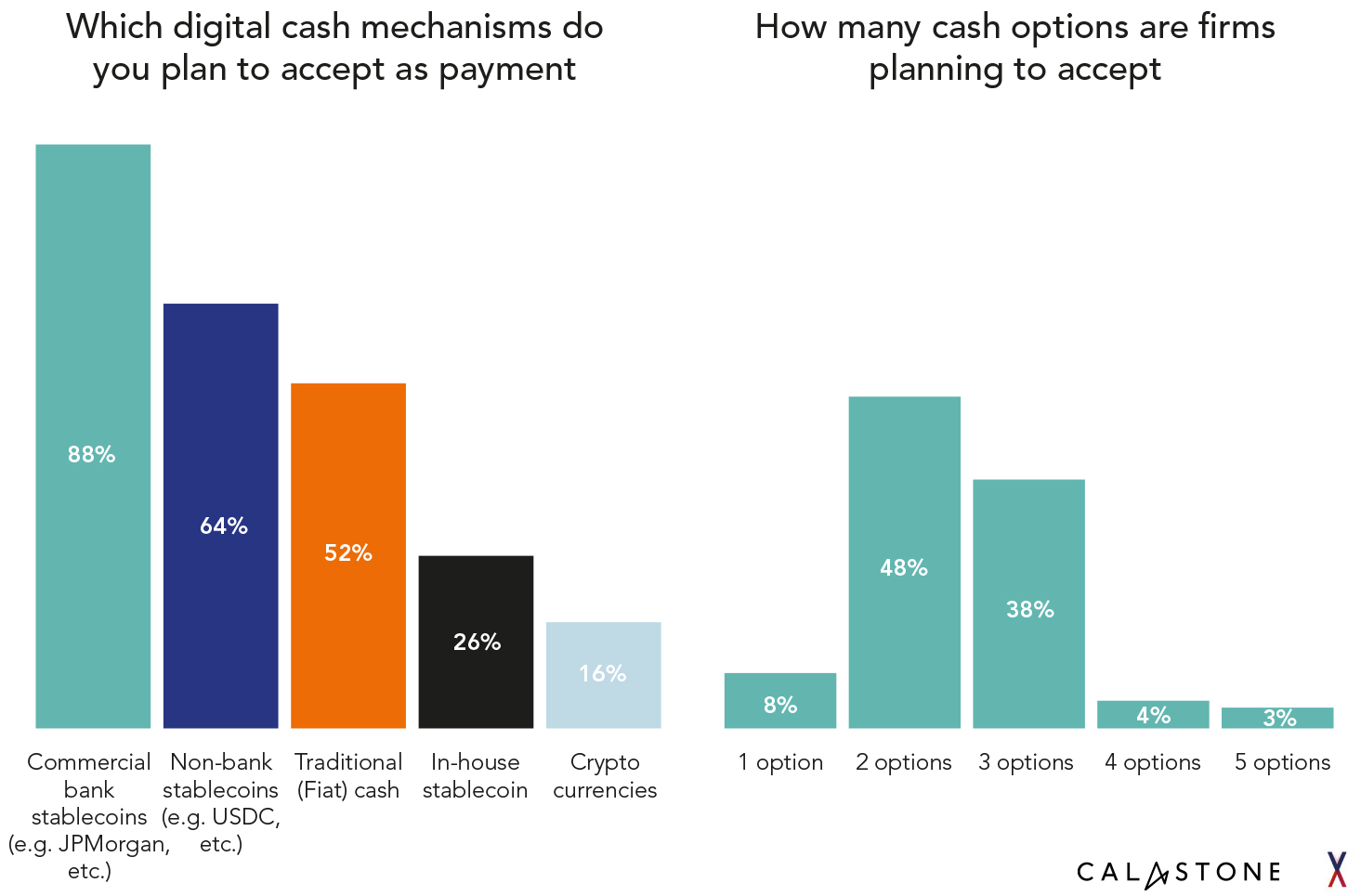

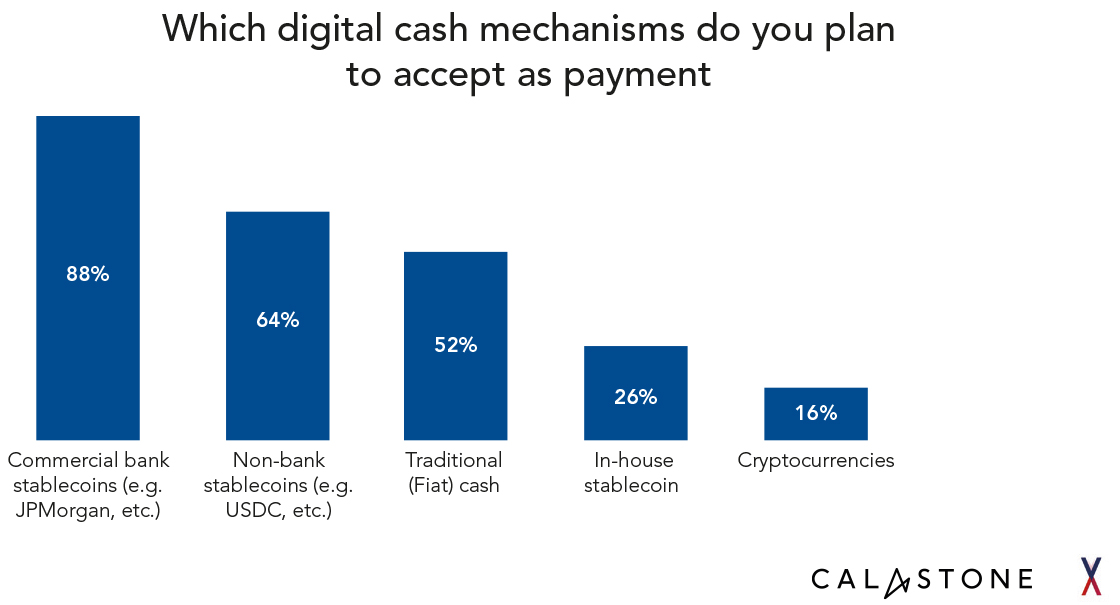

Asset managers also recognise the need for flexibility in how they interact with a new kind of customer, and to embrace digital cash rails. The vast majority said that they will accept multiple cash options for fund subscriptions, including commercial and non-bank stablecoins, fiat cash and cryptocurrencies. Of survey respondents, 48% said they will accept two cash options and 38% three options (Figure 13).

Figure 13

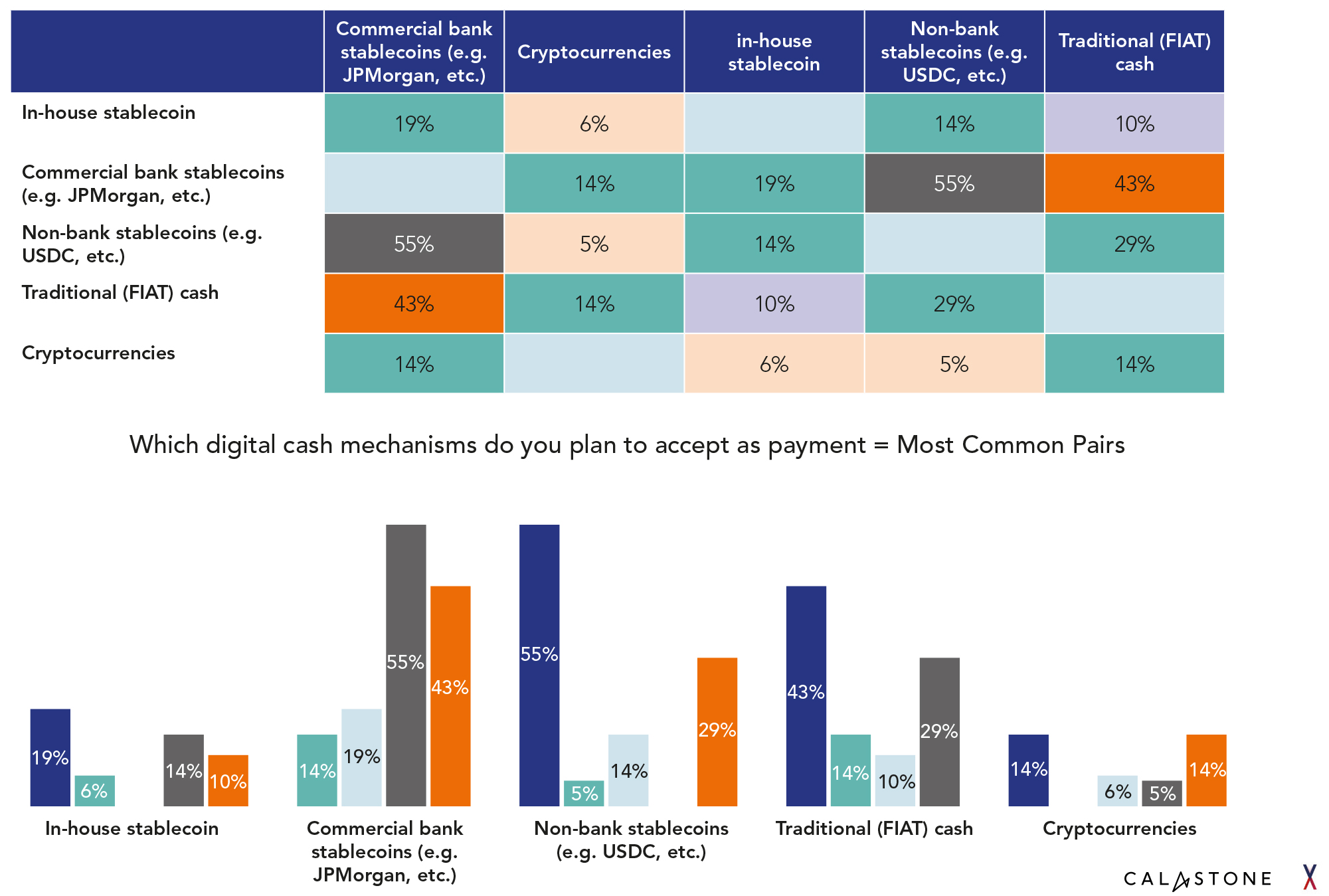

Bank-issued stablecoins were favoured over non-bank equivalents (88% vs. 64% said they would accept them as a payment option), reflecting the general preference for trusted institutional issuers. The most common pairs asset managers said they planned to accept were commercial bank and non-bank stablecoins (55%), fiat cash and commercial bank stablecoins (43%) and fiat cash and non-bank stablecoins (29%). Ultimately there may be scope for tokenised deposits, a stablecoin alternative in which the token is backed by bank deposits.

Figure 14

Taken together, the findings suggest that asset managers are prioritising speed, efficiency and flexibility as they prepare to distribute tokenised versions of their funds. Rather than investing in their own platform and sales force, they are leaning on technology partners and third-party channels. Rather than being prescriptive about the payment options they will accept, they are showing willingness to accept a variety of digital cash mechanisms. With the goal of reaching new investor cohorts, asset managers are trying to speak the customer’s language and make investing in these funds as seamless as possible.

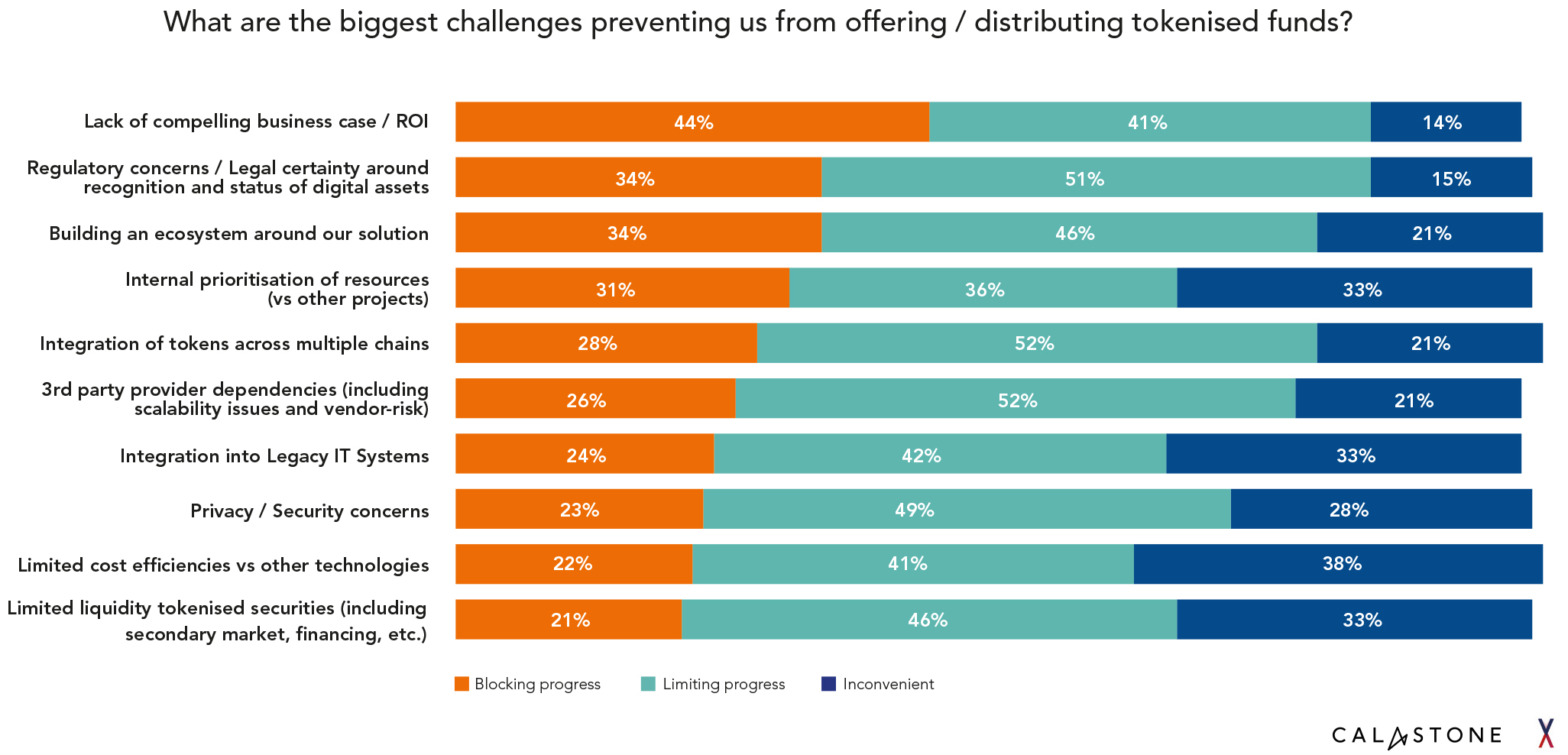

That does not mean every asset manager is sold on the potential of tokenised fund distribution or believes that implementation will be straightforward. The vast majority of respondents said that the lack of a compelling business case/ROI was either blocking their progress (44%) or limiting it (41%) (Figure 15). The same share identified regulatory concerns and uncertainty about legal recognition of digital assets, which 34% called a blocker and 51% a limiting factor. Other widely-identified challenges were how to build an ecosystem around the solution (34% blocker, 46% limiting factor) and internal prioritisation of resources against other projects (31% blocker, 36% limiting factor).

Figure 15

While the challenges were widely recognised, it was also striking that most relate to human rather than technological factors. The question of business case and ROI is one already being addressed by the rapid pace of inflows to tokenised funds, something which is only going to become more apparent over time. Regulatory and legal aspects can be mitigated to some degree by working through third parties, while internal priorities are likely to follow business outcomes. There is also every indication that regulation towards tokenised finance is advancing in supportive ways.

Asset managers may harbour some misgivings about distributing tokenised funds, but it does not seem to be deterring their willingness to act. By 2030, over a quarter expect to be distributing tokenised funds, activity which is set to drive AUM of this emerging sector into the hundreds of billions. That is how tokenisation will move from an area of interest and experimentation into an established feature of the financial landscape.

Figure 16

2025 is the year in which tokenised assets have begun to enter the mainstream. AUM in the category stood at $15.2bn at the end of 2024, up threefold from 2022. By June of this year, it had leapt again to over $24bn. While the absolute volumes are still small, on the current growth trajectory they will not remain so for long.

Rapid inflows underline that asset managers have turned to distribution as their gateway to digital assets. While there is significant long-term potential in bringing the entire infrastructure of a fund onto blockchain, it is distribution that offers an immediate opportunity for asset managers to implement tokenisation and reach new customers.

That focus is underpinned by demand from DeFi platforms, whose appetite for on-chain solutions to support treasury management – compatible with their rails and tradeable with stablecoins – was a key finding of this research. Most DeFi providers are currently using either traditional money market funds or bank accounts to hold cash. The vast majority believe that tokenised equivalents have an important part to play both in their treasury strategy and helping them to retain and acquire client assets.

For asset managers, such demand suggests that tokenised funds can be a customer acquisition tool in hitherto untapped markets. Respondents to our survey who have already launched tokenised funds said that reaching new customers was one of the top two benefits, alongside automation and programmability.

In the distribution of tokenised funds, therefore, asset managers have an immediate opportunity to tap into the benefits of change without undergoing operational upheaval. This research found that most are planning to work with technology partners and through digital intermediaries to launch tokenised funds. In practice, that means asset managers can reach new customers without creating new products, hiring a sales team or changing any underlying infrastructure.

Distribution may only be the beginning of the tokenisation journey for most asset managers, but it is a meaningful step which is set to deliver tangible results in terms of inflows and customer acquisition. As asset managers prove the value of tokenised funds, they can be expected to bring more products and processes on-chain, as well as exploring the opportunity to tokenise more elements of the value chain – accessing further opportunities in the DeFi ecosystem for product innovation and operational efficiency.

Tokenisation remains a long-term trend, but it is no longer simply a question of future-proofing. By focusing on distribution and tapping into the burgeoning DeFi market, tokenisation can help asset managers to compete and win new customers now. Many are already acting on that basis: the partnerships, pilots and fund launches that are currently in train will do much to define the shape of fund distribution and digital assets in the years to come.

Methodology

This white paper is based on a survey conducted exclusively for Calastone by ValueExchange, which received a total of 59 responses. Of these, 52 were from asset managers and 7 from Web3/DeFi platforms. The findings presented throughout the report reflect insights gathered from these respondents.