A clear correlation has emerged between risk appetite during the COVID-19 pandemic and the age of investors, according to research conducted by Calastone, the largest global funds network.

The research, which surveyed people in Australia, New Zealand, Hong Kong, UK, U.S. and Germany to assess current investment sentiment and behaviour, shows that investors, particularly millennials, are undeterred by volatility created by COVID.

Millennials (aged 24-39) are the most active demographic in every global market, with nearly 72% having invested or considering investing due to pandemic created conditions.

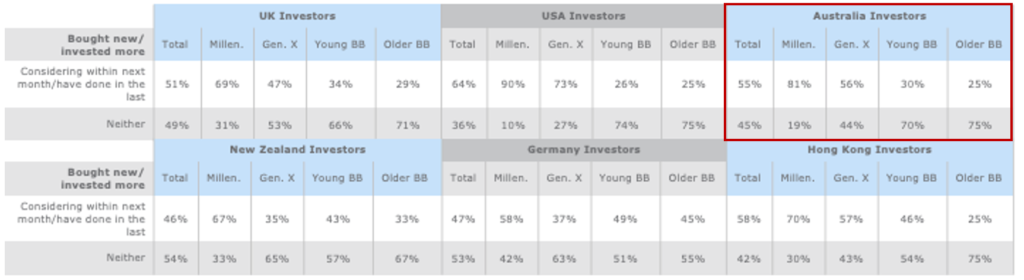

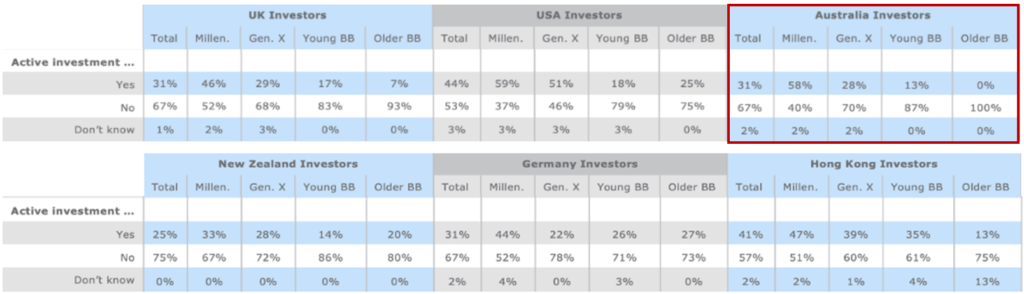

In Australia, 55% of all investors remain bullish, having made new investments already or considering investing in the near future (see Figure 1), while one third (31%) have actively invested as a direct consequence of COVID (see Figure 2), in a bid to capitalise on the continued market volatility.

The study shows that Australian millennials, who face a low interest rate environment and subdued economic growth, are very proactive with 81% either having invested since COVID or considering doing so soon (Figure 1). Further, they were almost twice as active than Australian generation X investors, with 58% actively investing as a consequence of COVID compared to 28% (Figure 2) of the older cohort.

Looking globally, U.S. millennials led investment activity and sentiment, with 90% having already invested since COVID or intending to do so, while German millennials showed least appetite, at 58% (Figure 1).

Figure 1: Investment action since COVID-19 (Calastone and DJS research), where investors have made new investments already or are considering doing so in the near future.

Figure 2: Investing in light of COVID-19 (Calastone and DJS research), showing investor likelihood of investing due to COVID, plus active investment as direct consequence of COVID

The study also found that older Australian baby boomers (aged 66-70), were the most bearish of all groups, with 100% refraining from making any new investments (Figure 2).

Ross Fox, Managing Director, Head of Australia and New Zealand at Calastone, commented on the findings: “The high level of engagement and consideration among Australian millennials during volatile market conditions shows a maturing and opportunistic investment mindset to capitalise on market dips.

“This proactive attitude to investing concurs with the local fund flows we’ve seen across the Calastone network, which in July processed record daily volumes into funds,” he said.

“Our data similarly indicates that COVID has contributed to a rise in investment activity among investors since the pandemic’s onset, driving a healthy return of flows into managed funds after an intense net outflow in March when markets sharply turned.”

Figure 3: Fund flows across Calastone network in Australia from 1 January to 31 July 2020

Methodology

Calastone surveyed 1,800 respondents, encompassing a sample size of 300 each for six key geographies – spanning the UK, USA, Germany, Hong Kong, Australia and New Zealand. Included within each region surveyed, more than half the respondents were proactive investors, having previously made active investment decisions to buy or sell into the market. The ages of those surveyed ranged across age bands from 24 to 70. Millennials are defined as anyone aged 24-39, Generation X are 40-55, Younger Baby Boomers are 56-65 and Older Baby Boomers are 66-70.

Please refer to the release linked here for global survey results.