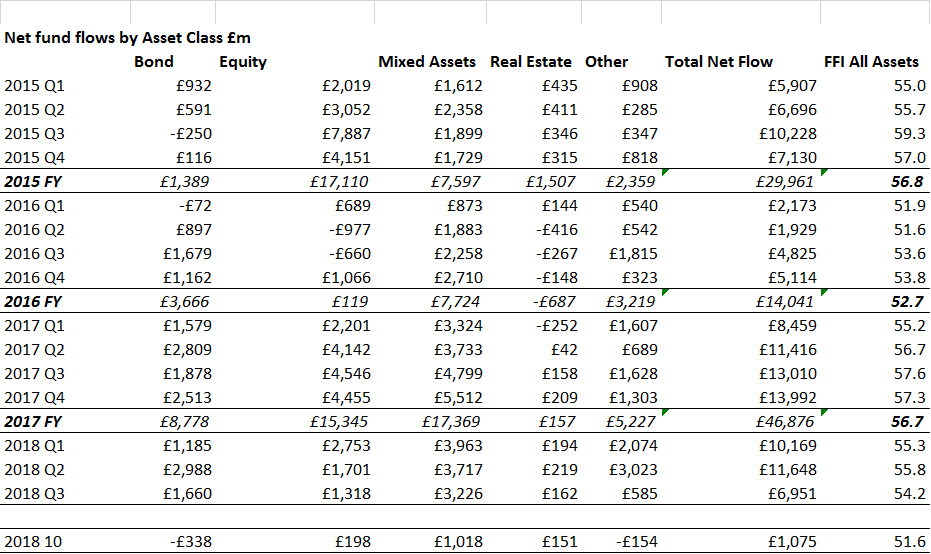

UK investor confidence fell to its lowest level in two years in October as falling share prices spooked investors, according to the new Fund Flows Index (FFI) from Calastone, the largest global funds transaction network. The new monthly index tracks orders representing millions of individual investor decisions, and is the most comprehensive, and up-to-date measure of UK fund flows (see methodology). In October, the index fell to 51.6 (50 means inflows equal outflows), as only £1.1bn net flowed into funds on unusually high trading volumes. The inflow was one third of the year-to-date average. The last time sentiment was this poor was late 2016, after the Brexit referendum and ahead of the US presidential election.

2018 has been marked by declining optimism among investors – the Calastone FFI has trended sharply down all year. Following October’s weakness, the second half of 2018 is set to see less than half as much money flow into UK-based funds compared to the same period in 2017.

Chart: Calastone Fund Flows Index (FFI All Assets)

Equity funds saw inflows of just £198m in October. Inflows into global funds dried up altogether, after consistently being the most popular equity category since early 2016: global funds have heavy weightings in US stocks, which fell most sharply last month. European funds saw outflows of money as the Italian crisis escalated, but relatively undervalued UK equities, which investors have avoided altogether since the Brexit referendum, saw inflows of £244m. Buying of UK equity funds only began during the October EU summit, as investors became more optimistic on a Brexit deal. Spiking bond yields (which mean falling bond prices) meant fixed income funds were no safe haven in October, and investors withdrew money from them for the first time since early 2016.

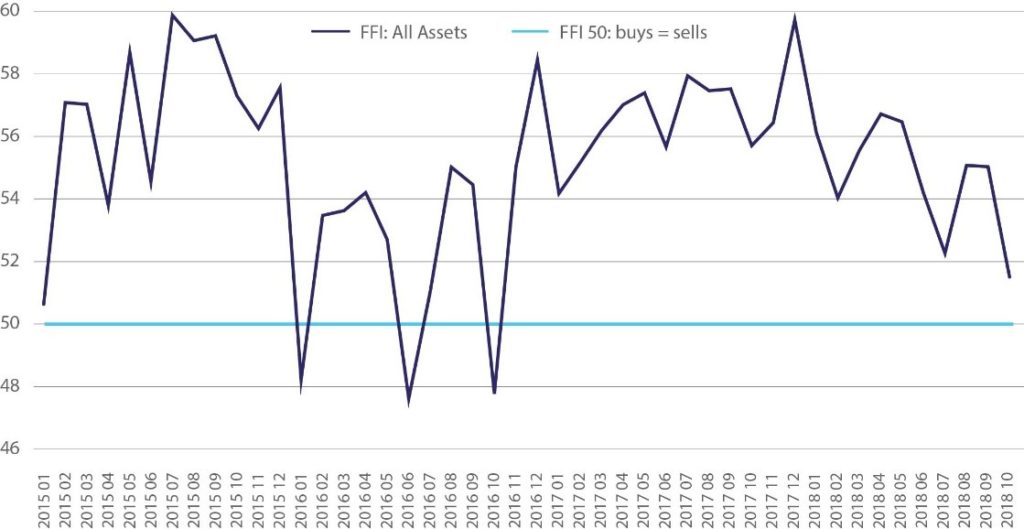

Investors have not only cut back sharply in recent months, but they are also avoiding higher risk funds. As concerns over stock market valuations have deepened, trade tensions have intensified, and market volatility has risen, the proportion of funds allocated to riskier assets has dropped from two-thirds of all inflows in March 2018, to under a quarter in October, its lowest level since early 2017. The FFI for funds with higher risk ratings, has been falling steadily too, from a high of 58.2 in January to just 51.3 in October. The last time investors were this risk-averse was in the run-up to, and after the Brexit referendum.

Chart: Proportion of net fund flows to low, medium and high-risk funds

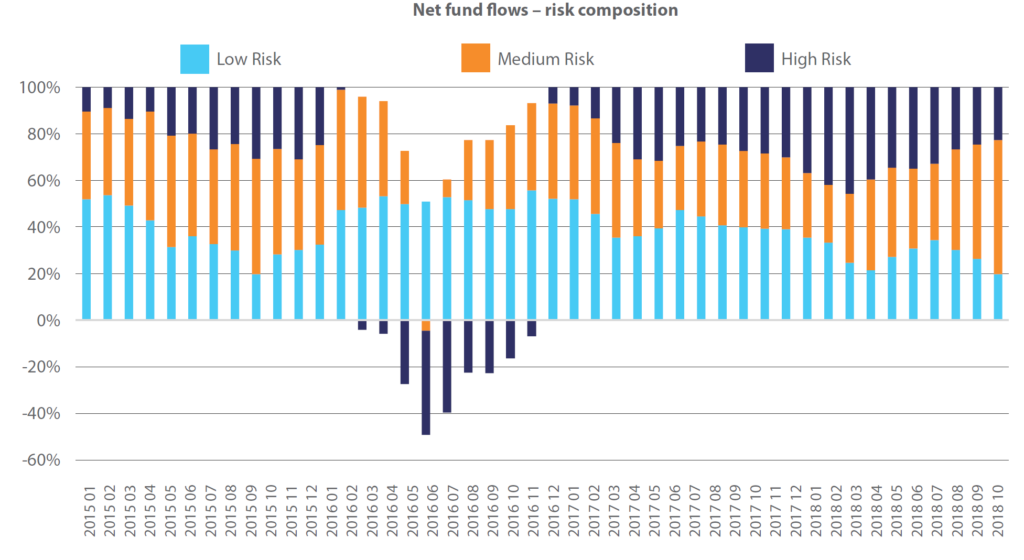

The same trend is apparent in the asset classes investors are choosing. This year, money market and fixed income funds have seen much stronger FFI readings than riskier categories like equities. The FFI Money Market has averaged a very high 62.6 in 2018, compared to just 51.8 for the FFI Equity: equity inflows have halved this year compared to the same period in 2017. The FFI Bonds has averaged 56.2, so the reversal in October must be set against the context of very strong inflows year-to-date.

Chart: Investors have been very cool on equities in 2018

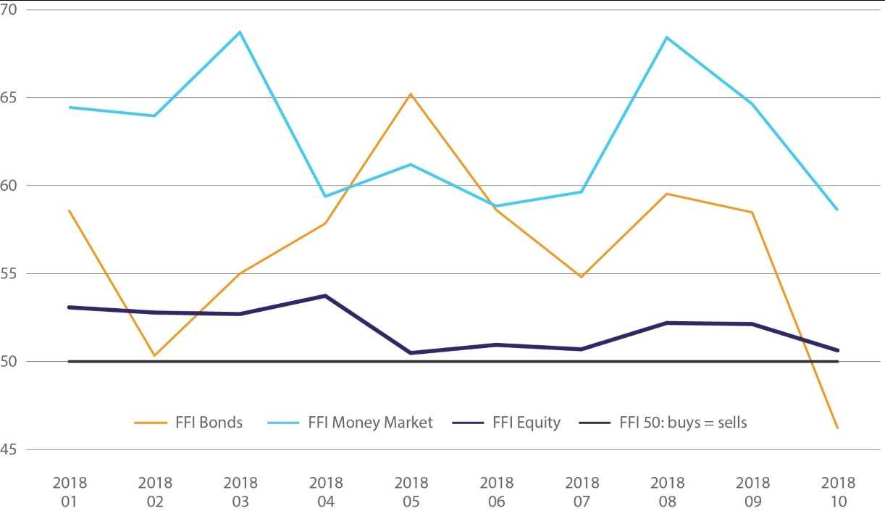

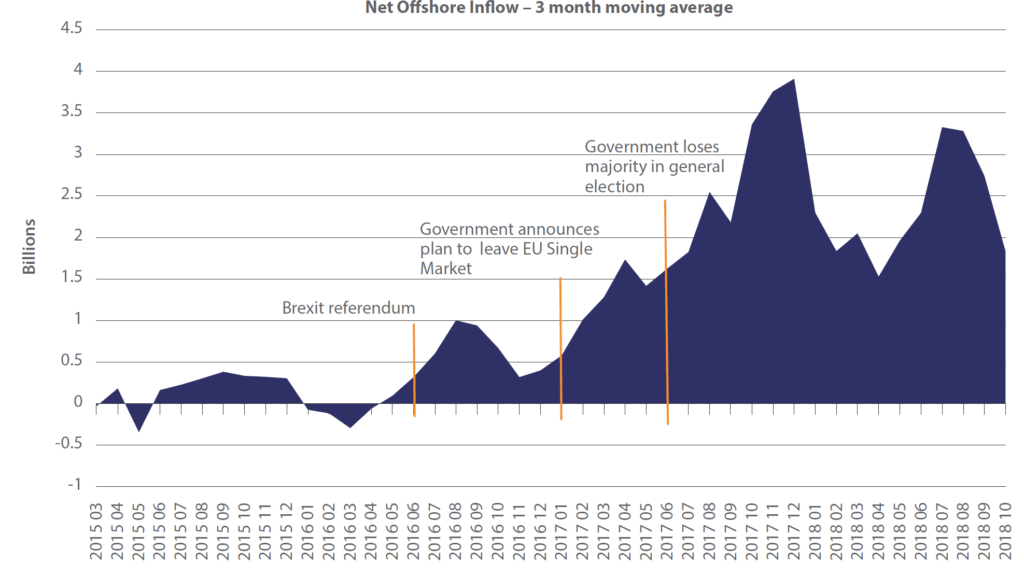

Concerns over Brexit are also showing up in a concerted shift into offshore funds. Institutional investors dominate demand for offshore funds, along with high net worth individuals. From the beginning of 2015 until May 2016, the FFI Offshore averaged 50.5, meaning almost no net flows offshore. Over the same period domestic funds saw strong inflows. As soon as the UK voted to leave the European Union, the tide turned. Since June 2016, the FFI Offshore has averaged 55.8, as a cumulative £53.1bn has flowed offshore, averaging £1.9bn per month. In the year before the vote, the monthly average was just £150m. The trend indicates an ongoing shift offshore.

Chart: Value of UK money flowing to offshore-domiciled funds

Edward Glyn, Calastone’s Managing Director, Head of Global Markets, comments:

“2018 is shaping up to be a disappointing year for fund inflows as market conditions have deteriorated in recent months, but overall trading volumes are very high as investors reassess their holdings. Risk aversion has risen sharply, and investors have committed less and less new money to funds, especially equity funds.

But this is not a rout. Even during the huge market disruption in October, there was opportunistic buying on down days. Moreover, fund flows overall remain structurally positive, as investors build their savings over the long term to meet their future needs.

The sea change in appetite for offshore funds is clearly linked to Brexit: the expected loss of passporting for the UK’s financial services industry, coupled with uncertainty about the UK’s regulatory future, and nervousness about Britain’s unstable political situation, have driven investors to move capital outside the country.”

To subscribe to the monthly edition of the Calastone Fund Flow Index, you can follow the link at https://www2.calastone.com/fundflowindex

Appendix – Fund flows and FFI All Assets