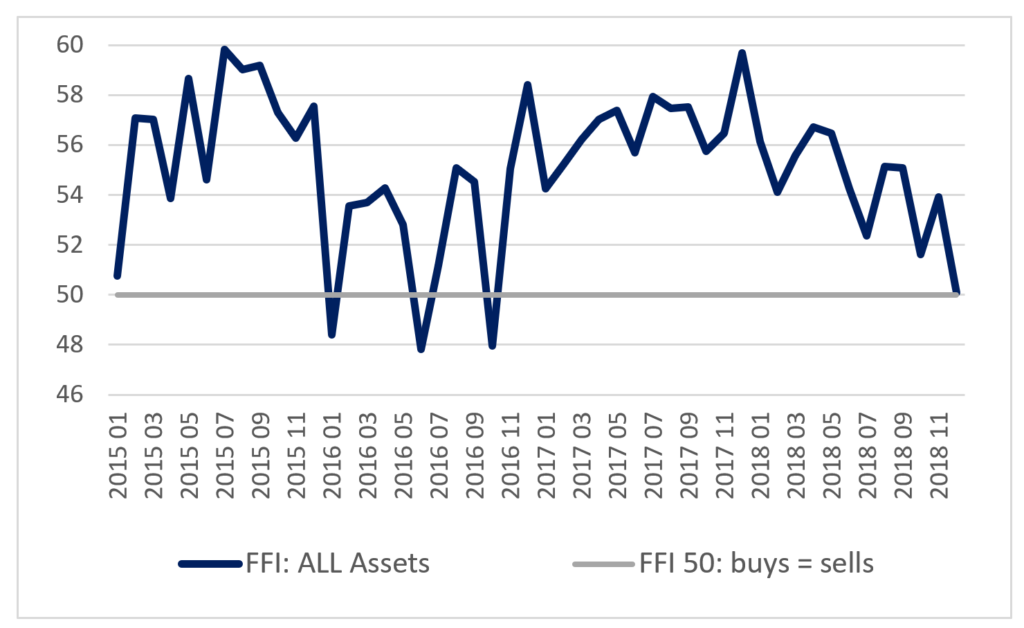

High volatility in global markets kept investors away in December, according to the latest Fund Flow Index (FFI) from Calastone, the largest global funds transaction network. Investor sentiment remained cautious following continued macroeconomic and political uncertainty.

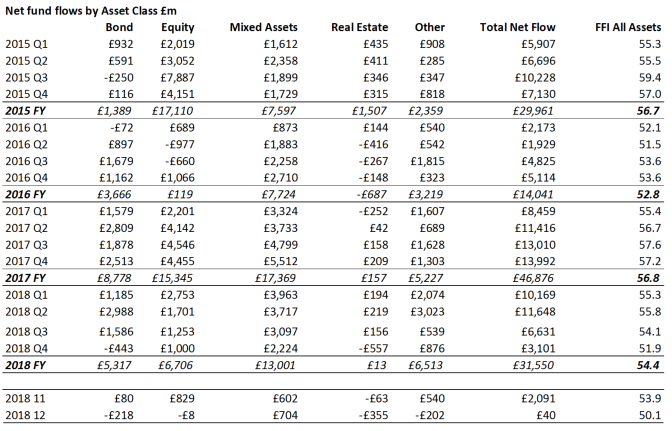

The Fund Flow Index fell to 50.1, its lowest reading since October 2016, as net inflows to UK-domiciled funds dropped to just £39.8m. This is marks a drop of 99.3% compared with December 2017, and is only a little over one hundredth of the average inflow each month over the last two years. December’s poor reading meant that Q4 2018 was the weakest quarter for UK funds since Q2 2016, with net inflows of just £3.1bn. For 2018 overall, fund inflows were a third lower year-on-year as a strong first half gave way to an increasingly difficult second. Calastone’s monthly index tracks orders representing millions of individual investor decisions, and is the most comprehensive and up-to-date measure of UK fund flows (see methodology). ![]()

Calastone Fund Flow Index (All Assets)

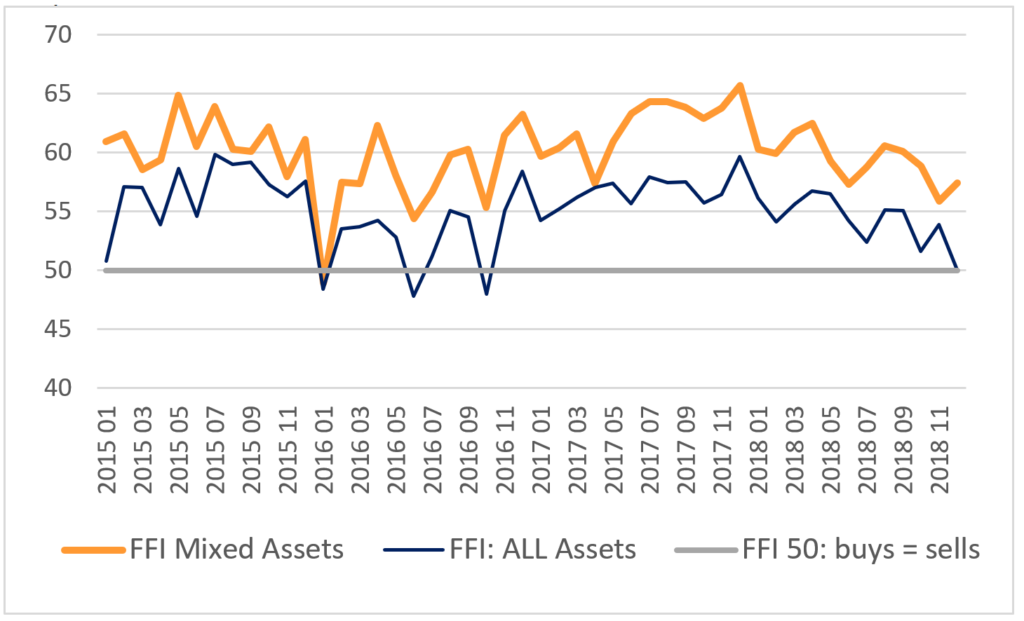

FFI Mixed Assets

Most major asset classes saw outflows in December as investors redeemed many of their holdings, but the overall figure just managed to stay in positive territory thanks to mixed asset funds. These habitually see steadier trading than other asset classes, as they are the stalwarts of many regular savings plans. Mixed asset funds saw net inflows of £704m, but even so, this was the second weakest month in two years for this category, with only November having performed more poorly.

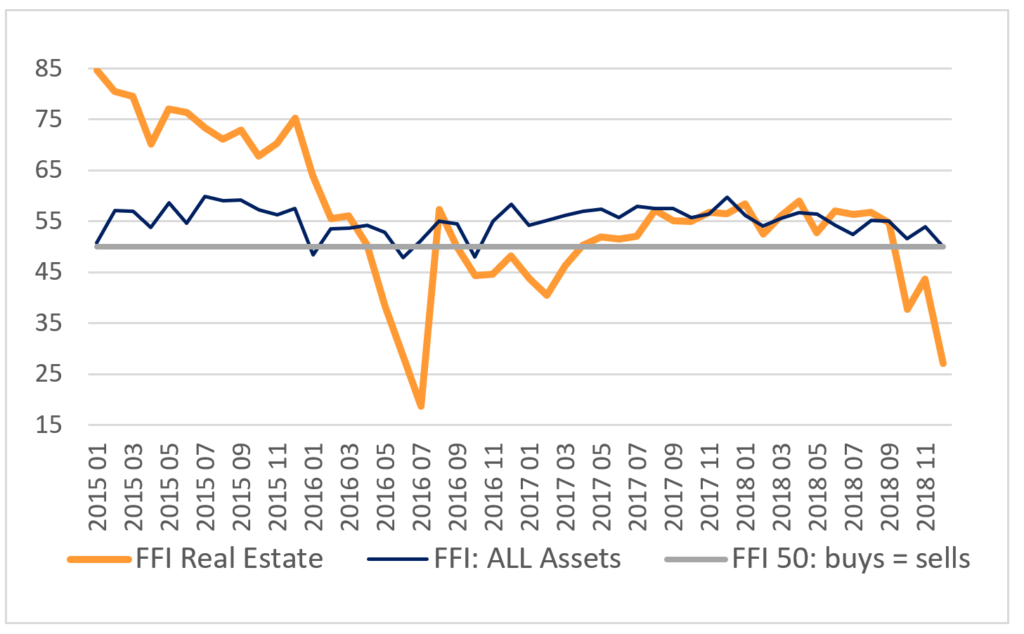

The biggest outflow in December was from property funds: the FFI Real Estate fell to 27.1, the second weakest reading on record for the Calastone index, marking the third consecutive month of capital leaving the sector – outflows in Q4 reached £557m. Fixed income funds also had a tough December, seeing £218m of outflows, making Q4 the weakest on Calastone’s record for the FFI Bonds.

FFI Real Estate

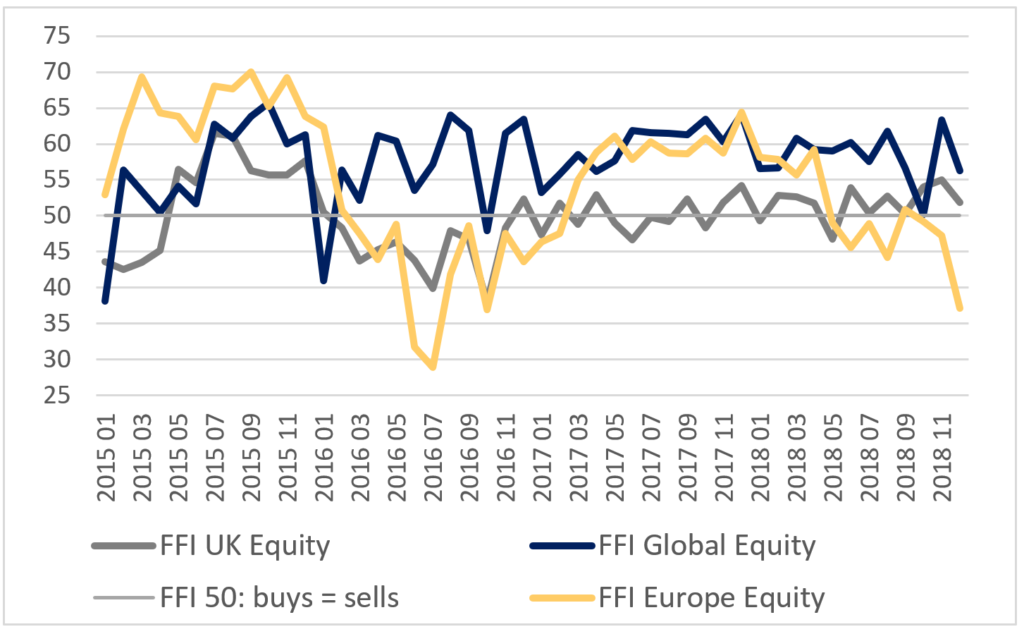

FFI Equity: UK, Global, Europe

Perhaps surprisingly given the wild fluctuations of the stock markets, equity funds saw outflows of only £7.8m, although this masked wide divergence between the different flavours. Funds investing in European stocks performed the worst, with £257m of outflows, followed by North America, equity income, emerging markets and Asia-Pacific. UK equity funds saw modest inflows, while global funds saw £249m of net buying, well below the monthly average for the last couple of years, but nonetheless far ahead of other categories.

The worst days for equity funds were the 4th and 6th December with heavy net selling following the momentous inversion of the US yield curve. After Christmas, the mood improved, and each trading day saw strong net buying activity. European funds saw steady net selling throughout the month, but North American funds saw outflows more closely correlated with especially poor days for the stock market. Real estate funds saw outflows on every day of the month except one.

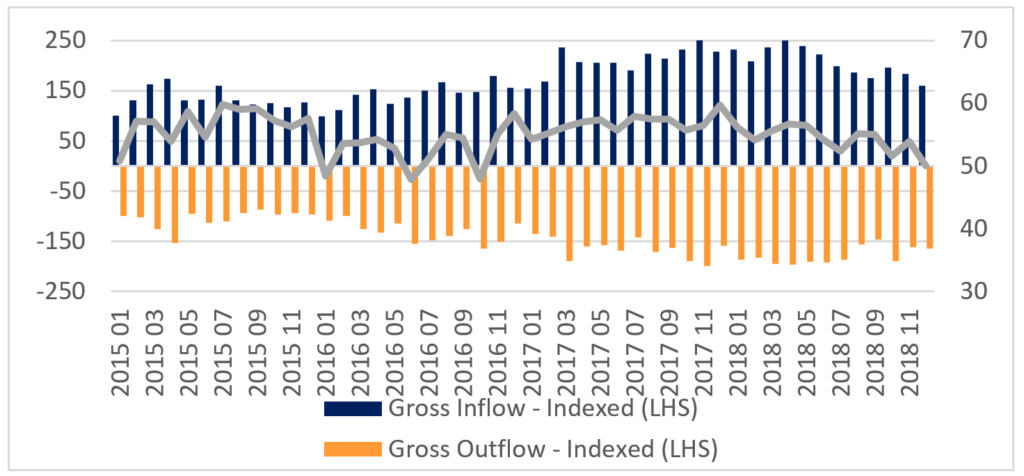

Not only were net inflows affected in December, but overall UK trading volumes were subdued too. The total volume of two-way trading in December was £25.0bn, relatively low compared to the busy activity over rest of the year, even after seasonal factors are accounted for.

Trading volume v Calastone FFI

Edward Glyn, Calastone’s Head of Global Markets, comments: “December rounded off a difficult year for some of the UK fund management industry, as increasingly bearish sentiment dampened investors’ enthusiasm to add to their fund holdings. Without the ballast of mixed asset funds to steady the ship, the ride would have been much rockier. Net flows into pure bonds funds and pure equity funds are more than twice as volatile as those into mixed assets over the long term, so even though mixed asset funds saw lower inflows than usual, they nevertheless enjoy a structural advantage compared to other asset classes.

As 2019 gets underway, investors are faced with rising global risks. The US yield curve inverted in early December for the first time in a decade. This a key indicator associated with a looming recession and is a very negative signal for investors. Meanwhile, wobbles in the eurozone economy are hitting sentiments hard around European assets, while in the UK, investors have to deal with the added uncertainty of Brexit and its difficult path through the parliamentary maze.

Fear may be trumping greed at present, but investors aren’t getting excitable. The relatively low volume of trading in funds in December, even allowing for the season, shows that most prefer to sit on the sidelines, rather than attempt to ride the highs and the lows.”

Methodology

Calastone analysed over a million buy and sell orders every month from January 2015, tracking monies from IFAs, platforms and institutions as they flow into and out of investment funds. Data is collected until the close of business on the last day of each month. A single order is usually the aggregated value of a number of trades from underlying investors passed for example from a platform via Calastone to the fund manager. In reality, therefore, the index is analysing the impact of many millions of investor decisions each month.

More than two thirds of UK fund flows by value pass across the Calastone network each month. All these trades are included in the FFI. To avoid double-counting, however, the team has excluded deals that represent transactions where funds of funds are buying those funds that comprise the portfolio. Totals are scaled up for Calastone’s market share.

A reading of 50 indicates that new money investors put into funds equals the value of redemptions (or sales) from funds. A reading of 100 would mean all activity was buying; a reading of 0 would mean all activity was selling. In other words, £1m of net inflows will score more highly if there is no selling activity, than it would if £1m was merely a small difference between a large amount of buying and a similarly large amount of selling.

Calastone’s main FFI All Assets considers transactions only by UK-based investors, placing orders for funds domiciled in the UK. The majority of this capital is from retail investors. Calastone also measures the flow of funds from UK-based investors to offshore-domiciled funds. Most of these are domiciled in Ireland and Luxembourg. This is overwhelmingly capital from institutions; the larger size of retail transactions in offshore funds suggests the underlying investors are higher net worth individuals.