After a bumper ISA season, fund inflows dropped sharply in May, according to the latest Fund Flow Index from Calastone, the largest global funds network. Equity fund inflows fell to their lowest level since November 2023, while fixed-income and mixed-asset funds saw outflows. Meanwhile, safe-haven money-market funds absorbed cash as investors switched out of these two asset classes.

Equity fund inflows fell to £775m in May – two thirds lower than the January to April average

Equity funds made a very strong start to 2024 – the £8.90bn of inflows were the best start to any year on Calastone’s record – but momentum slowed dramatically in May. Inflows more than halved month-on-month to £774m – and are down by almost two thirds from the average between January and April[1]. This is still a good month by the standards of the last three years, but it marks a distinct cooling of investor enthusiasm. Lower inflows to North American funds and sharply higher outflows from UK-focused funds were the key drivers of the slowdown.

North American inflows fell sharply – but May still numbered among the sector’s best months

North American equity fund inflows peaked in February and have slowed steadily since, but investors remain positive. They added a net £826m to their holdings in May, down by two thirds since February and one third month-on-month. Even so May’s inflow was six times the long run average, indicating investors are still positive about the US market. Moreover, each of the last six months has been one of the six best months of inflows for US equities.

Global funds maintained their momentum in May, adding £1.44bn, the fifth best month for this fund sector. European equities also continued to attract healthy net inflows, totalling £462m during the month.

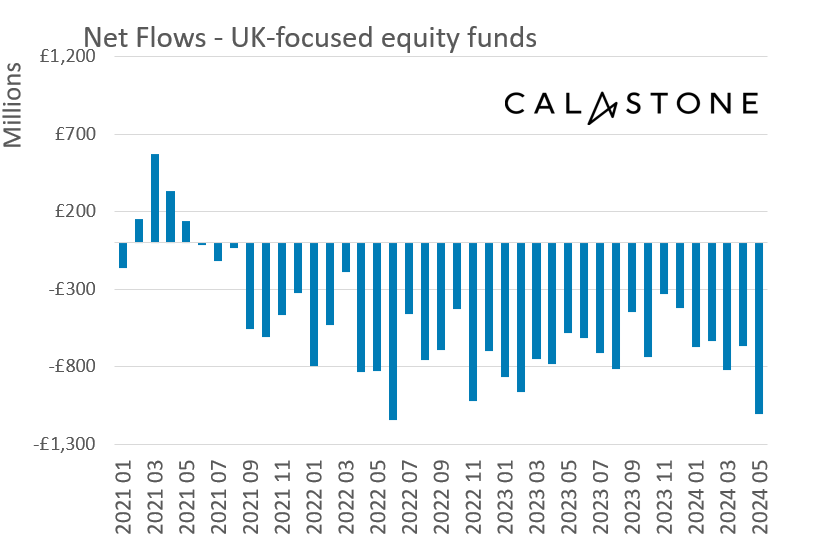

UK-focused funds saw second-highest outflows on record in May

UK-focused funds were hardest hit, especially actively managed ones. Profit taking after the recent UK market rally prompted a £1.11bn outflow from UK-focused funds, the worst net selling from this sector since June 2022[2], and the second worst on Calastone’s record. £792m of this was from actively managed UK funds. Outflows from emerging market and Asia-Pacific funds also accelerated in May. Again it was active funds that bore the brunt of investor withdrawals.

May was the second-worst month for fixed-income fund outflows on record

Investors finally showed signs of capitulation on the bond markets in May, withdrawing capital for the first time since October 2023. Bond yields had started the month by rallying from late April highs (when bond yields rise, bond prices fall) but this brief respite turned once again to pessimism as inflation data in the US and UK disappointed the markets and dashed hopes of early rate cuts. Bond yields by the end of May remained close the highest levels seen all year. Investors duly sold down a net £643m of their fixed-income holdings, the worst month for the asset class since March 2020, when the pandemic was declared and markets were seized by panic, and the second worst on Calastone’s near 10-year record.

Safe-haven money market funds absorbed cash

Rising bond yields and volatile stock markets reignited interest in safe-haven money-market funds in May too. After April saw the first month of outflows in more than a year, £134m of capital returned to money-market funds in May. Higher market interest rates make money markets an enticing prospect as a place to park capital at low risk for the short-term.

Outflows from mixed-asset funds resumed after brief ISA-season hiatus

Mixed asset funds suffered outflows of £531m in May. ISA-season had briefly turned investors more positive on the asset class, with inflows in April concentrated in the first five days of the month (the last few days of the tax year). But May saw net outflows resume as the flurry of ISA buyers melted away. Mixed asset funds have seen outflows in twelve of the last thirteen months, totalling a net £7.9bn.

Edward Glyn, head of global markets at Calastone said: “We often see fund inflows subside from mid-April after the ISA season is over, but this year the fall has been more pronounced than usual.

The prospect of interest rate cuts in the US and the UK has receded yet again, with only the ECB likely to move in the short term. Bond yields are approaching once more the post-GFC highs they reached in late 2023, pushing down bond prices as they have climbed. If you are confident rates will fall, then it’s possible to lock into these high yields for a very long time through fixed income funds, but the see-saw of hopes and fears over rates has finally led some investors to call time and withdraw capital for the first time in months, choosing instead to take refuge in cash or money markets.

“The same forces explain why bond-rich mixed asset funds are suffering outflows and why equity fund inflows slowed in May. The bond markets hold the key to equity valuations over time, but equity fund flows and stock markets are proving remarkably resistant to the tough conditions in the bond markets. Inflows have slowed, but equity investors have largely held their nerve.

“The UK stock market’s recent record highs are welcome news for UK investors who remain structurally overweight their domestic market, even following 36 consecutive months of outflows totalling £22.4bn. While buoyant markets usually attract new capital, many investors have seemingly chosen the UK rally as an opportunity to jump ship rather than a moment to reappraise the UK’s prospects. The election announcement made no difference to selling patterns during the month – this is a long-term trend of selling, not a news-driven flurry.”

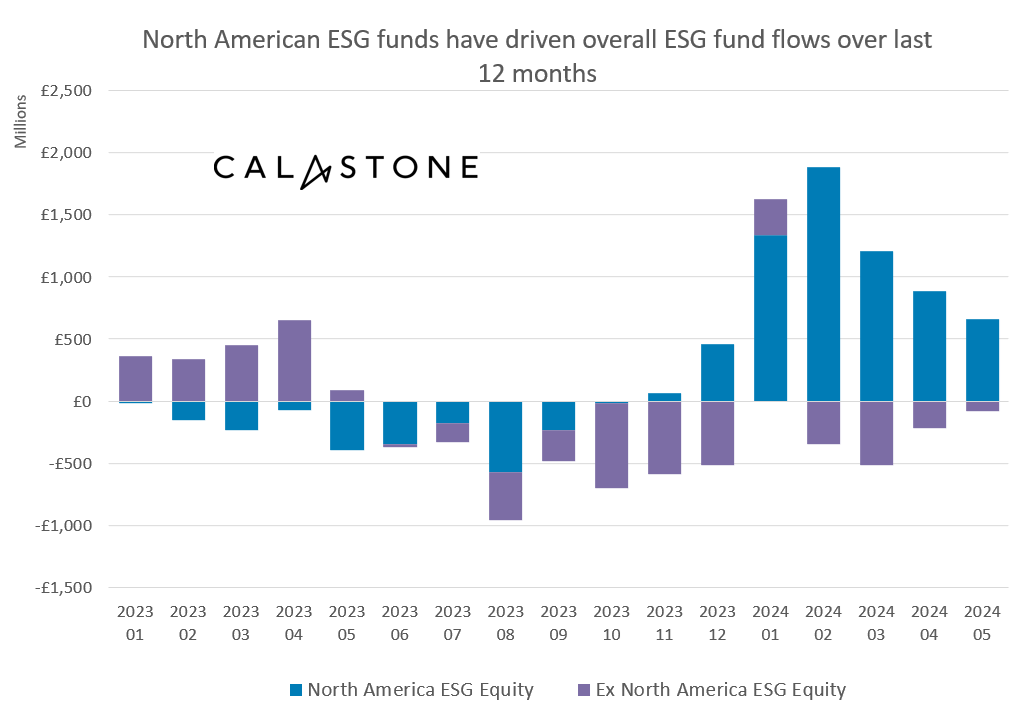

Focus on ESG: ESG revival or US tech story?

ESG equity funds enjoyed their fifth consecutive month of inflows in May after an extended period of net selling during 2023, but buying momentum is fading. Inflows have fallen every month since the January uptick and totalled £581m in May, with most of this inflow focused on ESG North American equities.

Year-to-date, inflows have recovered to £5.10bn after £3.72bn of outflows between May and December 2023. This year, global ESG funds – which until last year were the main beneficiary of investor buying – have seen continued outflows, along with UK, income, and sector funds. North American ESG funds have absorbed £5.96bn, however, with European ESG trailing some way behind on £806m.

Edward Glyn, head of global markets at Calastone added: “Our data highlights the extent to which ESG equity fund flows have been influenced by appetite for US stocks over the last year. Around half the outflows from ESG funds during 2023’s period of selling was driven by investors pulling out of US ESG funds. Moreover, heavy buying of US ESG equity funds this year essentially accounts for all 2024’s inflows to the ESG equity category. The heavy weighting of many US tech stocks in ESG funds helps explain why this is happening – the strong performance of tech stocks like Nvidia is attracting capital to funds with large weightings in the technology sector. If we exclude North America, ESG-compliant funds have continued to suffer outflows in recent months. So what is going on? Investors can obviously buy funds that only invest in technology stocks though these are small in size, but they may be picking North American ESG-compliant funds as an alternative route to tech exposure.”

[1] £2.22bn

[2] June 2022 net outflow £1.14 bn