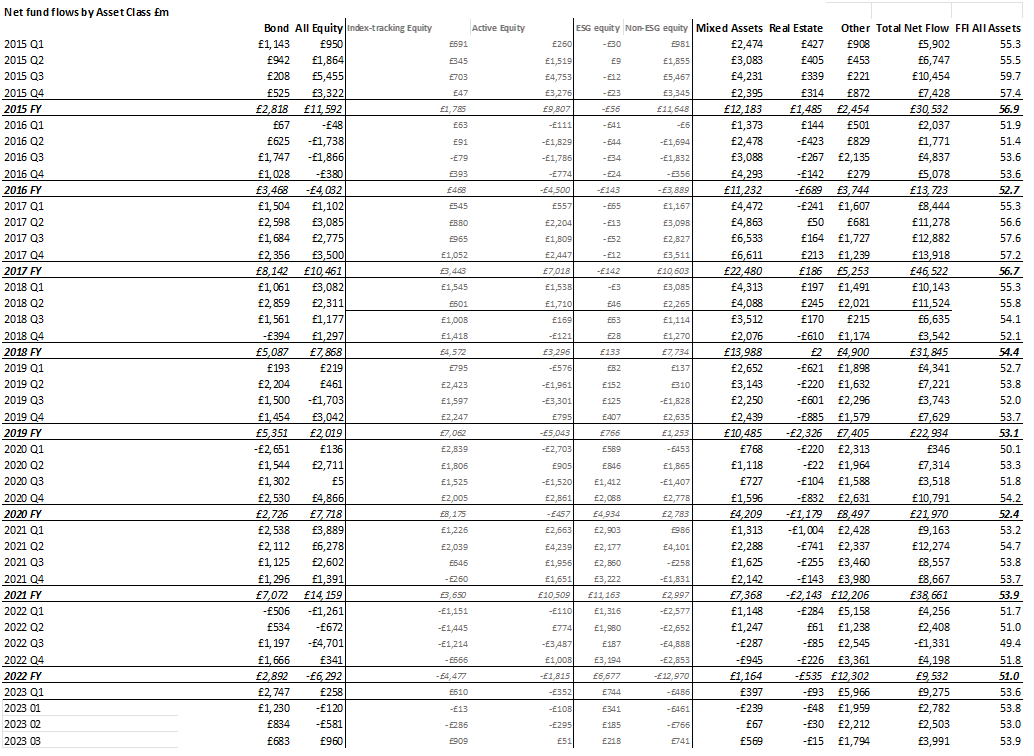

UK investors shrugged off concerns over bank failures in the US and Switzerland in March and turned decisively more positive on equity markets, according to the latest Fund Flow Index from Calastone, the largest global funds network. They added a net £960m to their holdings in March, the best month for equity funds since December 2021[1]. March marked a significant turnaround from outflows seen in January and February. Over the whole of the first quarter, just £199m flowed into equity funds.

Global funds scooped most of the new cash flowing into equity funds

Global funds were easily the biggest beneficiary of improving investor confidence. They absorbed £1.69bn of new capital, their best month since November 2021 and the third best on record.

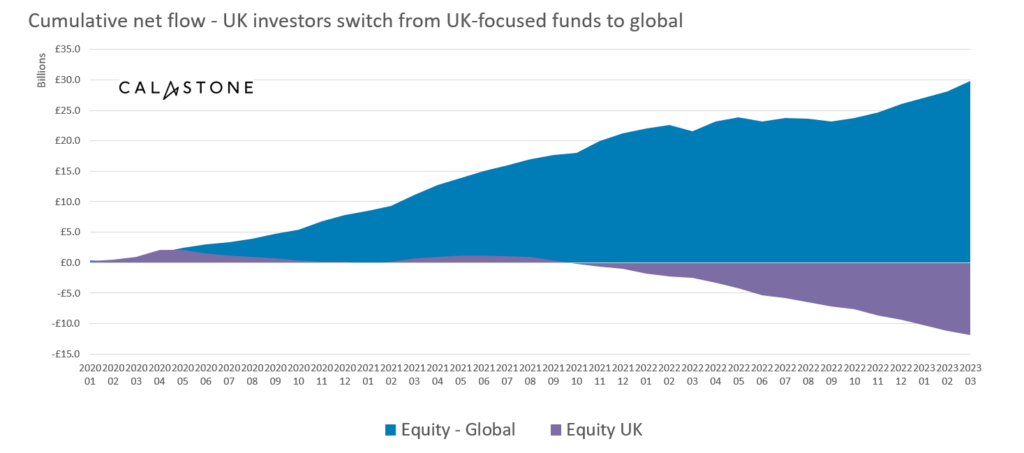

Investors are switching out of UK equities and into global funds

The most that could be said for UK-focused equity funds, however, was that the rapid tide of outflows was somewhat slacker in March than in recent months. Investors pulled a net £747m out of their UK-focused equity funds, down from an average monthly outflow of £888m between November and February. March was the 22nd consecutive month UK funds have suffered outflows.

Edward Glyn head of global markets at Calastone commented: “Global funds are the largest category of funds under management in the UK. They overtook UK equities as the largest sector for UK investors back in December 2020[2]. Since that time, Calastone’s figures show net inflows of £23.0bn to the sector, while UK equities have suffered outflows of £12.1bn. This mismatch has enabled global funds to retain the top spot in terms of assets under management, despite having performed significantly worse than UK equities over the last two years[3].

“The relatively strong performance of UK equities since the bear market began just over a year ago has not improved sentiment. If anything, we have seen outflows accelerate, which on the face of it seems surprising. Yet the large share of UK-focused funds in investor portfolios makes them an obvious source of cash for those keen to reduce overall equity exposure, while the increasing perception of the London stock market as an investment backwater, along with the political and economic difficulties the country has been facing, have kept the pressure on to rebalance holdings away from UK shares.

“A period of strong performance by UK equities, after years missing out on the global bull market has clearly provided an opportunity to cash out.”

Emerging markets are strongly in favour at present, but European equities join the UK in the doldrums

Calastone’s fund flow data showed that emerging markets were strong contenders in March, with £393m of inflows, the best since the autumn of 2021[4] and following a similarly strong February inflow of £294m. European funds remained out of favour, however. Allowing for the fact that UK investors have around three times as much capital invested in UK equities as in European ones, the picture is broadly similar for European- and UK-focused funds. UK investors sold down a net £238m in March, similar to the £250m average in recent months. European funds have suffered outflows for 15 consecutive months.

Passive funds benefit from bullishness on equities

Index-tracking funds were the major beneficiaries of March’s improved confidence. Investors added £909m to their passive equity funds in March, but allocated just £51m to active ones. This was easily the best month for passive funds since April 2021[5], and marked the first inflow to passive funds in more than a year.

Edward Glyn said: “The March turnaround for index tracking funds is a clear sign of improved investor sentiment. Between January 2022 and February 2023, investors sold £4.8bn of their passive fund holdings, but only £2.2bn of their active ones. Trackers bore the brunt of the big asset allocation switch out of equities in the bear market, with the expectation that active fund managers can better position funds defensively, while trackers just ride the market. Hopes, perhaps premature, that the worst is now behind us, caused a partial reversal of that pattern in March.”

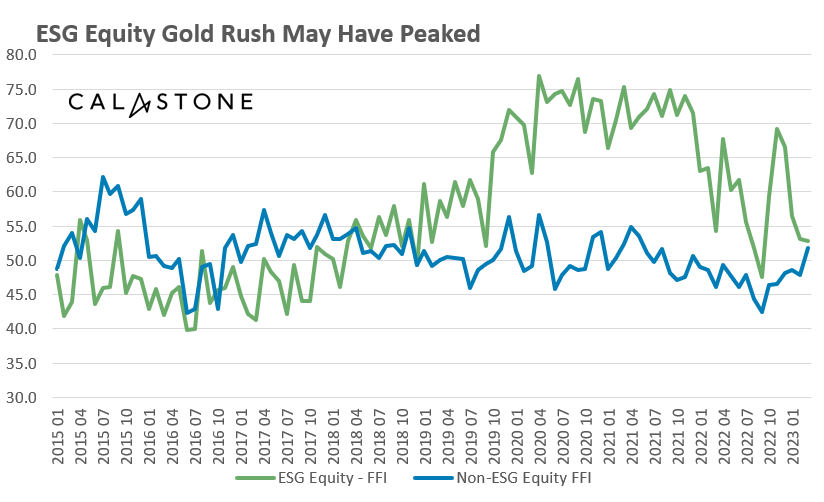

ESG gold rush has peaked

Meanwhile, ESG funds had their second-worst month in March since October 2019[6], absorbing just £218m, two thirds less than the monthly average over the last three years. Since 2015, ESG funds have enjoyed inflows of £24.1bn, almost all since 2019. This is more than half of all equity inflows over the last eight years. Calastone’s fund flow index for ESG and non-ESG equities has converged again for the first time since 2019.

Edward Glyn said: “The ESG gold rush has seemingly passed its peak. A host of factors are at play, including the high weighting of poorly performing technology stocks in ESG portfolios, the greenwashing backlash, and a refocusing of marketing activity by fund managers. ESG may be down, but it’s not out. Now the initial flurry has subsided, the asset class is likely to mature over the longer term.”

Record inflows to fixed income funds in Q1, despite slowing slightly in March

Among other asset classes, fixed income funds continued to attract interest in March, though at a somewhat slower rate than in recent months. This is the flipside of significantly improved sentiment towards equities. Investors added a net £683m in March, still above average, and reflecting hopes of capital gains if policy rates are near their peak and market interest rates fall further. Over the whole of the first quarter, £2.7bn flowed into fixed income funds, making it the best quarter on Calastone’s record.

METHODOLOGY

Calastone analysed over a million buy and sell orders every month from January 2015, tracking monies from IFAs, platforms and institutions as they flow into and out of investment funds. Data is collected until the close of business on the last day of each month. A single order is usually the aggregated value of a number of trades from underlying investors passed for example from a platform via Calastone to the fund manager. In reality, therefore, the index is analysing the impact of many millions of investor decisions each month.

More than two thirds of UK fund flows by value pass across the Calastone network each month. All these trades are included in the FFI. To avoid double-counting, however, the team has excluded deals that represent transactions where funds of funds are buying those funds that comprise the portfolio. Totals are scaled up for Calastone’s market share.

A reading of 50 indicates that new money investors put into funds equals the value of redemptions (or sales) from funds. A reading of 100 would mean all activity was buying; a reading of 0 would mean all activity was selling. In other words, £1m of net inflows will score more highly if there is no selling activity, than it would if £1m was merely a small difference between a large amount of buying and a similarly large amount of selling.

Calastone’s main FFI All Assets considers transactions only by UK-based investors, placing orders for funds domiciled in the UK. The majority of this capital is from retail investors. Calastone also measures the flow of funds from UK-based investors to offshore-domiciled funds. Most of these are domiciled in Ireland and Luxembourg. This is overwhelmingly capital from institutions; the larger size of retail transactions in offshore funds suggests the underlying investors are higher net worth individuals.

[1] £1,008m

[2] Source IA; Dec 2020 Global funds AUM £156.1bn, UK-focused £155.6bn; Jan 2023 Global £162.7bn, UK £151.7bn; note AUM, fund flows and index performance will not line up exactly owing to data lags in IA data, dividends reinvested and exchange rates. Figures are for illustration only.

[3] 01/01/2022 to 29/03/2023 MSCI World -14.7%, UK All Share -2.5%; 01/1/2021 to 29/03/2023 MSCI World -1.6%, UK All Share +11.7%;

[4] Sep 2009 £399m

[5] April 2021 £948m

[6] Source Calastone: ESG Equity fund inflow October 2018 £111m; worst month September 2022 -£125m, linked to mini-budget panic.