Are the UK’s investors turning green? To date, much of the evidence has been anecdotal. But Josh Wade, our Associate Director for Product, recently presented some corroborating statistics in a well-attended webinar, ‘The rise of ESG funds’. Josh explored data pulled from our unique Fund Flow Index (FFI) to highlight a significant and growing upsurge in both supply and demand for mutual funds offering environmental, social and governance (ESG) investment themes. Thanks to some enthusiastic online polling, the webinar also generated one or two data points of its own, which suggested ESG investments could become the new normal sooner than previously thought.

More flavours, more demand

The impulse to invest for good as well as profit has a long history, with religious convictions often guiding early forms of negative screening, for example prohibiting investment in alcohol or gambling. Ethical investing has grown steadily since the 1970s, especially in northern Europe, but initially struggled to scale, due partly to the inherently personal and transient nature of investor priorities.

The pace has picked up in the new century, particularly since then UN Secretary-General Kofi Annan invited large institutions to develop the Principles for Responsible Investment (PRI) framework in 2005. Today, there is more consensus around ESG, but still plenty of choice for those wishing to prioritise specific themes. Guidance from regulators and standards bodies is increasing clarity, stimulating supply and demand by making it easier to differentiate between types of ESG investment strategy, from negative/positive screening and ESG integration to active ownership and impact investing and beyond.

As Josh observed, “Investors have to engage closely to ensure their chosen fund delivers what they want. But the market is responding by creating more ESG flavours to meet demand.”

Step-change in ESG demand

On the supply side, Lipper lists almost 6,000 ESG mutual funds available to retail and institutional investors, more than half focused on equities. UK investors can choose from 373 ESG funds, two-thirds in equities, which collectively accounted for under 4% of the UK market by end-March 2020, in AUM terms. This hardly marks out ESG as the next big thing, but a closer look at Calastone FFI data suggests a step-change in demand.

Calastone’s FFI tracks net inflows and outflows of capital to and from open-ended investment funds on a month-by-month basis, relative to the total value of units bought and sold in those funds. This makes it a valuable and reliable indicator of UK investor sentiment. Uniquely, it is based on actual transaction data, making it more accurate than surveys; it is also both timely and comprehensive, capturing roughly 80% of UK fund flows within days of month end.

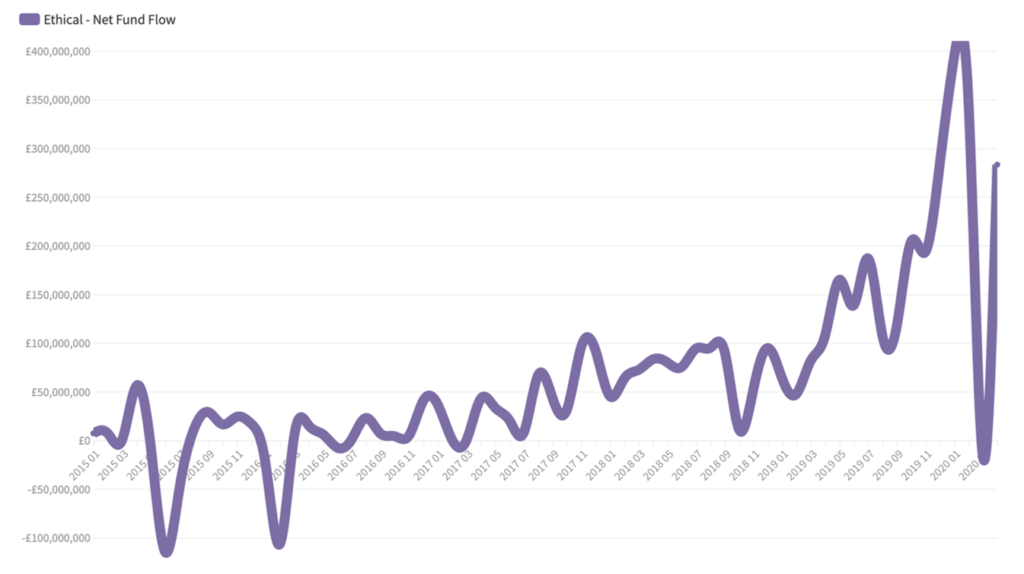

In the 31 months up to July 2017, a tiny net £107 million was invested in ethical funds, the result of £6.4 billion of two-way trading. There were several months of outflows too. In other words, buying activity roughly matched selling activity for almost three years.

In the 33 months after July 2017 (up to April 20), the total volume of trading more than doubled to £16.5 billion, but far more of that trading was from buying activity as more and more investors opted for ethical funds. Net fund inflows jumped to £3.9 billion, 37x greater than the net inflows running up to July 2017.

While multiple factors typically underpin any significant shift in investor sentiment, strengthening buy interest starting from Q3 2017 appears to coincide with sharply rising environmental concerns, partly in response to the screening of Blue Planet II, the Sir David Attenborough documentary series that highlighted the impact of plastic pollution on ocean and coastal environments.

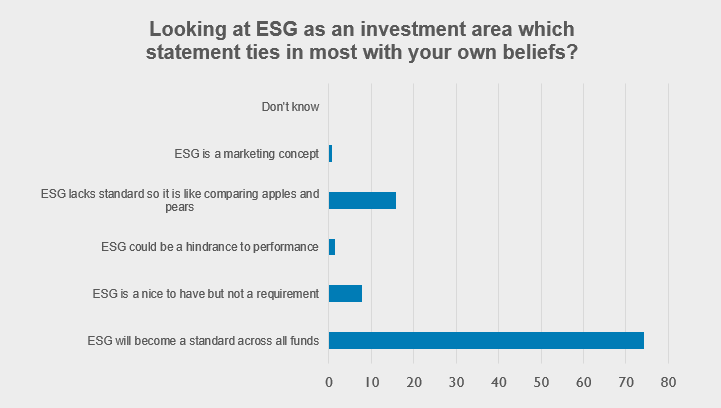

Undoubtedly, rising inflows from this quarter onward also reflect the response of fund managers to indicators of growing demand, both in terms of launching new products and a stronger marketing push behind existing ethical funds. Polling conducted during our webinar suggested many expect thriving supply and demand to lift ESG’s profile. Nearly three-quarters of respondents said ESG will become a standard across all funds, with only 16% viewing standards as a continued significant barrier to growth.

Inflows peaked with a record £394 million invested in January 2020, when ESG funds took in as much new money as in 2015, 2016 and 2017 collectively. And even when all UK funds suffered in February and March, as concerns soared over the economic impact of the Covid-19 pandemic, ESG funds experienced significantly lower outflows than most. As a record £3.1 billion flooded out on UK funds during March, with bond funds hit particularly hard, ESG only saw £17 million of outflows, more than offset by a £286 million rebound in the first three weeks of April.

And even though ESG funds are still a much smaller part of the overall market than equity funds, for example, Calastone’s FFI gives an indication of how much more popular they are with investors, relative to their size, now attracting much more flows per £100 of assets than mainstream funds. In the year to the end of March, ESG equity funds amassed an additional £5.10 per £100 AUM, for example, compared to just 30p for regular equity funds.

Governance on the agenda

The relative investor appeal of ESG funds versus mainstream funds can also be seen through comparison of buy and sell orders. For almost three years, growth in buys over sells for ESG funds has continually increased – reflecting increasing levels of investor enthusiasm – leaving the wider market behind. This enthusiasm gap has grown ever wider, peaking in January at 72.6, when buys outweighed sells almost 3:1. As net fund flow is both a function of demand and supply, the data reflects the launch of many new ESG fund over the past 18 months, which has generated further demand.

How significant is the continuing appeal of ESG funds as investors try to predict the post- Covid-19 landscape? Almost 80% of our webinar attendees said investors’ focus on all areas of ESG would increase going forward. But if ‘E’ got the ball rolling, perhaps the ‘S’ and especially ‘G’ are ensuring that momentum is maintained, from a fund flow perspective. Undoubtedly, the absence of oil stocks from ESG funds played a part in their popularity, as many sought to insulate themselves from the worsening travails of the energy sector. And although academic studies have long proved that ESG investing delivers at least similar returns to mainstream funds, the Covid-19-related lockdown could demonstrate that firms with the strongest resilient resources and capabilities, the most agile management teams and the most robust governance structures are best able to navigate unpredictable and unprecedented market conditions.

Not only issuers, but asset managers are being scrutinised, explained Josh, the latter now expected to document screening and stewardship practices as investors demand greater transparency. “We are seeing increasing recognition that ESG issues represent material risks which can impact financial returns,” he added. “Large asset owners are coming to terms with the reality that financial interests can be impacted by ESG related risks. The impact of Covid-19 on global financial markets only pushes sustainability, governance and oversight risks further up the agenda.”

A transitional decade?

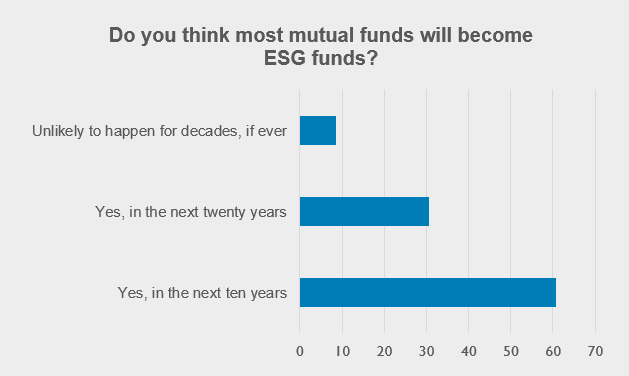

With such powerful forces continuing to propel ESG funds into the limelight, one of the key remaining questions is over the timing. Certainly, our webinar polling indicates that it’s a matter of ‘when’ ESG becomes the new normal not ‘if’. Almost 60% of attendees said most mutual funds will become ESG funds within ten years, while almost a third said the transition would take two decades.

As Josh noted, performance will be the ultimate test. “If ESG funds deliver performance to their investors, at least as good as, or even better than their conventional alternatives, we can expect them to become a major force in fund management.”