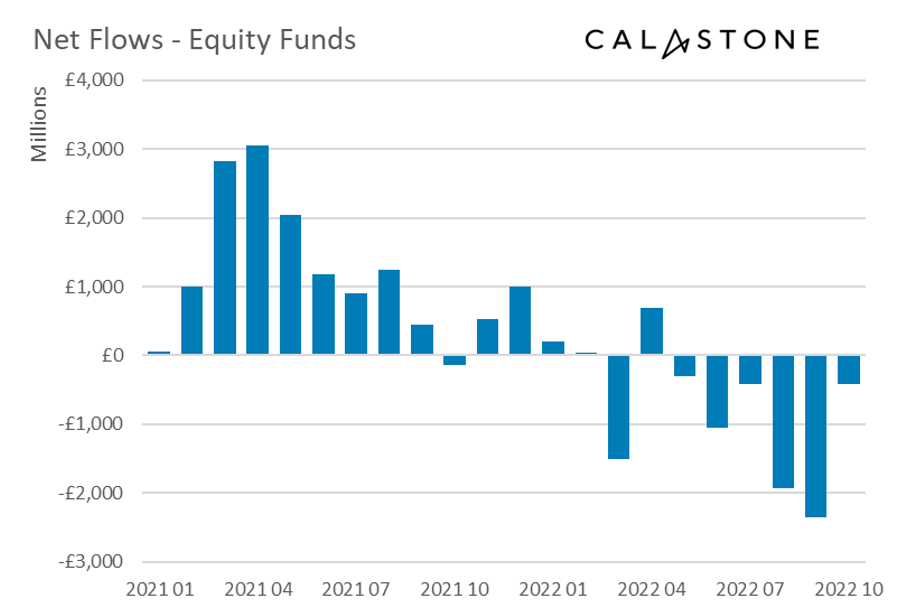

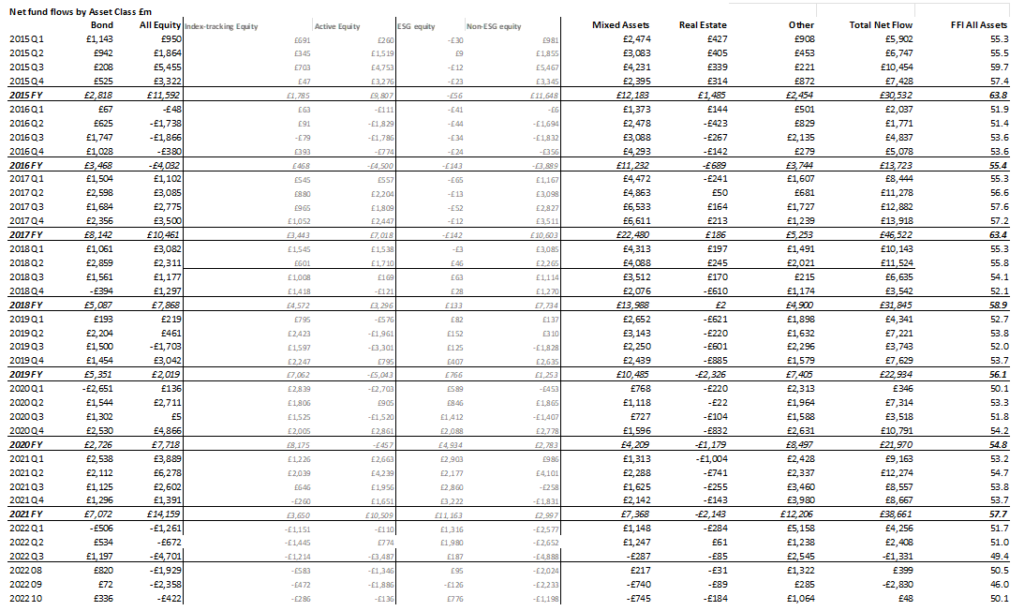

UK investors breathed a nervous sigh of relief in October as world markets stabilised. The latest Fund Flow Index from Calastone, the largest global fund’s network shows that outflows from equity funds slowed dramatically to £422m in October, having hit records in August and September of £1.9bn and £2.3bn respectively. There were significant differences between equity funds focused on particular geographies and categories, however. Overall, October was among Calastone’s top ten worst months for equity fund flows on record.

Global stock markets hit their lowest point of 2022 in the middle of October, having fallen by 27% since the beginning of the year. Since then, they have made up just over a quarter of those losses. Yet the calmer market conditions have only tempered investor pessimism, rather than seen it replaced by renewed confidence.

North American equity funds were hardest hit – investors sold into the market rally

North American funds were the hardest hit in October, suffering a record outflow of £684m, the third consecutive month of progressively larger record selling. Three quarters of the selling took place in the second half of the month as the US stock market was recovering, suggesting investors opted to sell into strength rather than chase prices higher. European equity funds shed £207m.

UK-focused equity funds saw large outflows staunched by Truss resignation

At home, selling of UK-focused equity funds continued for a 17th consecutive month with outflows of £424m. Nevertheless, this was the best month for the category since March, which has shed £6.65bn of capital year-to-date, three times more than European equities, the next worst fund category in any equity sector or wider asset class. Improved global market conditions helped reduce selling activity in UK-focused funds during the month, but it was the swift dispatch of Liz Truss, the ill-fated shortest-serving UK Prime Minister that was the key factor in staunching the outflow of capital. In the tumultuous six days before her resignation, which included the firing of her Chancellor Kwasi Kwarteng, investors sold a net £238m of UK-focused equity funds. In the three days following her departure, which included the installation of Rishi Sunak as prime minister, these outflows briefly turned to modest inflows of £2.5m.

Global ESG funds saw inflows return

Global ESG funds bucked the trend, enjoying their best month of inflows since April totalling a net £776m. Non-ESG global funds suffered outflows. Notably, specialist sector funds attracted new cash for the 24th month in a row in October. £136m flowed into the sector, close to the average monthly total in the last two years. The most popular flavours were green energy and healthcare.

Property funds hit by mini-budget and growth concerns

Meanwhile, the real estate sector suffered its worst month since June 2021, when the delta wave of Covid-19 was peaking. Investors sold a net £184m of their property-fund holdings as the fallout from the mini budget, along with concerns over global growth hit sentiment towards property.

Fixed income funds benefited from falling bond yields.

Elsewhere, falling bond yields encouraged more buying of fixed-income funds. Investors added a net £336m to their holdings in October.

Edward Glyn, head of global markets at Calastone said: “It is much too early to tell whether the current stock-market rally marks the end of the bear market or is just another bear trap. Investors in equity funds clearly think it’s the latter. So while October saw calmer conditions for equity funds, it did not mean an end to outflows. Stock prices are determined by the interplay of profit expectations and market interest rates. For most of this year, equity markets have been hit by rising rates. But now attention is turning to the likely impact of an economic recession on profits. Profit warnings are already on the up and economies are slowing fast, but until inflation shows signs of coming under control central banks are in no mood to return the punchbowl to the party. Investors are judging that this is bad for equities.

The particular hit to US-equity funds may reflect the high-profile crash in some of the US’s largest and most famous tech names, like Meta and Amazon. Meanwhile, trading activity in UK-focused funds has shown that political risk remains uppermost in investors’ minds.”

Methodology

Calastone analysed over a million buy and sell orders every month from January 2015, tracking monies from IFAs, platforms and institutions as they flow into and out of investment funds. Data is collected until the close of business on the last day of each month. A single order is usually the aggregated value of a number of trades from underlying investors passed for example from a platform via Calastone to the fund manager. In reality, therefore, the index is analysing the impact of many millions of investor decisions each month.

More than two thirds of UK fund flows by value pass across the Calastone network each month. All these trades are included in the FFI. To avoid double-counting, however, the team has excluded deals that represent transactions where funds of funds are buying those funds that comprise the portfolio. Totals are scaled up for Calastone’s market share.

A reading of 50 indicates that new money investors put into funds equals the value of redemptions (or sales) from funds. A reading of 100 would mean all activity was buying; a reading of 0 would mean all activity was selling. In other words, £1m of net inflows will score more highly if there is no selling activity, than it would if £1m was merely a small difference between a large amount of buying and a similarly large amount of selling.

Calastone’s main FFI All Assets considers transactions only by UK-based investors, placing orders for funds domiciled in the UK. The majority of this capital is from retail investors. Calastone also measures the flow of funds from UK-based investors to offshore-domiciled funds. Most of these are domiciled in Ireland and Luxembourg. This is overwhelmingly capital from institutions; the larger size of retail transactions in offshore funds suggests the underlying investors are higher net worth individuals.