Investors across Asia weathered the 2022 bear market better than those in other territories, according to the 2022 Global Fund Flow Index by Calastone, the world’s largest global funds network. While the UK and Europe saw fund outflows, Asian investors continued to add to their holdings, but sharply reduced their trading activity. Moreover, AUM in the region fell less than the global average.

While 2022’s global bear market delivered the biggest fall in AUM since the Global Financial Crisis, Asia Pacific saw smaller declines

The bear market delivered the worst year for the global mutual funds industry since the Global Financial Crisis. Assets under management peaked at $70.9 trillion at the end of 2021[1], but had fallen by 21% to $56.2 trillion by the end of September 2022. AUM in Asia Pacific fell by one seventh, with the biggest decline in Japan mainly due to the weak yen.

Fund trading volumes is typically high when markets are volatile, but in Asia buying and selling was markedly quieter in 2022 compared to other global markets which saw higher trading volumes

Globally, trading volumes remained very high in both 2021 and 2022, compared to the pre-pandemic years of quieter markets. On the other hand, in each of fixed income, equities, mixed assets and real estate, volumes were lower in 2022’s highly volatile bear market than 2021 when markets were in their bubble phase. This mainly reflected lower asset values but activity was quieter too. Across those four asset classes, the millions of orders Calastone handled totalled $976 billion in 2022, down from $1.15 trillion in 2021. Trading volumes fell much further in Asia than it did in Europe, Australia and the UK.

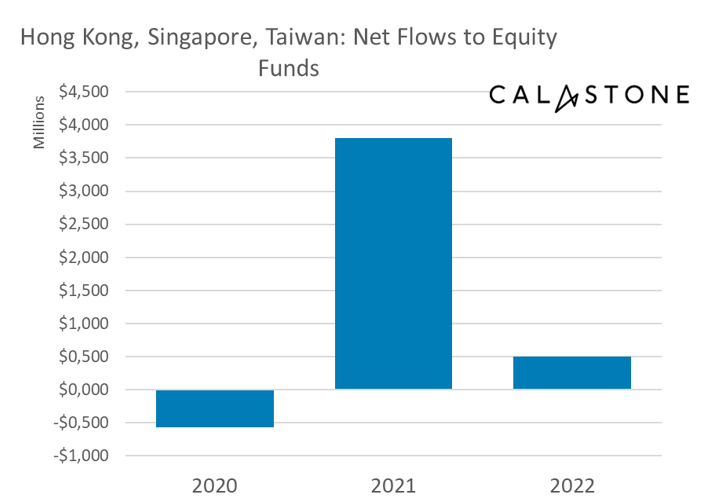

Justin Christopher, Head of Asia at Calastone said: “Asia Pacific’s investors have behaved a little differently to their peers elsewhere. A large weighting in Asian markets that have benefited from rising interest rates, as well as resources companies that have enjoyed high commodity and energy prices, has helped support AUM in the region. Investors in Singapore, Hong Kong and Taiwan clearly shied away from the bear market too, but they chose to wait until calmer times return.

Fund managers and investors alike cheered the rebound in asset values that took place in the last few weeks of 2022, but markets are still volatile. Volatility results from all the uncertainty over how inflation, economic growth, corporate earnings, energy prices, geopolitical turbulence and supply-chain snarl-ups will develop in the months ahead – and these are just the known unknowns.”

Across the world, 2022 was marked by lower buying activity in particular

Globally, nine tenths of the 14% volume reduction in equity funds across Calastone’s international network year-on-year was down to lower buy orders. In other words, the bear market did not drive a rush for the exits, but rather chased buyers away, while provoking a high level of switching between funds. At the global level, this still resulted in net outflows of capital but not because of a big increase in sell orders.

Buying activity fell further than selling activity in all markets but the difference was less marked across Asia where buys fell by 54% and sells 42%. The less extreme fall in buying activity explains why these markets continued to see inflows.

Across the world, equity funds saw significant outflows in 2022, but not in Asia

Investors across our global network added a net $52.8 billion in equity funds in 2021, but the buyers’ strike in 2022 meant there was no appetite to risk more capital in volatile markets. The value of equity fund buy orders on our network fell 23% in the year but were down as much as 40% in September as global bond yields surged higher, spooking investors. By contrast, the value of sell orders dropped just 4.5% over the year so the net result was a significant outflow, to the tune of $13.3 billion, equivalent to one quarter of the cash that had entered the market in 2021.

Investors in Singapore and Hong Kong, however, continued to buy equity funds while inflows were a fraction of the 2021 levels and were focused on regional funds. Taiwanese investors slightly increased their net buying, but inflows remained low.

Investors shied away from China funds

Funds focused on Chinese equities had a tough year in 2022 as the impact of the Covid-19 pandemic was prolonged. China country funds are relatively small in the global context, but they show that investors betted against it throughout 2022. Those in Europe, the UK and Australia all pulled cash out of China funds, while those in China’s neighbouring countries sharply reduced their net purchases during 2022. For the full year, outflows totalled a net $1.8 billion. Sell orders were almost 40% larger by value than buy orders.

Fleeing for the apparent safety of cash, Asian investors pulled out of fixed income

For the full year, fixed income funds shed $6.2 billion as higher interest rates crushed bond prices. Investors in Europe, Hong Kong, Singapore and Taiwan were most negative on fixed income and were responsible for all the outflows, pulling a net $7.3 billion out of bond funds. Those in the UK and Australia cut their purchases significantly year-on-year, down by 66% and 92% respectively, but were still net buyers for the full year.

Looking ahead to 2023, Justin Christopher added, “2023 will present its own new set of challenges as well, but those asset managers who are able to embrace these challenges and leverage technology to find opportunities in the midst of volatility will be well positioned for success.”

“When markets are strong and AUM is riding high, it is easy to lose the sense of urgency for change. Investors overlook the impact of fees on investment performance when they are making big gains on their funds. When markets are weak, fees take a more painful bite, so the need to strip needless cost out of the process is much more acute – and benefits both fund managers and their customers. Cost reduction is the purest form of alpha – this is an easy win for asset management firms and can be achieved through the power of automation.”

[1] Source: ICI