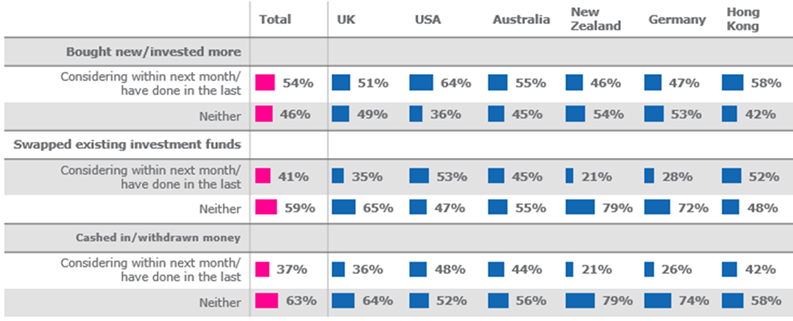

Over half of global investors have a positive view of the market, and are planning to invest in the near future, despite the economic downturn caused by the COVID pandemic. This follows a survey conducted by Calastone – the largest global funds network – where investors were asked about their likelihood to invest in the markets since COVID and a clear majority remain undeterred despite recent events. Calastone surveyed investors worldwide to assess current investment behaviours and appetite in the context of the current COVID pandemic, and future sentiment as the situation evolves. This can be seen in greater detail in Figure 1, below.

Figure 1: Investment action since COVID-19 (Calastone and DJS Research)

In the UK, 51% of investors are bullish, having made new investments already, or considering doing so in the near future. The study has also revealed that nearly one third (31%) of investors in the UK were in fact actively making new investments in light of COVID, looking to capitalise on the continued market volatility (see Figure 2).

Investor fund flow data from Calastone’s June Fund Flow Index (FFI), had revealed the trend of investors buying into the market on the cheap (when markets were subdued in April and early May), and quickly cashing in their profits as the global stock markets rallied. Investors bought into the equity markets at a net £3.9bn between April and the first week of May, and in June investors then sold a net £1.2bn, banking profits they have made on the market rebound.

The data in this survey launched today shows investors in the UK and around the world adopting a similar mindset, looking to capitalise on the continued market volatility to buy in on the dip and sell-off as sentiment picks up again.

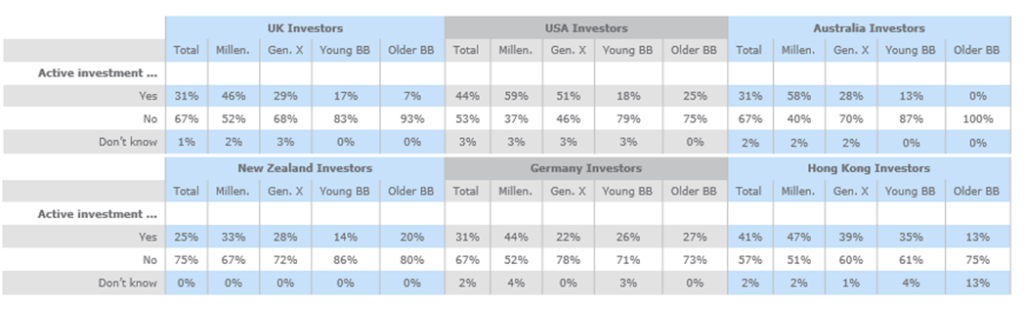

Especially interesting is the clear correlation between risk-appetite and the age of investors, with much of the investor appetite coming from millennial investors. While a relatively large 46% of millennials in the UK have actively made new investments in light of COVID, only between 7% and 17% of the older generation have done so.

The trend is even more marked in other countries, most notably in the US where a massive 59% have already actively made new investments in light of the pandemic. In Australia the appetite to invest appears strong also, where almost the same proportion (58%) had already actively made new investments. In Hong Kong younger investors share in this view, with almost half (47%) having already made investments in light of COVID. The full data from each region can be seen in Figure 1, below.

Figure 2: Investing in light of COVID – Generational Overview – UK Investors by age (Calastone and DJS Research)

Andrew Tomlinson, Calastone’s Chief Marketing Officer, comments on the data;

“It’s encouraging to see renewed optimism in the markets, and the charge being led by younger, next generation investors. Record low to negative interest rates have been compounded by the ongoing market volatility caused by COVID, making it an increasingly difficult environment for savers. Our research shows that young investors are awake to the need to invest and put their cash to work.

The recent figures from our Fund Flow Index (FFI) has shown investors who bought in early when markets were subdued in the earlier phases of the pandemic, are now reaping the rewards and cashing in on their profits. A signal younger investors are taking with great energy and risk appetite to grow their financial future in the near term.”

Calastone surveyed 1,800 respondents, encompassing a sample size of 300 each for six key geographies – spanning the UK, USA, Germany, Hong Kong, Australia and New Zealand. Included within each region surveyed, more than half the respondents were proactive investors, having previously made active investment decisions to buy or sell into the market. The ages of those surveyed ranged across age bands from 24 to 70.