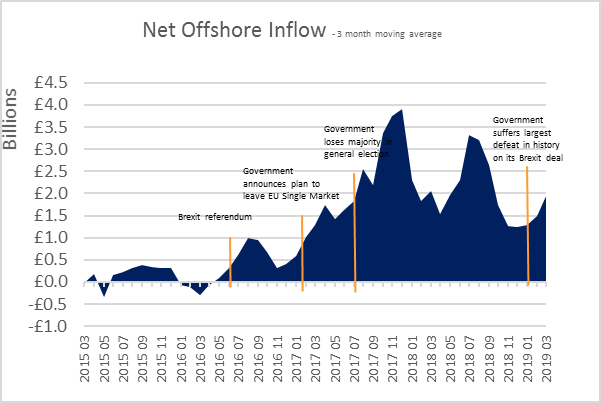

UK investors have moved a net £62bn of their fund investments outside the UK since the Brexit referendum in June 2016, according to the latest Fund Flow Index (FFI) from Calastone, the largest global funds transaction network. In March 2019 alone, as the UK Parliament teetered on the brink of a no-deal Brexit, they placed a net £2.7bn in EU-based funds, almost three times the amount that flowed into UK regulated funds.

Almost all of this £62bn in capital is now invested in funds based inside the European Union. Dublin has been the biggest winner taking two thirds of the total, equivalent to almost £42bn. Luxembourg has taken almost all of the rest, just under £20bn. Other jurisdictions saw negligible inflows.

In the eighteen months ahead of the Brexit referendum, UK investors placed a mere £2.5bn offshore (compared to £62bn since the referendum). In that period, for every £14 invested in UK-domiciled funds, only £1 went offshore, a ratio of 14:1. Since the Brexit vote, that ratio has shrunk to 1.5:1.

In the last six months, more UK investor capital has flowed into offshore funds than it has into UK-domiciled ones, £9.5bn compared to £7.5bn.

Flows offshore have been across all asset types, reinforcing the notion that it is the choice of jurisdiction inside the EU and outside the UK that is the key determinant, rather than simply to do with the investment propositions available.

Figure 1: Net flows of UK capital to offshore funds

Edward Glyn, Calastone’s Head of Global Markets, comments: “Dublin and Luxembourg have been the real winners from the UK’s decision to quit the EU. Before the Brexit referendum, there was relatively busy two-way trade in offshore funds, but the net amount that flowed offshore was extremely small. Since June 2016, the picture has changed completely as a wall of UK investor money has fled from the UK to Dublin and Luxembourg, where it will remain inside the EU’s regulatory jurisdiction once the UK leaves the union. Big political events have clearly influenced investors: flows offshore have risen markedly at key moments of instability connected to the Brexit story. Institutional and high-net-worth individuals are mainly responsible for the trend; smaller retail savers remain focused on UK-domiciled funds, suggesting that more sophisticated investors have the greatest concern about the consequences of Brexit.”

Edward Glyn, Calastone’s Head of Global Markets, comments: “Dublin and Luxembourg have been the real winners from the UK’s decision to quit the EU. Before the Brexit referendum, there was relatively busy two-way trade in offshore funds, but the net amount that flowed offshore was extremely small. Since June 2016, the picture has changed completely as a wall of UK investor money has fled from the UK to Dublin and Luxembourg, where it will remain inside the EU’s regulatory jurisdiction once the UK leaves the union. Big political events have clearly influenced investors: flows offshore have risen markedly at key moments of instability connected to the Brexit story. Institutional and high-net-worth individuals are mainly responsible for the trend; smaller retail savers remain focused on UK-domiciled funds, suggesting that more sophisticated investors have the greatest concern about the consequences of Brexit.”