After four years of uncertainty and acrimony, the UK and EU finally clinched a post-Brexit trade deal at the tail end of 2020, leading to a resurgence in UK equity markets. However, the agreement excluded financial services, which could have serious ramifications on cross-border fund distribution.

Deal puts momentum behind UK funds

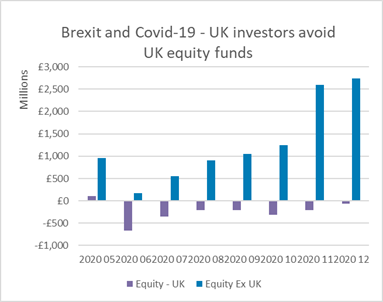

2020 was a difficult year for funds focused on UK equities with outflows totalling £2 billion between June and December as a result of the ongoing COVID-19 crisis, the cancellation of dividends and mounting fears about a no-deal Brexit. However, the announcement of a deal on December 24 – together with the roll-out of a vaccine – led to a sharp rally across UK equity funds. Our Fund Flow Index (FFI) showed outflows in December 2020 were at their lowest levels in months, while inflows into UK equity funds turned positive in the last 5 trading days of the year to the tune of £148 million.

As the global vaccination push accelerates, it is likely that the economies of the UK and EU will recover later this year and into 2022. According to Deloitte, the UK’s GDP is expected to grow by 4.4.% in 2021, whereas S&P anticipates the eurozone’s GDP will rise by 4.8%.

Financial services in limbo

The post-Brexit trade deal – while welcome – does not include financial services. Conscious of this, a number of UK policymakers have since urged the EU to grant regulatory equivalence to the UK’s financial services sector in what would enable its domestic banks, asset managers and insurance companies to freely access EU markets. At present, the EU is unlikely to acquiesce on equivalence as the bloc is purportedly concerned about the risk of UK divergence on financial services regulations.

There are already stark indications that some of the financial services activities historically performed in the UK are starting to migrate into the EU. For instance, reports said €6 billion of EU share trading shifted from the UK to EU markets on the first trading day of 2021. Further cementing the growing UK-EU chasm, the European Securities and Markets Authority (ESMA) withdrew the registrations of six UK-based credit rating agencies and four UK trade repositories at the beginning of January. It is expected that uncertainty will prevail across the UK financial services industry in the near future, or at least until some sort of agreement with the EU is reached.

Fund Distribution: One way traffic

At the point of Brexit, UK mutual funds subject to the UCITS directive will no longer be able to rely on the pan-EU marketing and distribution passport when targeting retail investors across member states. Instead, UK managers will need to abide by the local regulations in the markets where they are distributing their funds. A number of large UK asset managers are likely to have parallel EU operations in place, in which case disruption to their distribution activities will be minimal. The same, however, may not be true for some of the smaller UK investment firms, who are less likely to have physical EU branches. As a result, SME managers could struggle to distribute their funds into the EU post-Brexit.

The UK’s FCA (Financial Conduct Authority) has been charitable, introducing a Temporary Marketing Permissions Regime (TMPR), which will enable EU UCITS and AIFMs to continue distributing into the UK with only limited disruption. The TMPR is expected to remain in place until 2025, by which time it is hoped there will be a reciprocal agreement covering funds distributed between the UK and EU. The FCA’s roll-out of the TMPR comes despite the EU not yet awarding equivalence to the UK funds industry.

Conclusion

The post-Brexit trade deal is a relief for many, evidenced by the significant inflows into UK equity funds at the end of December. However, the omission of financial services from the final agreement is poised to cause a number of longer-term challenges, not least for the UK funds industry. Right now, managers in both the UK and EU are trying to figure out how the new arrangements will impact their existing client relationships, in addition to their future distribution plans, but I expect us to see some further clarity in the coming months.