Introduction

Next year will mark the centenary of the first mutual fund. Investors have been using the investment vehicle since the 1920s, but it only really became an industry mainstay from the 1960s onwards before it truly exploded in the 1990s – at least in the US and Europe.

Asia, broadly speaking, took longer to warm to mutual funds and the boom at the turn of the century largely passed Asian investors by.

Today, however, the region’s fund industry is booming, driven not just by Singapore and Hong Kong but by emerging players in China, Japan, Korea, Thailand, Malaysia and more. As a result, the Asia Pacific (APAC) asset and wealth management industry is forecast to reach US$30 trillion in assets under management by 2025, according to PWC China.

But as the world of fund management enters a new era, the region’s relatively slow uptake of mutual funds may be working to its benefit. Unencumbered by legacy systems and boosted by lower labour costs and innovative regulation, Asian asset managers are able to take advantage of industry-defining new technologies like tokenisation.

Tokenisation, the process of converting rights to an asset, or pool of assets, into a digital token, which can be held and traded on a distributed ledger (i.e. a blockchain), enables assets to be divided, bought, and sold much more easily, and it adds a layer of security and transparency due to the nature of distributed ledger technology (DLT). It also allows for instant settlement, increased and possibility of customised choice along with a more granular portfolio visibility for investors. Importantly it will also significantly reduce costs, further supporting asset managers in their mission to deliver alpha to the end investor.

In partnership with Global Custodian, we set out to determine the commitment of asset managers and service providers in Asia to incorporating tokenisation into their customer offerings in comparison to their European and North American counterparts.

1. Asia overwhelmingly convinced tokenisation is the future

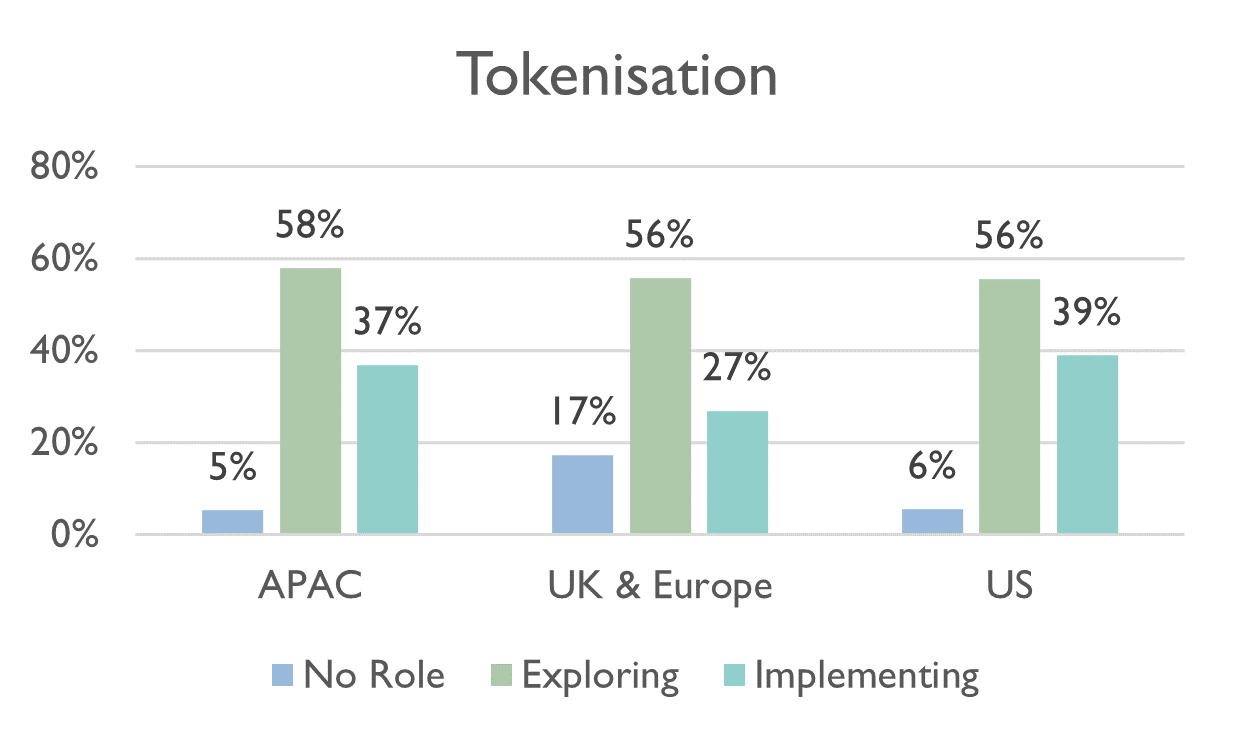

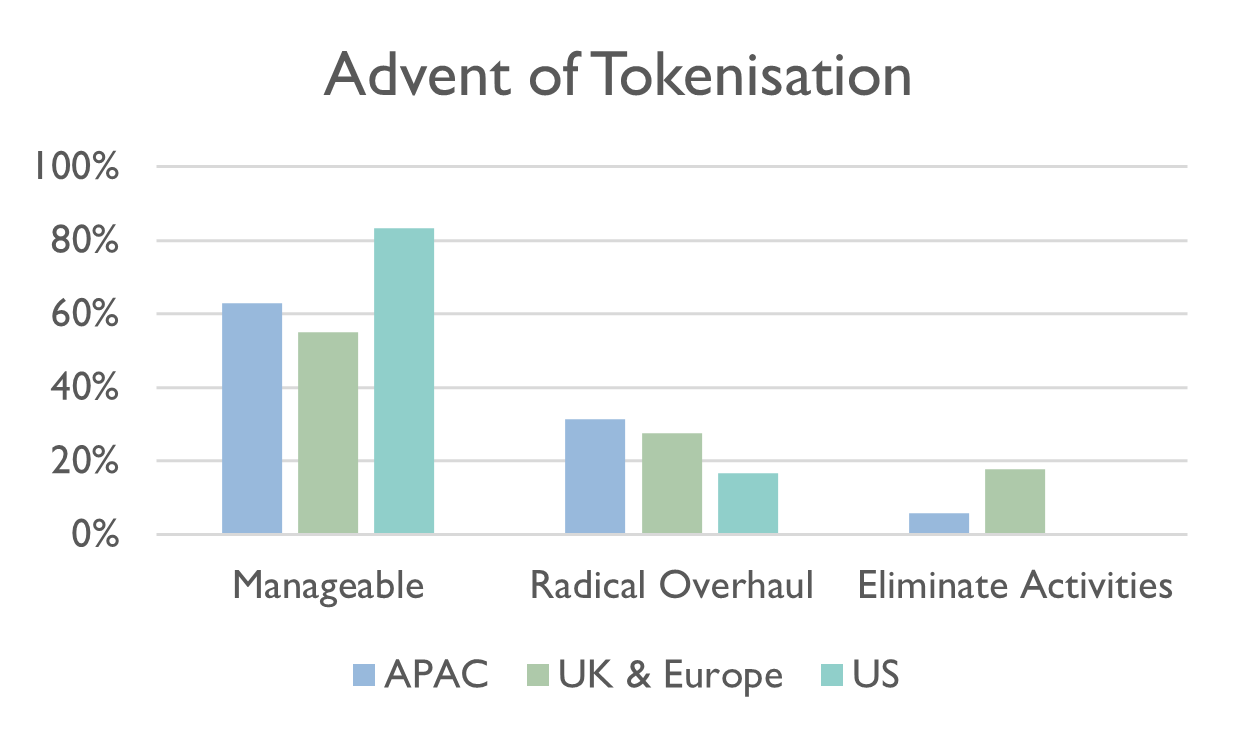

Respondents were asked about their current attitudes to tokenisation and its likely impact on their own day-to-day activities. While over half of the respondents across all surveyed regions are exploring how their businesses can implement tokenisation, what’s noticeable is the reticence towards the technology from UK and European respondents in comparison to their Asian and North American counterparts. However, exploration of the technology is similar the world over, with almost 60% of all asset managers exploring its use. But once it comes to implementation, Asian and US asset managers soar ahead. Only 27% of European respondents have begun implementing a tokenisation project, whereas 37% of Asian and 39% of North American respondents are already in the process.

The similar responses from these two regions highlights just how much ground Asia’s fund industry has made up on North America’s, and the US in particular, and the impact the legislative efforts of the region’s governments are having, with Singapore’s Project Guardian the driving force. The initiative from the Monetary Authority of Singapore (MAS) seeks to test the feasibility of applications in asset tokenisation and decentralised finance (DeFi). It recently announced Calastones collaboration with Schroders Singapore to explore the capabilities of a tokenised investment vehicle, which presents the opportunity to transform the value chain and create better value for investors by reducing costs, laying the foundation for more flexible investment products that are more aligned to the digital experiences consumers find in other industries.

Elsewhere, rival financial centre Hong Kong has been pursuing tokenisation trials through its Fintech 2025 programme, Malaysia’s central bank has set out its own Financial Sector Blueprint charting a path to a digitised financial sector by 2026, and Thailand has launched a national digital ID platform to enable secure and seamless digital transactions.

2. Cost savings and customisation via tokenisation the aim for Asian funds

Tokenisation can offer funds and service managers numerous cost savings, from decreased risk exposure via instantaneous trades to automated compliance and security. Therefore, it’s no surprise that respondents in all regions saw that as the technology’s primary benefit.

When it came to their additional choices, however, 25% of respondents in Asia saw the ability to develop more customised investment solutions as a key advantage of tokenisation, higher than any other region, notably to better serve ultra-high-net-worth (UHNW) clients. By providing access to new asset classes and the ability to purchase fractionalised assets, tokenisation enables asset managers to tailor portfolios to the specific needs of individual investors. Tokenisation also makes customisation cheaper due to the lower operational costs behind it. With younger investors used to digital and personalised financial services, many Asian asset managers have rightly concluded that offering this new generation the ability to customise their portfolios is a smart way to secure their business.

3. Asian funds very optimistic on tokenisation timeframes

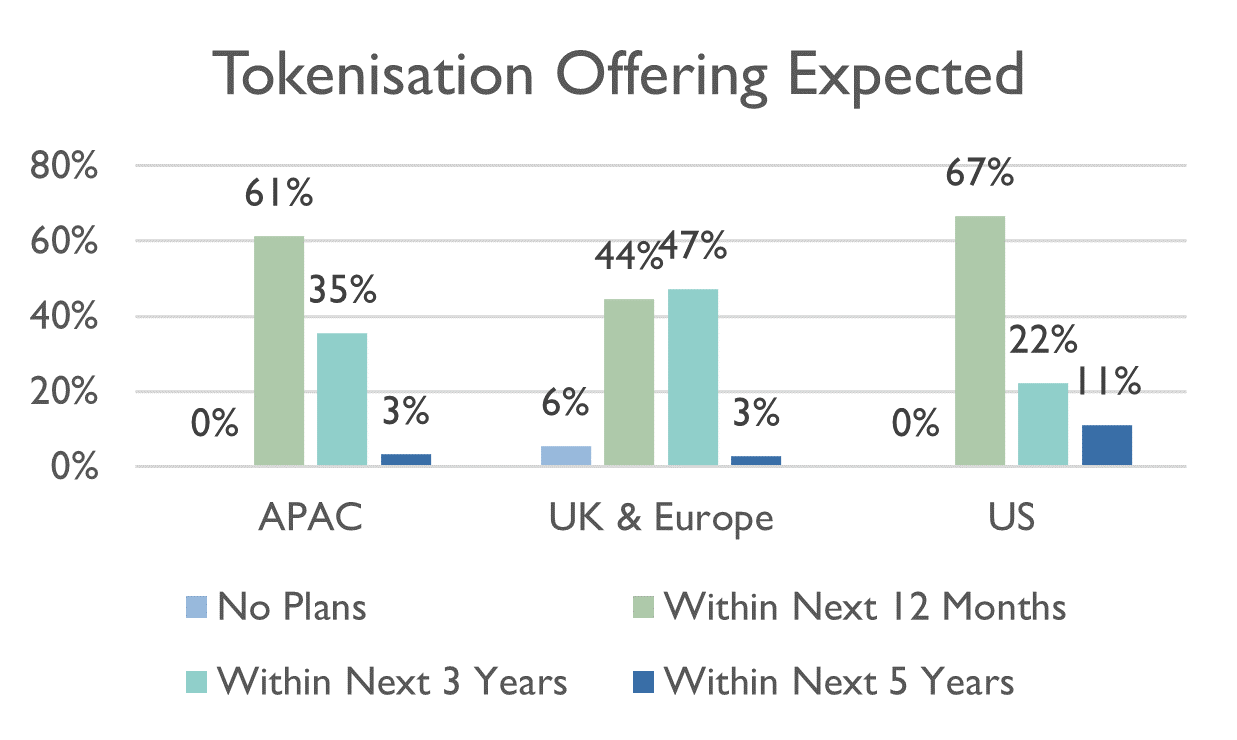

86% of Asia respondents expect to offer tokenised funds as part of their product range in less than three years. This optimism reflects the innovation environment regulatory bodies like the MAS have fostered and the relative lack of legacy infrastructure issues that plague more mature markets. As such, over 60% of Asia respondents feel confident they could implement tokenisation with their existing technology and expertise.

Launching a tokenised product, however, doesn’t just rest upon having the right tech in place. It means reconfiguring infrastructure, adapting to regulatory changes, shifting mindsets, managing and accessing the right distribution channels and addressing scalability. Progress is being made quickly in all these areas and for those asset managers that have thought about their investors’ needs and assessed the challenges correctly there’s every likelihood of a successful launch within the year.

Timelines will also depend on the type of tokenised vehicles being launched. Afterall, not all tokenisation projects are created equal. Some simply tokenise existing funds, which while quicker to implement, offers limited benefits.

4. Regulation and connectivity vital for tokenisation to take hold

The most frequently cited hurdle in the survey was lack of a central bank digital currency (CBDC), rated by over 80% as the first or second most prominent obstacle. Again, Asia – and Singapore in particular – is leading the way on that front and has recently published a whitepaper exploring what conditions would be required to launch a CBDC.

The second concern was regulatory uncertainty, which, as we’ve pointed out, are concerns Asian regulators are working hard to relieve. In doing so, they are providing their global colleagues with a standard to follow. The EU’s Markets in Crypto Assets Regulation (MiCA) has established a pilot regime creating a framework to support the trading and settlement of digital securities, while individual European regulators are also starting to regulate digital assets including tokens.

For tokenisation to truly take hold, regulatory engagement with digital assets and DLT is critical. Fortunately, the current landscape suggests that regulators appreciate the significant role that digital assets will play in the investment industry, but also that gaps are emerging between markets where regulators are leading and where they have started to lag. For asset and service managers in Asia, this presents a huge opportunity to steal a march on their colleagues in Europe and the US.

However, one of the biggest challenges for funds is not necessarily implementing the technology but getting the most out of it. One of the potential vulnerabilities of a tokenised product is that asset managers, after creating tokens, have no place to sell them other than public blockchains which, being anonymous, present numerous anti-money laundering (AML) and Know Your Customer (KYC) challenges.

Our approach combines the ability to create tokenised investment vehicles with the network to distribute them alongside traditional funds, with providers joined together on one common platform. The unwieldy procurement process that currently underpins the buying and selling of such services would ultimately become redundant, and the gradual process of product development could be radically accelerated. Investment providers will no longer be limited to a set menu of products, but will be able to build bespoke collections of assets that, in tokenised form, become more accessible and portable.

More than an experimental new product, this is a model that enables asset managers to move into the new world of tokenisation, via the stepping stone of a platform they are already using. Calastone’s work in Singapore is already making this a reality. Now, managers across Asia can experiment with and adopt new approaches at a pace of their own choosing, while laying the foundations for the radical potential of token-based investing.

Methodology

For this survey we spoke to around 150 institutional respondents from across the globe, representing the full range of investable asset classes, including equities, fixed income, alternatives and private assets. Asset managers made up around 80% of the respondents, with fund administrators, custodians and management companies making up the rest.