UK investors continued their stampede into equity funds in March, according to the latest Fund Flow Index (FFI) from Calastone, the largest global funds network. They added a net £2.30bn to their holdings and ensured Q1 2024 was a record for equity-fund inflows, totalling £6.97bn since January.

Inflows were very concentrated – a feature Calastone’s data has revealed every month since November 2023 when investor sentiment first turned positive again.

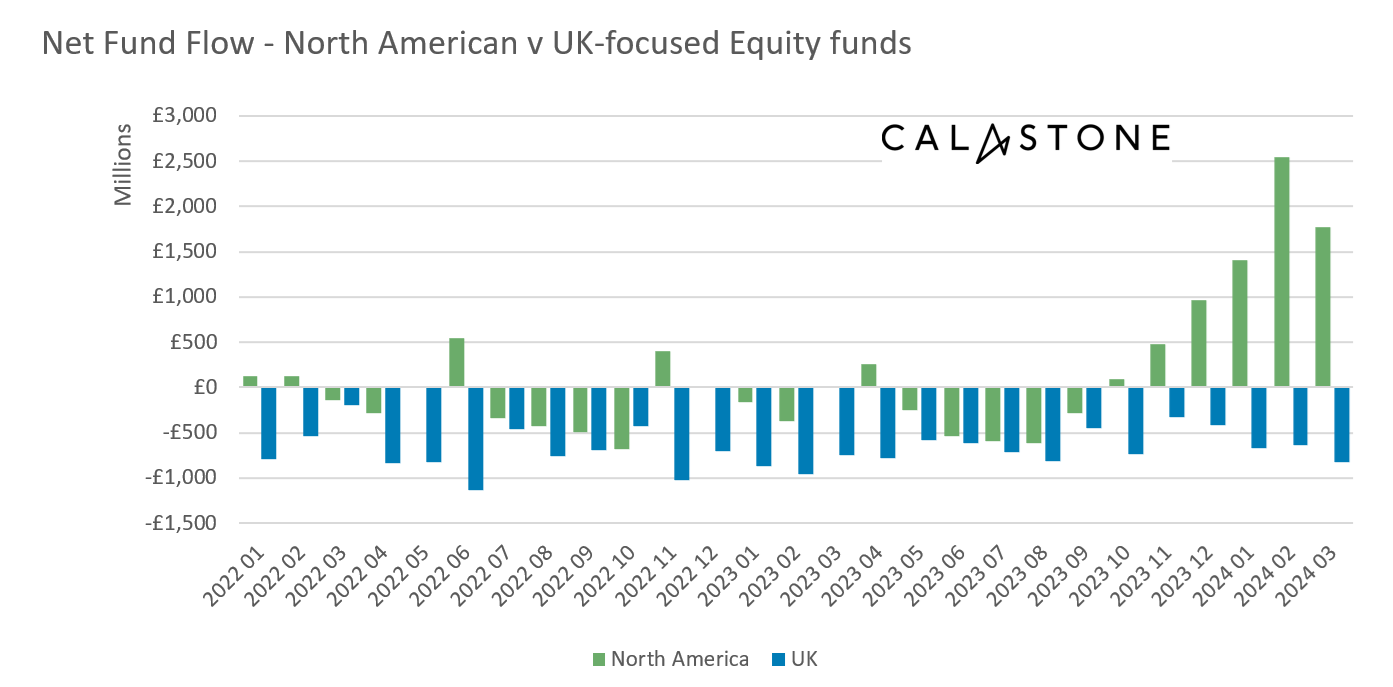

North American funds absorbed a record £5.72bn of UK investor capital in Q1, more than three times the previous best quarter

North American funds were by far the biggest beneficiary, attracting £1.77bn of new capital, taking the Q1 total to a record £5.72bn, more than three times the previous best quarter in Q4 2020 (£1.76bn).

More UK investor cash flowed into North American equity funds between December and March than in the previous nine years combined

In the four months since December 2023, UK investors have added more cash to North American equity funds than they have in the previous nine years combined (£6.69bn v £6.38bn).

Global equity funds and emerging markets also enjoyed strong inflows; inflows to European funds slowed sharply

Global equity funds were the next most popular in both March and the first quarter, with inflows of £1.22bn and £3.30bn for each respective period – no records were broken, but Q1 was nevertheless one of the four strongest for the sector in the nine-year history of Calastone’s data.

Emerging market equity funds came third in March, with inflows of £362m. It was not a record quarter for emerging markets but the £700m inflow in Q1 was almost three times the historic quarterly average, indicating strong demand for emerging market equities. Individual country funds are a small category, but Calastone noted inflows to funds focused on India, Japan and South Korea and outflows from those investing in China. Inflows to sector funds were dominated by healthcare.

Europe ex UK has had a strong run of inflows in recent months, but these dried up in March, dwindling more than 90% compared to the three-month average to just £37m.

UK equity funds saw outflows jump to their highest since February 2023 – now 34 consecutive months of net selling

Only Asia-Pacific and UK equity funds saw outflows among geographical sectors, but the UK really stood out. Outflows surged to £823m, their worst month since February 2023 (-£962m) making March the 34th consecutive month to see net selling. Q1 outflows of £2.13bn made for the fourth worst quarter for UK equity funds on Calastone’s record. Income funds, which are heavily weighted to the UK, also saw outflows continue.

ESG equity funds enjoyed continued inflows though at a far slower pace (£691m) than in the previous two months. March inflows to non-ESG equity funds were significantly larger (£1.61bn).

Edward Glyn, head of global markets at Calastone said: “Global equity markets have surged since the end of October. Japan, the US and Europe have led the charge, all up by more than a quarter and leaving the UK in the dust – the UK’s top 100 has eked out just 8.6% over the same period.. UK equities are certainly cheap, but investors worry where the growth is going to come from to drive earnings higher. Add a relentless narrative of gloom about the prospects for the London stock market and it’s hard to persuade anyone to hold UK-focused funds. Meanwhile the US earnings recession is over – profits are once again on the up and that seems to be the main catalyst driving fund inflows and higher share prices.”

Among other asset classes, fixed income fund inflows accelerated to their best level since June 2023. Investors added a net £460m to their holdings. Mixed asset funds and the property sector saw outflows continue.

Edward Glyn added: “Bond markets have had a rough start to 2024 as hopes for rate cuts were pushed further out into the future. Yields have risen to levels last seen in November (which pushes prices lower) and are proving increasingly attractive to investors keen to lock into relatively high levels of income and who believe there is the prospect of capital gains to come when rates fall.”