Millennial New Zealanders are looking to capitalise on COVID-19 related volatility, with 67% having invested or considering investing since the spread of the virus, according to research conducted by Calastone, the largest global funds network.

This finding is consistent with global trends, with the study finding that 72% of all millennials (aged 24-39) have invested or are considering doing so as the pandemic evolves, proving to be far more proactive and undeterred by COVID than their older peers.

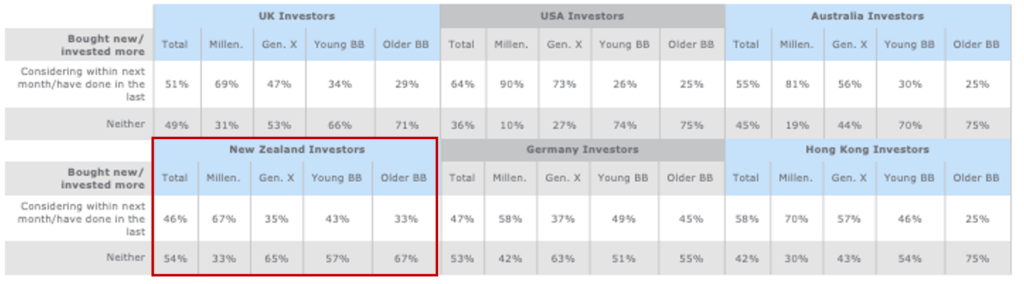

The research, which surveyed people in New Zealand, Australia, Hong Kong, UK, U.S. and Germany, found that 46% of New Zealand investors remain bullish, having already made new investments or considering investing in the near future (see Figure 1).

A more bearish signal from the survey was the one in four New Zealanders who have actively invested as a direct consequence of COVID (see Figure 2), relative to the 35% global average. Further, while millennials are the most proactive investor demographic in New Zealand, they are relatively less so than millennials in other markets.

Figure 1: Investment action since COVID-19 (Calastone and DJS research), where investors have made new investments already or are considering doing so in the near future.

In fact, millennials in New Zealand trailed Germany as the least bullish millennial group, with 67% either having invested since COVID or considering to do so (Figure 1).

While New Zealand millennials were less active relative to millennials offshore, they were almost twice as likely to have invested or be considering to invest than local Gen Xers (aged 40-55), showing the largest lead between the two demographics. (Figure 1).

Conversely, one in five older New Zealand baby boomers (aged 66-70) actively invested in light of COVID, well above the 15% global average and starkly different to Australia, where all Australian boomers refrained from actively investing (Figure 2).

Figure 2: Investing in light of COVID-19 (Calastone and DJS research), showing investor likelihood of investing due to COVID, plus active investment as direct consequence of COVID

Ross Fox, Managing Director, Head of Australia and New Zealand at Calastone, commented on the findings: “Millennials in New Zealand have shown resilience and a future focus by actively seeking to benefit from investment conditions despite the economic hardship caused by COVID.

“Persisting high levels of unemployment, housing affordability pressures and a low growth economic outlook are reasons for why New Zealanders are more bearish relative to other markets, particularly among younger groups. Conversely, the relative pro-action demonstrated by older baby boomers likely reflects their independent approach to saving and investing for retirement ahead of national schemes such as KiwiSaver which came into operation in 2007.

Methodology

Calastone surveyed 1,800 respondents, encompassing a sample size of 300 each for six key geographies – spanning the UK, USA, Germany, Hong Kong, Australia and New Zealand. Included within each region surveyed, more than half the respondents were proactive investors, having previously made active investment decisions to buy or sell into the market. The ages of those surveyed ranged across age bands from 24 to 70. Millennials are defined as anyone aged 24-39, Generation X are 40-55, Younger Baby Boomers are 56-65 and Older Baby Boomers are 66-70.

Please refer to the release linked here for global survey results.