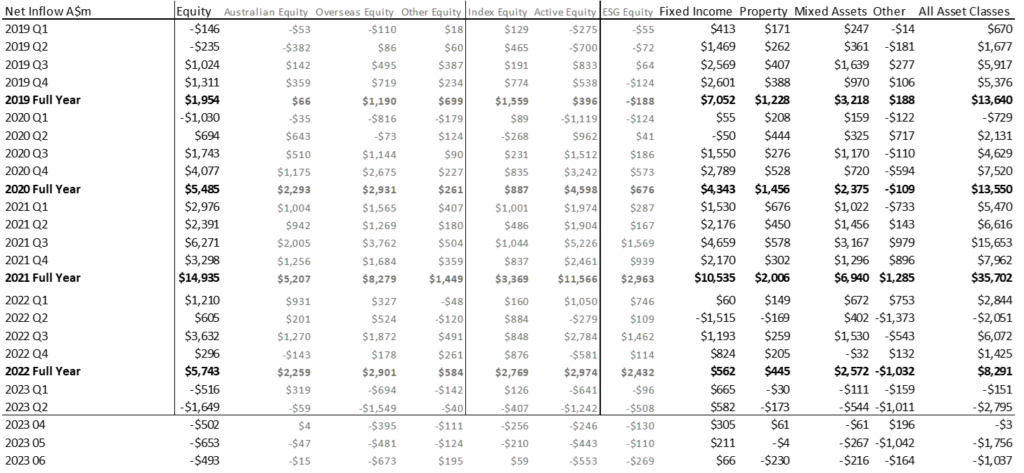

Australian investors fled managed equity funds for the perceived safety of fixed income and cash during the second quarter, according to the latest Fund Flow Index from Calastone, the largest global funds network. Across all fund types, outflows totalled a net A$2.80bn in Q2, the worst quarter for managed funds since Calastone started compiling the numbers almost five years ago. Q2 marked the first time that Calastone has recorded two consecutive quarters of net outflows from managed funds. Riskier assets (equities, property and mixed asset funds) saw outflows, while fixed income funds, offering their best yields in years, saw strong inflows. These trends are similar to what Calastone has seen in other markets across its global network.

Equity funds suffer record outflows, but emerging markets buck the trend

Equity funds saw the largest outflows, totalling A$1.65bn between April and June, easily the worst quarter on Calastone’s record. To illustrate how strong 2023’s anti-equity trend is, all the worst individual months for managed equity funds in Calastone’s data have been since February this year.

Global equity funds bore the brunt of the selling in the second quarter, shedding a net A$1.52bn. Domestically focused Australian equity funds saw a net outflow of just A$59m, however.

Meanwhile ESG equity funds, which cut across geographical categories, shed A$508m. ESG funds have now seen consecutive outflows for five months, having only shed capital in two months out of the previous two years. Emerging market funds bucked the wider trend. Investors tentatively added a net A$4m to the sector.

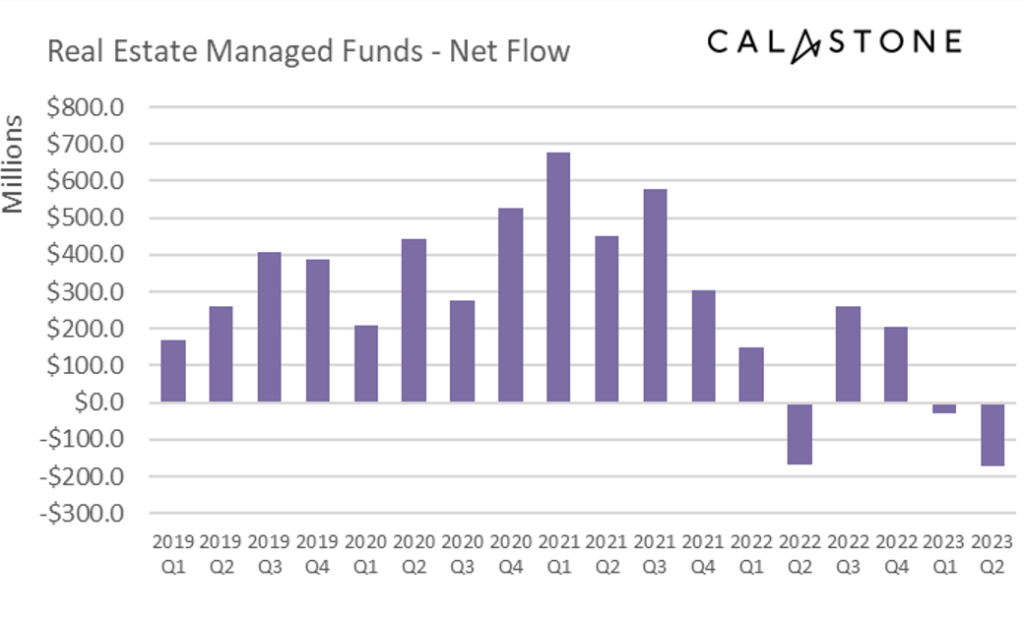

Record outflows for property and mixed asset funds too

Investors were strongly negative on other classes of riskier assets in Q2 too. Mixed asset funds, which tend to be heavily weighted towards equities saw record quarterly outflows of A$544m, while property funds also suffered their worst quarter on record, shedding A$173m.

Teresa Walker, Managing Director of Australia and New Zealand at Calastone said: “Global equity funds have borne the brunt of outflows as investors are losing confidence in the prospects for the global economy. Australia-focused funds have seen remarkably little selling yet this country is not immune to today’s global trends. The RBA has hiked rates aggressively to tamp down inflation and is content to generate Australia’s first recession in a generation (barring the initial Covid-19 shock) if it is necessary to achieve its ends. In the short term, banks, which dominate the ASX, benefit from rising interest margins, but recessions are costly for banks too if non-performing loans increase, so there is no particular reason to favour the Australian market more than those elsewhere at present.

“From time-to-time different regions come into favour. Emerging markets funds are having just such a moment. The actual cash invested in Q2 was admittedly very small, but against a backdrop of such large outflows from other equity funds it is certainly significant. Investors are attracted by relatively low valuations, and the benefits to emerging markets both of a weakening US dollar and of the impending turn in the credit cycle. As part of the emerging market story, China’s economic recovery from zero-Covid may have disappointed everyone so far, but investors are hoping the government will step in with renewed stimulus to spur the economy back to life.”

Investors focus on fixed income funds – high yields and the prospect of capital gains

Meanwhile, fixed income funds which are offering attractive yields at present, saw net inflows of A$582m in the second quarter. This is not a record but stands in stark contrast to trends in riskier assets. June’s shock rate rise from the RBA pushed bond prices down and this slowed the inflows, but with yields now having reset at even more attractive levels this slowing may well prove temporary.

Q2 intensifies a trend of risk aversion that began last year

Q2’s trend extends a shift in investor behaviour that began last spring and has intensified steadily since. This year to date they have added A$1.25bn to their fixed income holdings and withdrawn A$2.16bn from equities, A$655m from mixed assets and A$203m from property funds.

Teresa Walker added: “Fixed income funds have not looked so attractive since before the global financial crisis. At the same time, the recession fears stalking equity and property markets are making investors nervous. The result is a flight to safety. Short-dated fixed income funds currently enable investors to earn an income of 4.4% or more at very low risk. Meanwhile the 10-year Australian bond yield has jumped from 3.1% to 4.0% in three months. Fixed income funds which invest in longer-dated bonds like this now offer the chance to lock into the highest yields in years. They now offer both income today and the prospect of capital gains when the credit cycle turns and market interest rates fall back.

“Inflows to fixed income funds have not been enough to offset the overall departure of capital from managed funds. Cash helps explain why. Cash savings rates are also at their most tempting in years – with some deposit accounts offering as much as 5%. Investors are content to sit on the sidelines and take the interest.

“Finally a word on property which also helps illustrate the theme of risk aversion. The yield gap between most types of commercial property and the short-end of the yield curve has largely disappeared over the last year as central banks have raised interest rates and property prices are falling. That leaves property offering no compensation for additional recession risk.”