Regulation is often cited by funds market participants as a major barrier to progress and profitability, introducing added complexity and costs while impeding innovation. Conversely, others within the industry welcome regulation, as those very same rules can help insulate the market against new competition, such as from the big tech incumbents.

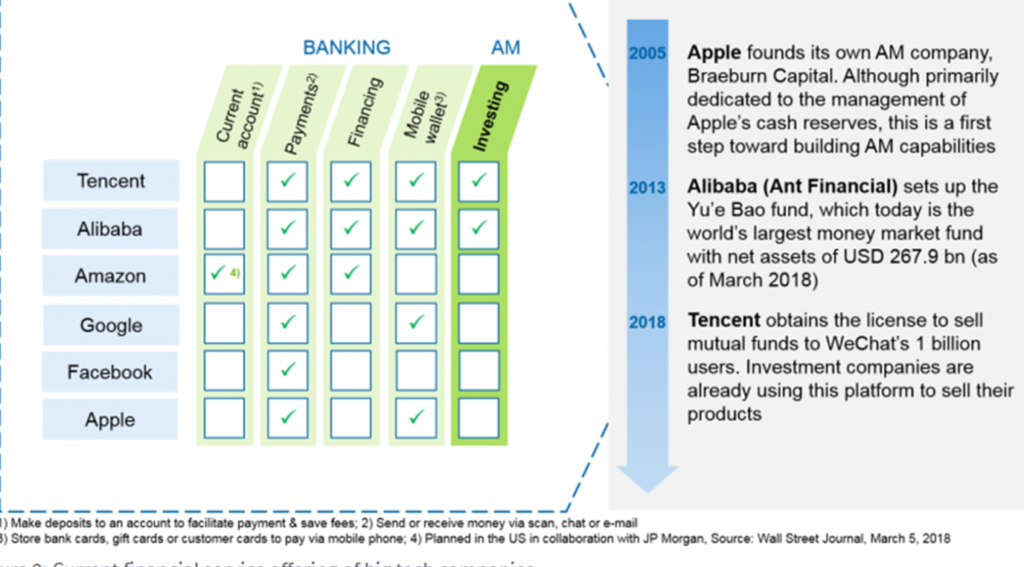

But is the funds industry misguided to presume that regulation will always act as an impenetrable obstacle precluding technology firms from moving in on their territory? While many large global technology companies have not yet fully immersed themselves in the investment management world, they have encroached on other areas of financial services.

Regulation as an innovation enabler

Major technology companies are increasingly diversifying their business models and transforming the financial services industry in the process. A number of technology firms (such as Amazon, Samsung1 , Baidu, WeChat, Google and Facebook) have already launched their own digital wallets and online payment facilities, while some are even beginning to offer financing to small enterprises, although the latter service has not really taken off. Many of these initiatives have been made possible by regulatory design, as new rules such as Open Banking (i.e. the EU’s Payment Services Directive 2 [PSD2], Singapore’s API (application programming interfaces) guidelines) along with various other virtual banking schemes are making it easier for digital entrants to offer financial services more widely.

Through the growing adoption of APIs, open banking has allowed technology companies and start-ups to securely access information on individual bank customers, which in turn enables them to develop their own bespoke products, often in coalition with the banks themselves, thereby increasing competition.

Elsewhere, Hong Kong is opening up its retail banking market to online competition.

Beginning in March 2019, Hong Kong has awarded a handful of virtual banking licenses including some to technology firms such as Ant SME Services; ZhongAn Virtual Finance and WeLab Digital. This comes as the HKMA (Hong Kong Monetary Authority) – the domestic regulator – looks to promote greater financial inclusivity and cement its digital innovation credentials.

As virtual banks do not necessarily need to operate expensive physical branches, they can potentially net cost savings allowing them to offer services (i.e. loans, mortgages) to consumers at a discounted rate relative to the existing, traditional providers. Rather than stifling change, regulators are actively encouraging it, especially if it works in the best interests of the end customers. The initiative is likely to receive a warm reception, especially

as Accenture found client dissatisfaction with banks to be particularly high in Hong Kong with just 53% of consumers saying they liked their bank, a score well below that of the US (88%) and UK (78%). The study said many Hong Kong clients were frustrated with poor customer service, inefficient account opening processes, sub-par online banking capabilities and fee opacity. [1]

The regulator has limits

While regulators are supportive of innovation – evidenced by the number of incubation labs that many of them have openly endorsed – there are limits. Earlier this year, Facebook announced it was working on plans to launch a digital currency – Libra – in conjunction with a number of companies (Uber, Spotify, Farfetch) and payment groups (Visa, Mastercard, Pay Pal), in what would allow users to make real-time, low-cost cross-border payments using their mobile phones. Inevitably, Libra has found itself facing regulatory scrutiny from agencies including the UK’s Financial Conduct Authority (FCA) and the Bank of England, along with supranational bodies such as the G7 and the Financial Stability Board (FSB), alarmed the digital currency could perpetuate systemic risks and money laundering.

Scrutiny is also increasing in the United States, where lawmakers have started to think about introducing legislation to bar large technology groups (defined as online platforms with annual revenues exceeding $25 billion) from functioning as financial institutions or issuing digital currencies.[2]

Simultaneously, the Bank for International Settlements (BIS) has issued a warning about big techs’ entry into financial services. It highlighted that while big tech firms can offer efficiency gains and democratise the provision of financial services, their market power could give rise to a captive ecosystem which inhibits potential competitors from building rival platforms. The BIS report added some big techs may exploit their market power and network externalities to increase user switching costs or exclude competition.[3]

Evolving with the customer

It goes without saying that millennials are at ease with technology, especially when managing their own financial affairs. A Calastone study – “Millennials and Investing: A detailed look at approaches and attitudes across the globe”- found nearly three quarters of young people would happily purchase investment products through big technology companies. That figure is even higher among millennials who already actively invest, suggesting young people hold a very high level of trust in big tech. While Silicon Valley’s technology leaders have yet to expand beyond payments and financing into asset management, their peers in China appear to be ahead of the curve.

In just five years, Ant Financial – an offshoot of internet giant Alibaba – has successfully challenged the existing funds model. By taking an existing brokerage business and leveraging the Alipay payment processing platform, Ant Financial now runs one of the world’s largest money market funds – Yu’E Bao – which currently looks after $168 billion in AuM. Not only has Ant Financial made it simple for people to invest into its own funds, but the company has developed a platform enabling third party managers to target its users. Earlier this year, Invesco won $14 billion worth of investor mandates as a result of its recent partnership with the Alipay platform. This has not gone unnoticed within the industry.

Will Silicon Valley follow in China’s footsteps?

Admittedly, Ant Financial’s mutual funds business sprung up in a market which is less strictly supervised than much of the rest of the world. Despite this, regulations aimed at the asset management industry – be it MiFID II, PRIIPs or UCITS – are not going to deter big technology companies from moving into fund distribution, especially as a few of these organisations have market caps far greater than the market value of some of the world’s biggest stock exchanges. In short, the impact of regulation is not an issue for big tech, although anti-trust fears could well be. With Facebook vying to disrupt the existing payments’ ecosystem, fund distribution is likely to be on the radars of big tech firms too.

[1] Financial Times (February 21, 2019) Hong Kong opens banking market to online competition

[2] Reuters (July 14, 2019) US proposes barring big tech companies from offering financial services, digital currencies

[3] BIS (2019) Big tech in finance: opportunities and risks