Outflows from equity funds accelerated in February as the third bear-market rally since summer 2022’s global market nadir deflated during the month. The Fund Flow Index from Calastone, the largest global funds network saw investors pull £581m from equity funds.

UK funds punished hardest – February saw third-largest outflows on record

Despite shrugging off the trend of sagging asset prices that has hit global markets over the last year, UK equities were by far the least popular sector with their domestic investors. The FTSE 100 reached a record high in February, and it also fell far less than its global peers as market confidence waned through the month, yet UK investors nevertheless pulled £962m from their UK-focused equity fund holdings, making it the third worst month for the sector on record.[1] February was the 21st consecutive month of outflows from UK-focused equity funds.

US and European equity funds also saw strong selling in February, but global funds did better

Sharp falls in the US stock market prompted redemptions of £368m from North American equity funds, more than double the level in January, while European equities suffered their 17th consecutive month of outflows as investors pulled £250m of capital from the sector. A £50m outflow from Asia-Pacific almost exactly reversed January’s modest inflow.

It was not all bad for equity funds. Those with a global mandate garnered £1.08bn in new capital in February, with most of the net buying focused in the early days of the month when markets were still rising. Unusually this inflow was not driven primarily by the popularity of funds with an ESG mandate. These accounted for 43% (£466m) of the inflow, with ‘traditional’ global funds making up the rest (£613m).

Bond market inflows moderated in February as rate fears rose but remained strongly positive

The deterioration of conditions in the bond markets also meant reduced inflows to fixed income compared to January’s near-record net purchases. Despite this reduction, bond funds were nevertheless popular in February, attracting a net £834m of inflows (the third best in two years).

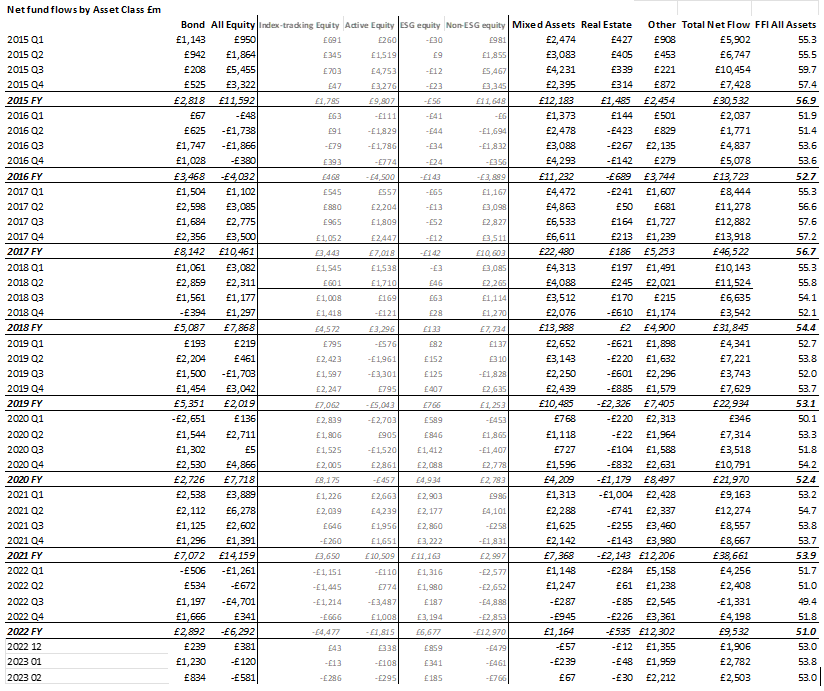

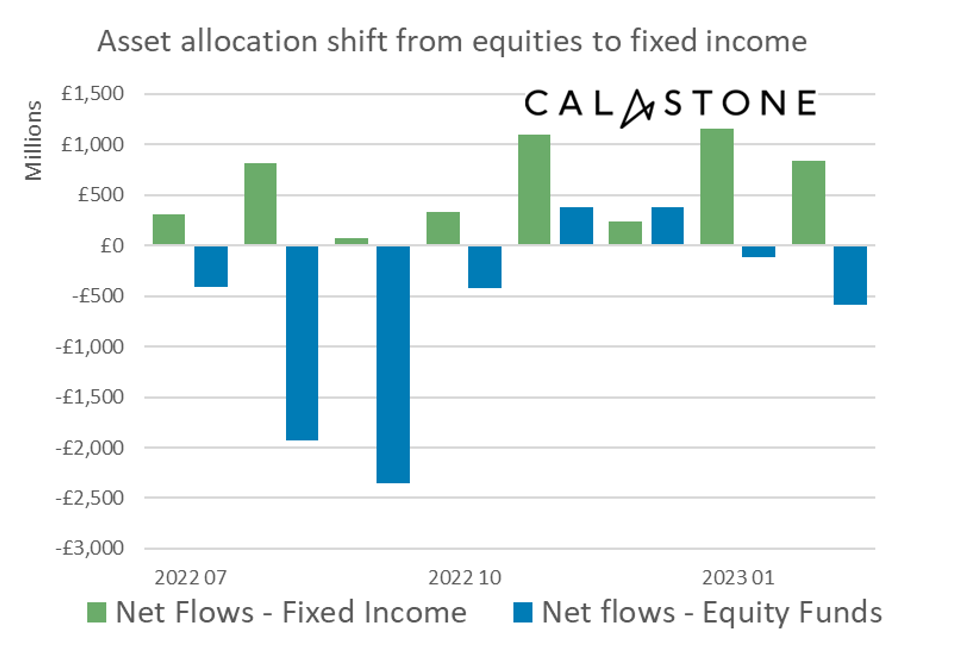

Asset allocation shift from equities to bonds

The higher yield environment is prompting an asset allocation switch from equities to bonds. Since July 2022, investors have added £4.93bn to their fixed income fund holdings while withdrawing £5.06bn from equity funds.

Money markets acting as safe haven in troubled times

Money markets are the safest place to park surplus capital. Government-backed bonds with extremely short maturities are the least volatile asset class and they are currently paying the highest level of interest in more than a decade. In months when investors flee from equities, money market funds typically tend to do better[2]. These funds saw inflows of £315m in February.

Edward Glyn, head of global markets at Calastone said: “Stock markets have sagged on the realisation that the interest-rate medicine prescribed to control inflation will be needed in higher doses and for longer. The UK economy may need more rate hikes too, but its stock market nevertheless has some natural resistance to the valuation compression that higher rates mean for asset prices, owing to its relatively low growth/high cash flow profile. Yet UK investors cannot be persuaded to stick with UK equities, despite their extremely strong relative performance over the last year. It is clear that a structural diversification is under way to reduce the relatively heavy weighting in UK investor portfolios to UK-focused funds. The general air of pessimism over the UK’s economic decline, weak government finances, political chaos and rising corporate taxes seems to have accelerated this trend with consistent outflows from UK funds and inflows to global ones.

“The inflows to fixed income funds are interesting. Like equities, bonds have also endured a bear market over the last year, yet these funds have enjoyed inflows even as equity funds have suffered outflows. There are two factors at play. First, investors are structurally overweight equities. Years of strong market performance not only attracted new cash to equities but also saw existing holdings swell in value – equity funds assumed an ever-larger weighting in investor portfolios as a result. Equity and bond prices have already suffered the value compression that comes with higher interest rates, leaving bonds offering the most attractive yields since before the Global Financial Crisis, as well as the prospect of capital gains if a recession bites and market interest rates fall. Meanwhile, equities are at risk from a second downturn if that same recession bites into profits.

“A combination of enticing interest income and potential capital gains along with fear of losses on equities and the need to restore a healthier asset mix are therefore all working in favour of fixed income at present.”

[1] The worst month was June 2022 -£1.1bn; the second worst was November 2022 -£1.0bn. January 2023’s -£868m now becomes the fourth worst.

[2] Over the last eight years the correlation between net flows to equity funds and money market funds has been -0.25