In the competitive world of exchange-traded funds (ETFs), a prevailing trend of fee reduction has been seen as a strategic move by issuers to attract more investors. However, it is now becoming clear that the decision-making process for institutional investors extends far beyond just the headline fees, touching on deeper aspects of the ETF’s overall value and efficiency.

Despite nearly 940 European ETFs slashing their fees over the last five years, new data from Morningstar reveals that only about 52% of these funds saw an increase in net inflows[1]. This statistic challenges the conventional wisdom that lower fees automatically lead to higher investor interest. It suggests that institutional investors are examining the total cost of ownership (TCO) of ETFs, which encompasses not only the expense ratios but also liquidity costs, tracking error, and the efficiency of the investment process.

ETFs begin to dominate

As the ETF market matures, it is witnessing a surge in both the volume and variety of products available. With assets under management (AUM) globally exceeding $11 trillion, and projections from PwC indicating a potential rise to $19 trillion by 2028[2], the complexity and diversity of the ETF landscape are more pronounced than ever. This growth demands that ETF providers not only compete on fees but also consider the broader implications of their service offerings, technological prowess, and operational efficiency.

The operational and technological infrastructure supporting ETFs is critical to their market performance and investor appeal. Efficient and reliable asset servicing mechanisms are paramount, especially in the face of increasingly complex ETF structures, such as actively managed, semi-transparent, thematic, and even cryptocurrency-focused ETFs. These products require sophisticated creation and redemption processes, accurate tracking, and robust liquidity management.

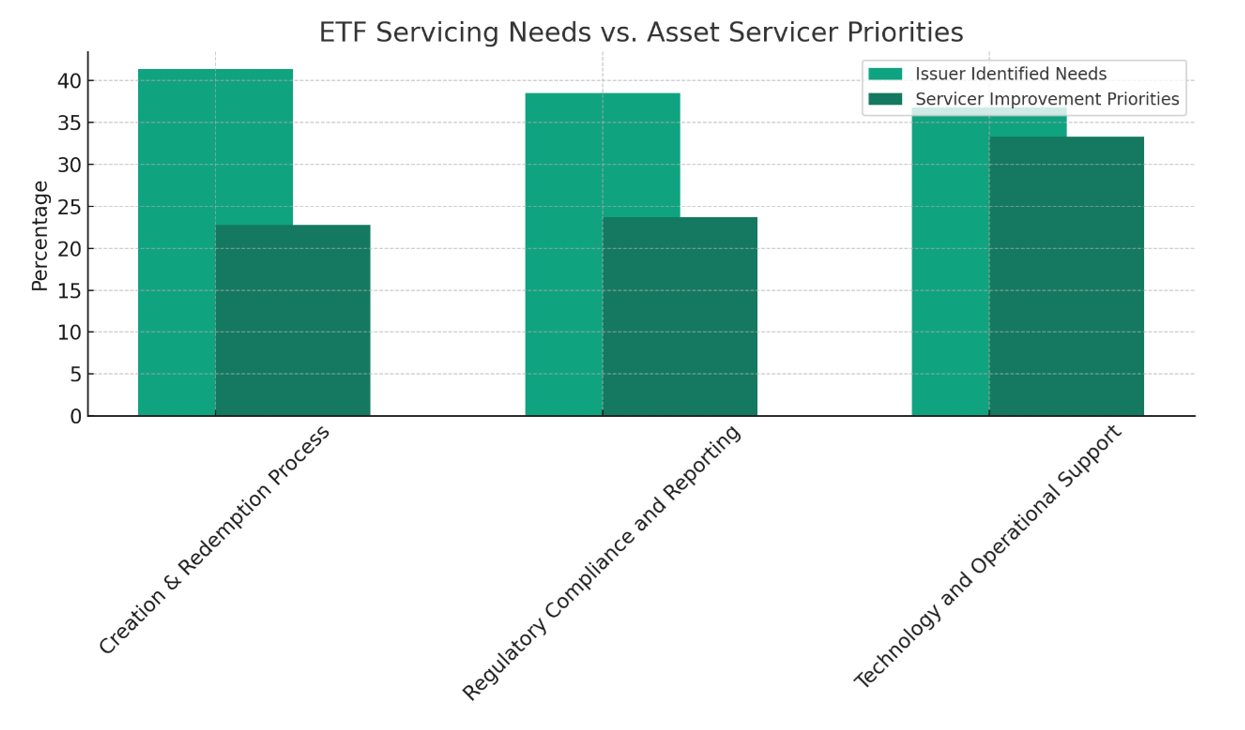

Calastone research[3] has identified a significant gap between the priorities of ETF issuers and the service enhancements offered by asset servicers. For instance, while 41.4% of issuers stress the importance of improving the creation and redemption process, only 22.8% of asset servicers align with this as a top priority. This discrepancy underscores a potential misalignment in the industry’s efforts to evolve in tandem with the market’s demands.

Moreover, the regulatory landscape is also shifting, with initiatives like the EU’s Central Securities Depositories Regulation (CSDR) and the transition to shorter settlement cycles (e.g., T+1) influencing operational priorities. These regulatory changes are not just bureaucratic hurdles; they have real implications for the cost and efficiency of ETF operations, further emphasising the need for ETF providers to reassess and realign their service capabilities.

Where next for ETFs?

The narrative around ETF investments is changing. Fee reduction, while still relevant, is no longer the sole driver of investor interest. Institutional investors increasing focus on the total cost of ownership is driving a broader evaluation of operational efficiencies and technological capabilities. As the ETF market continues to expand and evolve, providers must adapt to these multifaceted demands, ensuring their offerings are not only competitively priced but also operationally and technologically equipped to meet the sophisticated needs of today’s investors.

First published ETF Express April 2024: https://etfexpress.com/2024/04/12/the-evolving-landscape-of-etf-investments-beyond-fee-reduction/

Calastone ETF Servicing

Calastone ETF Servicing is a unique ETF administration platform created specifically for managing the full ETF lifecycle in the primary market.

The solution was designed specifically for the ETF industry and is powered by our Distributed Market Infrastructure (DMI). It uses the latest technologies together with our unique microservice architecture to enable real-time processing and visibility of order management through to the underlying trading in a highly secure environment.

Global solution bringing efficiency and visibility to ETF administration

Our ETF solution digitalises the primary market ETF lifecycle. The unified workflow lets administrators eliminate manual processes and the need to move data between third-party tools/spreadsheets.

Calastone’s ability to integrate with each member in the value chain – authorised participant (AP), ETF issuer, portfolio composition file (and other reference data) providers, common depository and fund accountant – means the administrator can give the market a real-time process and end-to-end visibility.

[2] ETFs 2028: Shaping the future | PwC

[3] Calastone 2024: https://www2.calastone.com/etfwhitepaper2024