Investors in Asia shifted away from equity funds and turned to the perceived safe haven of fixed income funds as market conditions began to sour into the second quarter of 2023, according to the latest fund flow data from Calastone, the largest global funds network. Analysing real-time transaction data, the update highlights a quick shift in investor preference toward safety after a strong run up in global equity markets at the beginning of the year.

- Fixed income funds attract Asian investors seeking safe haven assets

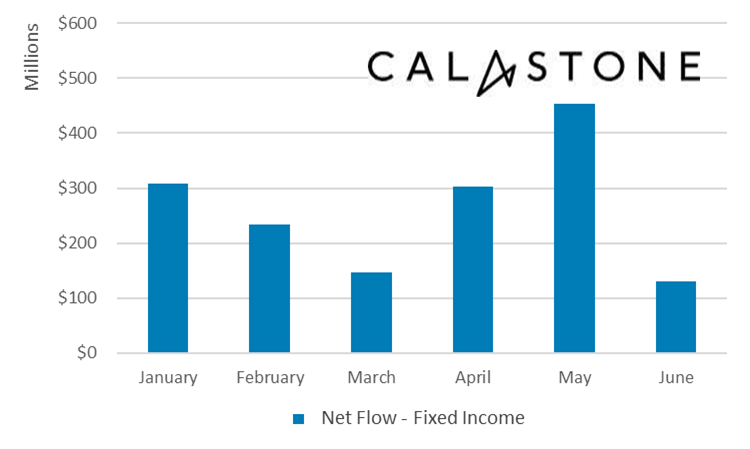

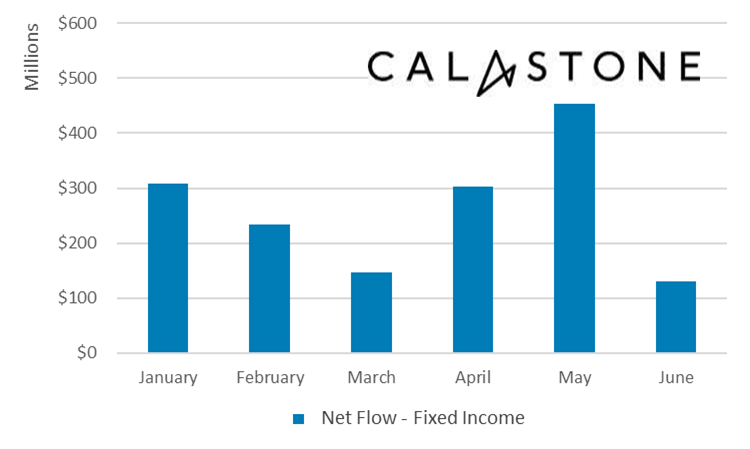

After a very challenging year for fixed income fund flows in 2022, capital inflows in Asia returned in H1 2023. From January to June, investments into fixed income funds totalled an impressive 6.7 billion USD and 1.6 billion USD on a net inflow basis. This is in sharp contrast to the more than 2.0 billion in net outflows recorded over the same period last year.

Looking closer at the data, April and May recorded the largest net inflows for fixed income funds this year, coinciding perfectly with the two biggest months for equity fund outflows. This likely suggests ample demand for additional safety in portfolios amid continued uncertainty and a growing opportunity to lock in attractive risk-adjusted returns.

Justin Christopher, Head of Asia at Calastone, commented on the shift towards fixed income, stating: “The results highlighted in our latest fund flow data is, perhaps, unsurprising given the current macroeconomic backdrop. Fixed income and money market funds have not had such attractive yields since before the Global Financial Crisis. At the same time, equity markets across Asia have been underperforming. As a result, we have witnessed a notable shift towards the relative safety of fixed income opportunities.”

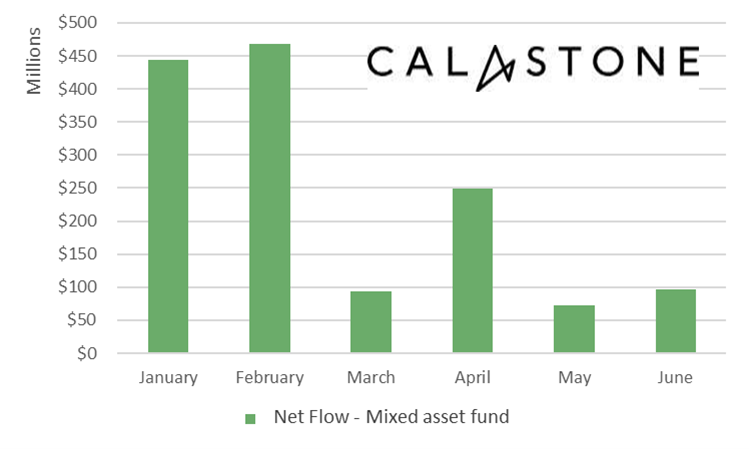

- Mixed asset funds demonstrate muted activity for Asia

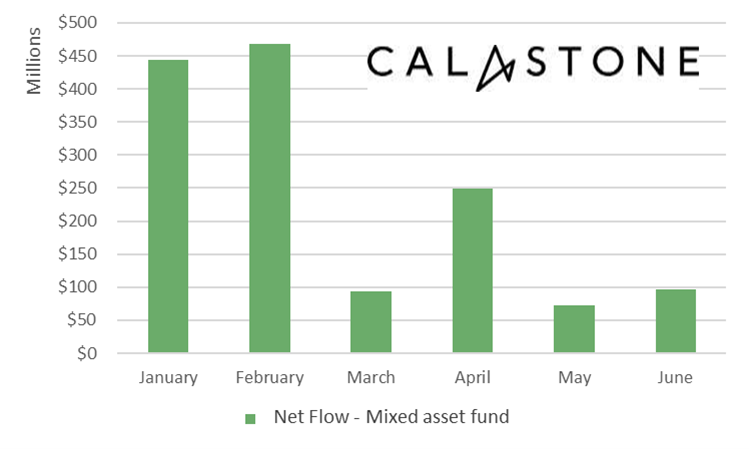

Investor demand for mixed asset funds remained positive in the first half of 2023. The consistent buying patterns can largely be attributed to these offerings serving as core products in long-term regular savings plans, meaning they are generally less susceptible to flows driven by short-term, tactical rebalancing, although buying did reduce significantly as the year progressed.

Looking ahead to the rest of 2023, Justin Christopher added, “Funds flows in Asia indicate a diminishing risk appetite, as outflows from equity funds pick up pace and investors shift their allocations toward fixed income opportunities. With lingering fears of further economic downturn and expectations that interest rates could remain higher for longer, we expect investors to maintain cautious positioning within their portfolios until the general outlook for growth and global monetary policy is materially clearer.”

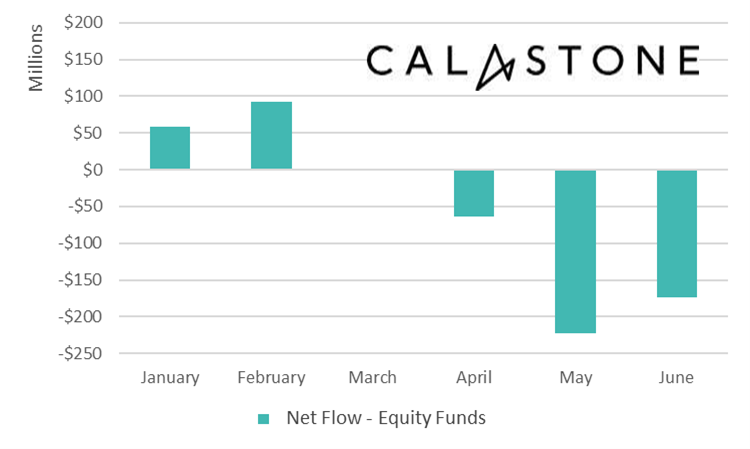

- Net buying of equity funds reverses sharply in Q2 2023

Despite an optimistic start to the year for global equities, fuelled by prospects of continued economic recovery, fund inflows have struggled to maintain momentum into the second quarter. An increasingly uncertain macroeconomic backdrop saw equity funds record net outflows of 63 million USD in April as investors trimmed risk appetites. This selling pressure accelerated in May and June, with net outflows of 222 million USD and 174 million USD respectively.