Investors across Asia moved quickly to lock in attractive yields offered by fixed income funds in 2023, while also maintaining more resilient equity fund exposure than their peers around the world according to the latest Global Fund Flow Data release from Calastone, the largest global funds network.

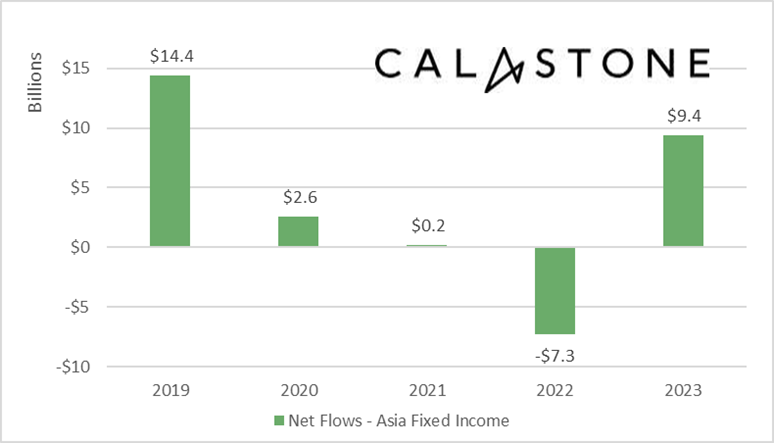

Investors in Asia ploughed a net US$9.4 billion into fixed income strategies from January to December. This is in stark contrast to the US$7.3 billion in net outflows recorded the year prior and the biggest reversal in investor sentiment toward this asset class seen in any region.

That said, the robust cumulative rise seen over the last 12 months has not been uniform. After a solid start to the year, investment inflow momentum weakened into the third quarter of 2023. Much of the loss of enthusiasm could be explained by stronger than anticipated global economy and sticky inflationary pressures, prompting market participants to weigh the growing likelihood of further rate hikes.

Coming into the end of the year, however, the prospect of both capital gains and a desire to lock-in attractive yields ahead of monetary policy normalisation saw buying activity resume. Investors in Hong Kong almost reversed all outflows they made in 2022 by the end of the year, while those in Singapore and Taiwan invested more money than they had withdrawn.

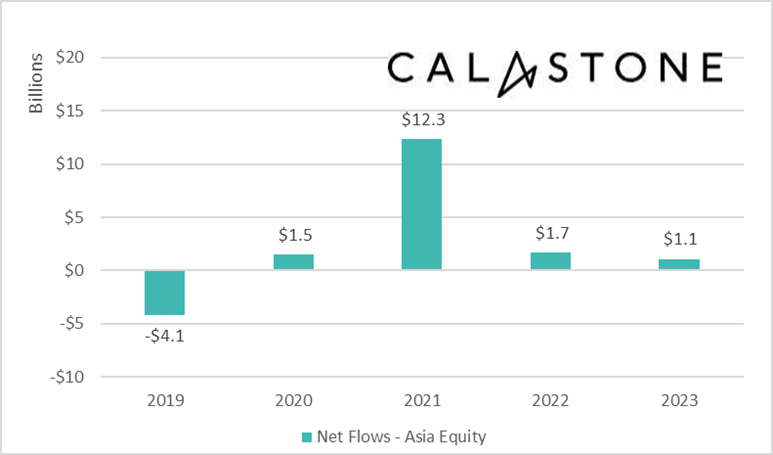

At a global level, equity funds saw US$7.1 billion in net outflows over the course of the year, a solid improvement from the US$13.3 billion withdrawn in 2022. Investors added equity exposure cautiously between January and April as markets rallied amid optimism around artificial intelligence, before succumbing to become net sellers for the rest of the year aside from a short burst of enthusiasm in November.

Looking closer at the data, unlike investors in Europe and the UK which recorded clearly negative outflows, equity allocations in Asia actually saw a modest gain last year. Equity funds took in US$1.1 billion in net inflows from Asian investors in 2023 thanks in large part to investors based in Hong Kong. Despite net outflows in Singapore (US$376) and Taiwan (US$806), Hong Kong investors almost single handedly offsetting any pessimism held by their regional peers. After a weak start to the year that reflected a stuttering reopening of the Chinese economy, Hong Kong added US$1.6 billion to equity funds.

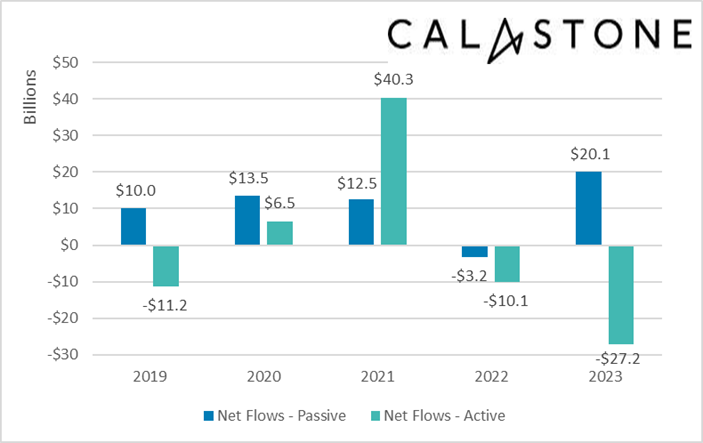

Amid the volatility seen across global markets in 2023, typically seen as a boon to the appeal of active strategies, investors shifted allocations in favour of passive funds. Index tracking vehicles attracted US$20.1 billion in net inflows at the expense of active strategies, which saw US$27.2 billion in redemptions – the largest net outflow in the last five years. That being said, the sizeable redemption from active funds seen in the last twelve months continues a general trend in recent years of investors looking to build portfolios with generally lower cost passive index strategies. Globally, investors have bought a net US$53 billion in passive funds and just US$1.7 billion in active ones from 2019 to 2023.

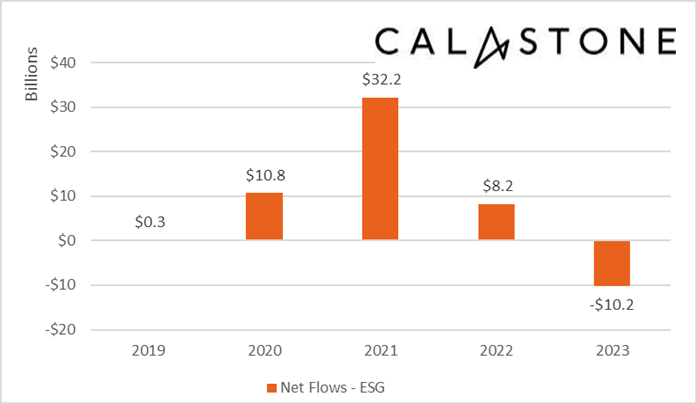

In 2023, global investor attitudes toward ESG funds saw a profound shift, reversing a notable boom from 2020 to 2022 which saw US$51.2 billion flow into equity strategies with an ESG label. Net outflows from ESG funds totalled US$10.2 billion over the last twelve months, reflecting a wider backlash against greenwashing and accusations of vague classification criteria.

European investors were the first to turn their backs on these offerings in 2022, but other markets across Asia quickly followed. In 2023, net outflows in Singapore more than doubled to US$712m, which overshadowed net inflows into traditional non-ESG equity fund options. Similarly, investors in Australia, Hong Kong and Taiwan joined their peers withdrawing US$292 million, US$370 million and US$552 million from ESG equity strategies last year.

Justin Christopher, Head of Asia at Calastone, commenting on the data release said: “The latest edition of our Global Fund Flow Data release highlights the agility and foresight Asian investors exhibited in 2023. We have observed a decisive shift to quickly capitalise on attractive yields in fixed income in anticipation of interest rate reductions across the world’s major economies. At the same time, investors have been more willing to maintain equity fund exposure despite market volatility – likely to their benefit into the end of the year. Looking forward into 2024, we expect trading volumes to remain high as investors navigate a very uncertain economic and geopolitical environment. Fixed income will likely stay in hot demand, and we will continue to monitor how equity fund flows progress over 2024.”