The mainstreaming of tokenised assets is fast approaching, with asset management firms around the world increasingly optimistic on implementation timelines and their internal adoption capabilities, according to a new survey by Calastone, the largest global funds network. Conducted in partnership with Global Custodian, this survey reveals that firms in Asia and the US are setting the pace on delivering commercially viable tokenised offerings.

Asia firms optimistic on the near-term delivery of tokenised funds

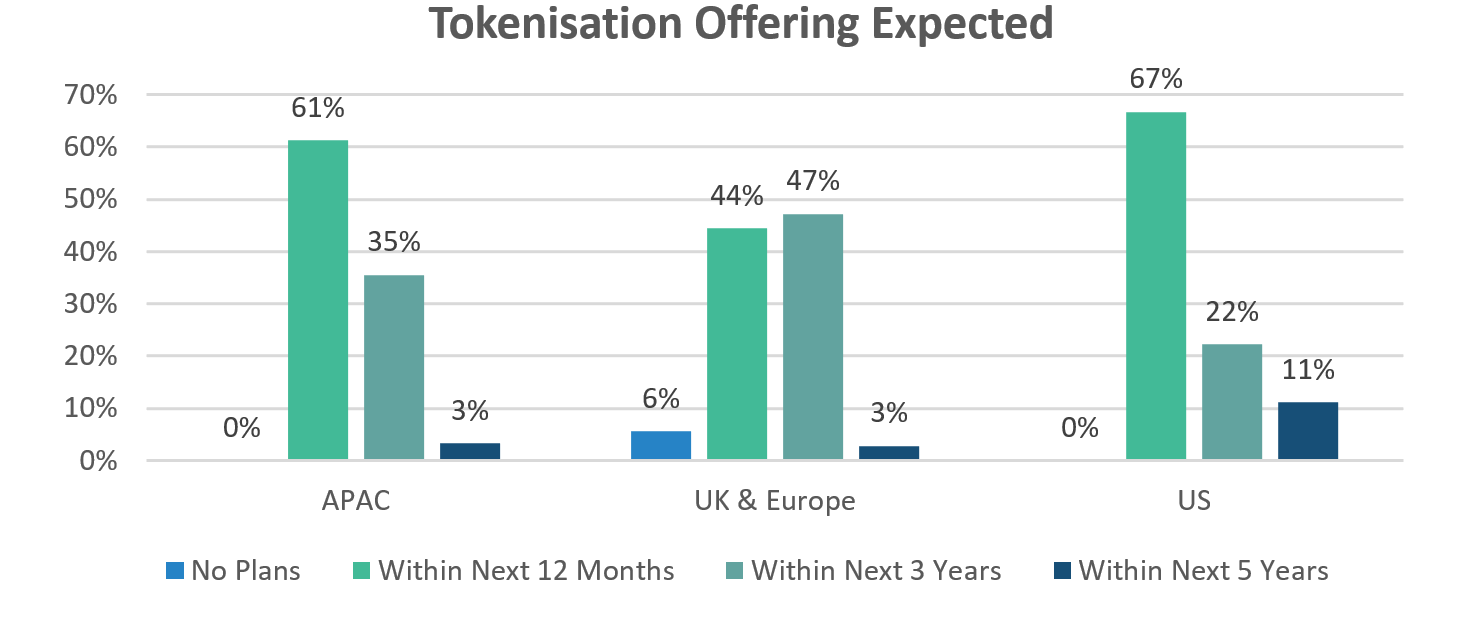

It is clear from the survey data that adding tokenised funds to product ranges is high on the agenda for asset managers in all regions as competition heats up. A clear majority of participants highlighted that they expect this to be a commercial reality in three years or less.

Parsing the data further, we see that firms based in the US and Asia are most optimistic on getting tokenised offerings to market for customers, with 67% and 61% of survey participants respectively indicating it would be possible in less than a year. Taking Asia in isolation almost 86% of firms said it would be possible to achieve within three years.

Asia and US lead implementation efforts

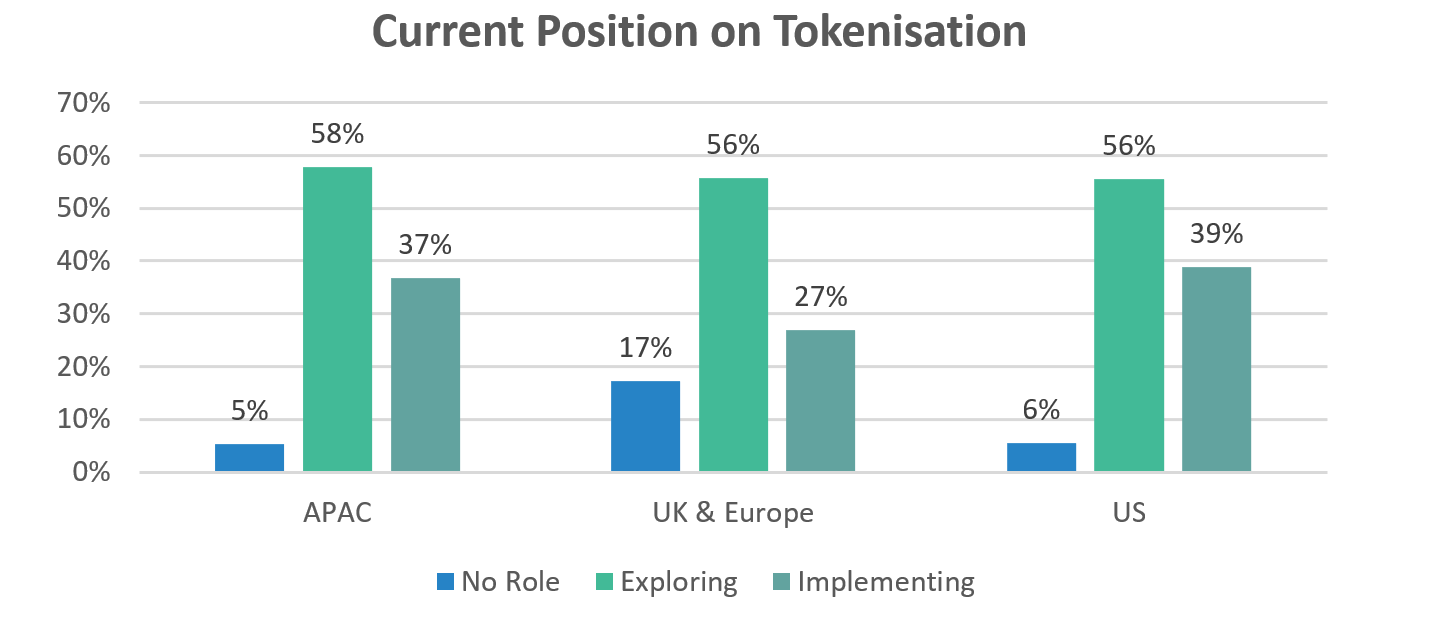

When asked about their current attitudes to tokenisation and its likely impact on day-to-day activities only a small minority of all respondents (around 10%) said they did not currently see a roll for the technology in their business. More impressive, perhaps, was that over 50% claimed to be exploring its use in specific areas.In terms of the actual implementation of tangible tokenisation projects, the US and Asia again came out ahead of the pack on a regional level. Close to 40% of firms in both geographies said they were actively implementing projects in their businesses.

Despite many participants having multiple offerings across the asset class universe, the data seems to indicate that while tokenisation projects are being applied across the investment opportunity set, firms engaged in fixed income and private assets are most advanced in their implementation efforts.

“Our clients in Asia are not just anticipating the rise of tokenised funds, they are proactively paving the way for it. This survey shows that asset managers in the region are keen to capitalise on the benefits of tokenisation and are gearing up for implementation at an impressive pace with scalable implementations already taking place in product development, distribution and trading,” said Justin Christopher, Head of Asia at Calastone.“Proactive efforts by regional governments and the private sector to form collaborative initiatives, like Project Guardian here in Singapore, have been critical in supporting Asia’s lead on the global stage.”

The personalisation of investment experiences for UHNW in Asia

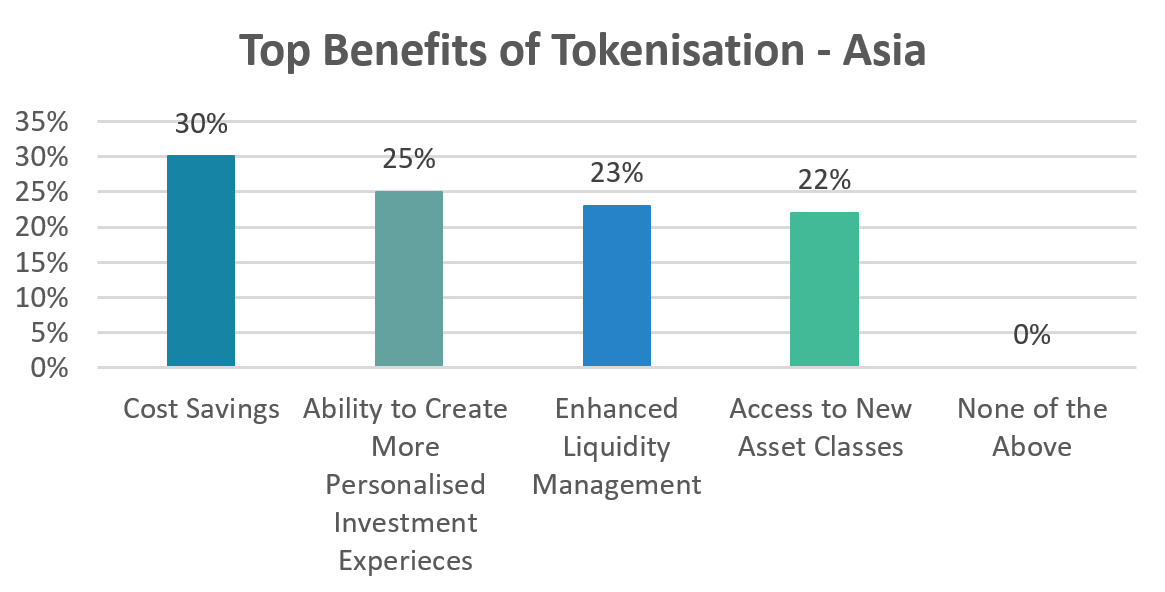

On a whole, the survey confirmed that a consensus is forming around many of the perceived benefits of tokenisation for customers, from cost savings and enhanced liquidity to accessing new asset classes and the ability to create more personalised investment experiences. When asked to select what participants personally regarded as among the top two benefits, opinion was more or less evenly split with roughly a quarter of total responses pointing to each of the four options.

While Asia-based respondents did see cost savings as the top benefit of tokenisation, these participants were marginally more likely than their regional peers to indicate that the ability to develop more customised investment solutions was a key advantage, notably to better serve ultra-high-net-worth (UHNW) clients. Around 25% of firms in the region said that this was an important benefit to consider, compared to 23% at the global level.

External factors biggest hurdles to digital asset adoption

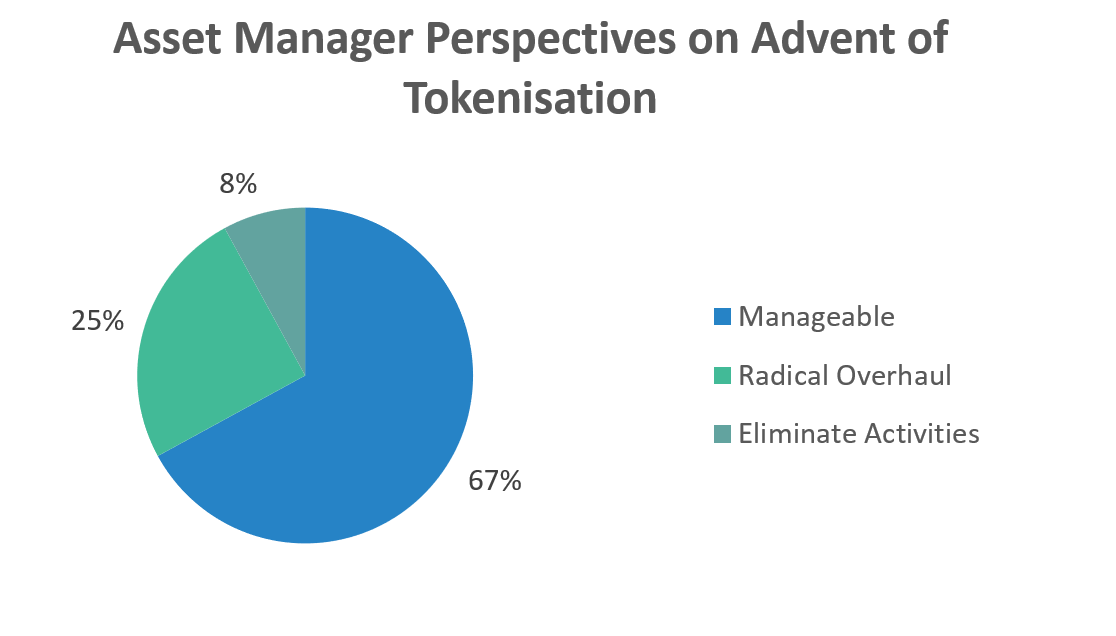

Optimistically, a majority (67%) of asset managers say they expect to be able to manage the introduction of tokenised investment vehicles with existing technology and expertise. On a practical level this highlights rising confidence among firms to execute on their tokenisation strategies in the coming years. In part, this is likely thanks to growing familiarity and knowledge in-house, but also the expanding capabilities of technology partners and administrative service providers in this area.

The most frequently mentioned hurdles to institutional engagement with digital assets were the lack of a central bank digital currency (CBDC), rated by over 80% as the first or second most prominent obstacle for the industry, followed by regulatory uncertainty. This seems to support the idea that firms are increasingly able to manage or overcome challenges directly or in collaboration with partners.

Looking ahead Christopher explained, “Institutional adoption of digital asset integration is undoubtably on the rise in Asia, and there is growing confidence in the ability of firms to manage and resource this transformation. However, the journey is not without its challenges. To unlock the full potential of the digital asset ecosystem, we continue to advocate for greater collaboration across the industry.”

Survey Methodology

The data referenced in this press release is based on findings from a global survey conducted in Q3 2023 by Calastone, in close partnership with Global Custodian. The objective of this study was to assess the funds industry’s adoption and attitudes towards asset tokenisation.

A majority (80%) of the survey’s 141 participants were asset managers with the balance made up of other industry stakeholders, including fund administrators, custodians, and management companies (Mancos). Respondents were selected from the US (16%), Asia (35%) and UK & Europe (49%) to ensure a broad range of regional perspectives were captured.

The data was collected through an online survey using both multiple choice and constructed response questions. Figures referenced in the press release were derived from the analysis of this data.